Taiwan’s semiconductor industry is expected to see its production value grow by 16.5 percent next year to top NT$6.17 trillion (US$192.28 billion) for the first time, fueled by sustained demand for artificial intelligence (AI) and high-performance computing (HPC) devices such as servers and data centers, the Industrial Technology Research Institute (ITRI, 工研院) said yesterday.

That meant Taiwan would outpace the global semiconductor industry, which is expected to expand by 12.5 percent in production value to US$684 billion next year, according to the institute.

Taiwan’s foundry sector would be the biggest beneficiary of this AI boom, with an annual expansion of 20.1 percent in production value next year to NT$3.86 trillion, Terry Fan (范哲豪), a semiconductor analyst with ITRI’s Science and Technology International Strategy Center, said at an industry forum in Taipei.

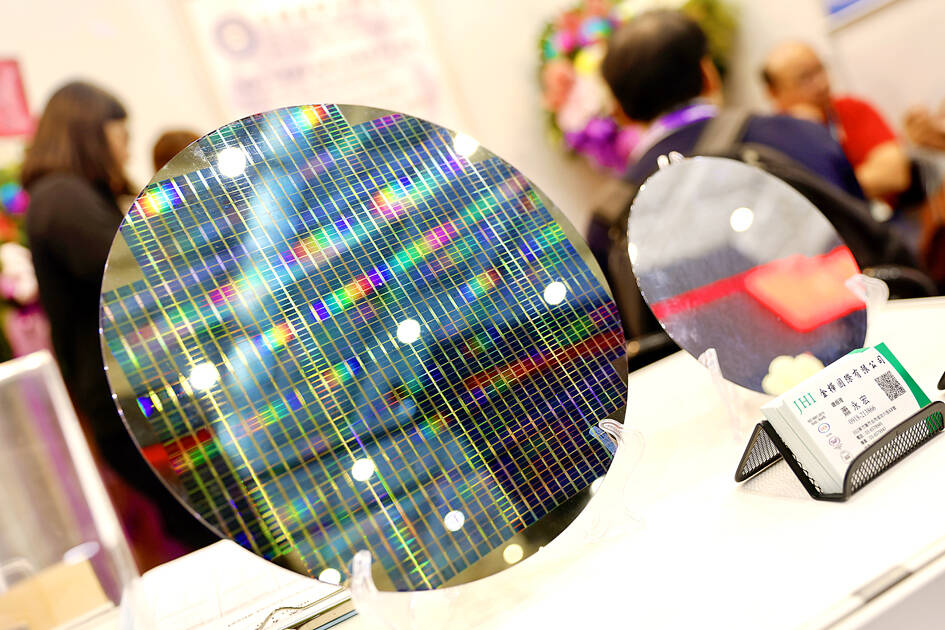

Photo: RITCHIE B. TONGO, EPA-EFE

The foundry sector’s production value would reach NT$28.60 billion next year, thanks largely to robust demand for advanced technologies including 3-nanometer and 2-nanometer chips, Fan said.

“The rise of generative AI is stimulating demand for HPC devices that are powered by advanced chips,” Fan said. “That is reflected in the fact that more than half of Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) wafer revenue came from HPC chips.”

TSMC is a major supplier of 3-nanometer technology in the industry and would be the world’s first to offer 2-nanometer technology next year, the company said.

The production value of local chip packaging and testing service providers next year is projected to grow 12.7 percent to NT$700 billion, an all-time high, as firms use advanced technologies, primarily 2.5-dimension chip-on-wafer-on-substrate technology, to package advanced chips used in AI and HPC devices, Fan said.

A recovery in sales of smartphones, PCs and other consumer electronics would also propel growth, he said.

Globally, the advanced packaging market next year would surpass the traditional chip packaging market for the first time and would make up about 51 percent of the total chip packaging market, the institute projected.

ITRI yesterday also raised its growth forecast for the nation’s semiconductor producers to 22 percent, or NT$5.3 trillion, up from its previous estimate of 17.7 percent. This would be the highest year-on-year increase since 2021.

It attributed the upward adjustment to faster-than-expected growth in the foundry sector, which is expected to see production value grow 27.5 percent this year, compared with an earlier estimate of 20.2 percent growth, the institute said.

Local chip designers are also expected to grow at a faster rate of 16.5 percent this year, up from the previous estimate of 5.1 percent, it added.

However, the institute trimmed its growth forecasts for chip packagers and chip testers to 8.6 percent and 5.2 percent respectively this year, down from previous estimates of 10.5 percent and 13.3 percent.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the