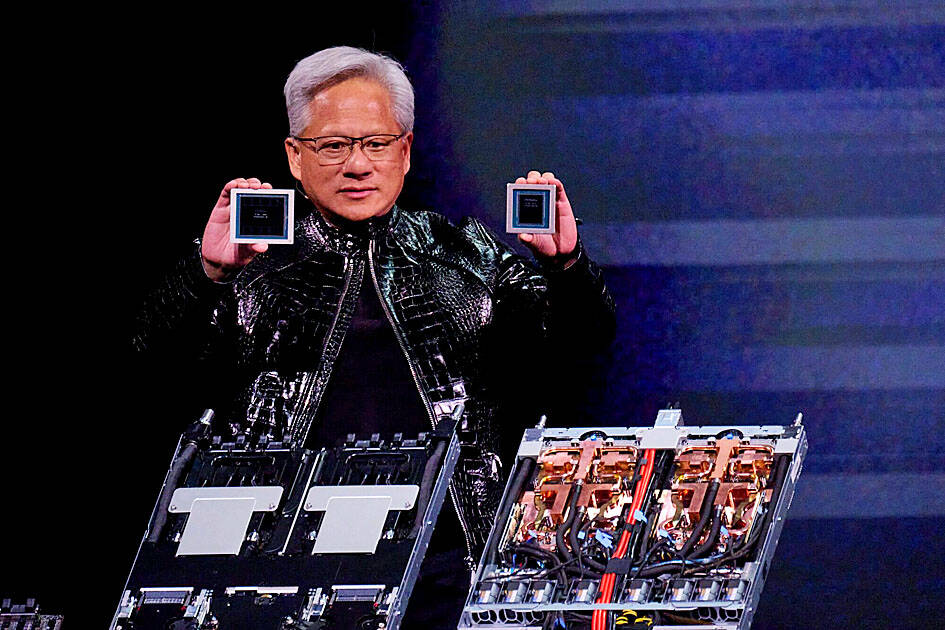

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.”

“If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas.

The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic departure from Nvidia’s previous “one or two chip” cadence, Huang said.

Photo: Bloomberg

More than one or two new chips need to be developed in a world where AI models are growing 10-fold annually and the tokens generated are increasing five-fold each year, he said.

“It is impossible to keep up with those kinds of rates ... unless we deploy aggressive extreme codesign, innovating across all the chips, across the entire stack, all at the same time,” he said.

The six-chip road map was first teased by Huang during his visit to Taiwan in August last year, when he confirmed the Silicon Valley giant had taped out the new designs at TSMC.

Photo: Bridget Bennett, Bloomberg

At the time, he described Vera Rubin as “revolutionary,” because all six chips were new.

The suite — comprising the Vera central processing unit, Rubin graphics processing unit (GPU), NVLink 6 switch, ConnectX-9 SuperNIC, BlueField-4 data processing unit and Spectrum-X ethernet switch — succeeds the Blackwell architecture, with the chips primarily manufactured using TSMC’s advanced 3-nanometer process.

Vera Rubin is 3.5 times better at training and five times better at running AI software than its predecessor, Blackwell, Nvidia said.

The new supercomputer slashes inference costs to one-seventh of the Blackwell platform and reduces the GPU count required for training mixture-of-experts models by 75 percent, the company said.

Leading AI labs, cloud service providers and system builders, including Amazon Web Services, Meta Platforms Inc, Google and Microsoft Corp, are expected to be among the first to adopt the new platform, while Hon Hai Precision Industry Co (鴻海精密) is said to be the main manufacturer of AI servers using Nvidia's Rubin platform.

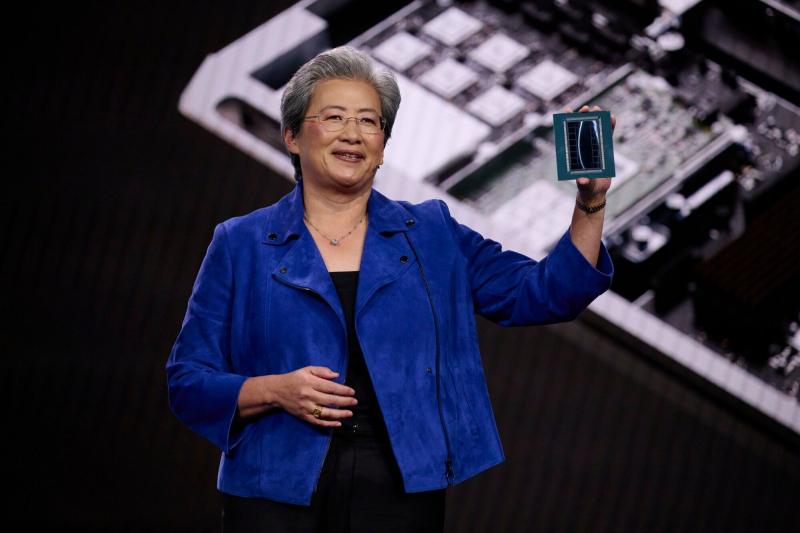

Separately, Advanced Micro Devices Inc (AMD), aiming to make a dent in Nvidia’s stranglehold on the AI hardware market, on Monday also announced a new chip for corporate data center use and talked up the attributes of a future generation of products for that market.

The company is adding a new model to its lineup — called the MI440X — for use in smaller corporate data centers, at which clients can deploy local hardware, while keeping their data in their own facilities.

The announcement came as part of a keynote at CES, where AMD chief executive officer Lisa Su (蘇姿丰) also touted the firm’s top-of-the-line MI455X, saying systems based on that chip are a leap forward in the capabilities on offer.

The AI surge would continue because of the benefits it is bringing and the heavy computing requirements of that new technology, Su said.

“We don’t have nearly enough compute for what we could possibly do,” she said. “The rate and pace of AI innovation has been incredible over the last few years. We are just getting started.”

OpenAI cofounder and president Greg Brockman joined Su on the CES stage to talk about the two company’s partnership and plans for deployment of OpenAI’s systems. The two also talked about their shared belief that economic growth would be tied to the availability of AI resources.

Additional reporting by Bloomberg

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or