ASML Holding NV and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) have ways to disable the world’s most sophisticated chipmaking machines in the event that China invades Taiwan, people familiar with the matter said.

Officials from the US government have privately expressed concerns to both their Dutch and Taiwanese counterparts about what happens if Chinese aggression escalates into an attack on the nation responsible for producing the vast majority of the world’s advanced semiconductors, two of the people said, speaking on condition of anonymity.

ASML reassured officials about its ability to remotely disable the machines when the Dutch government met with the company on the threat, two others said.

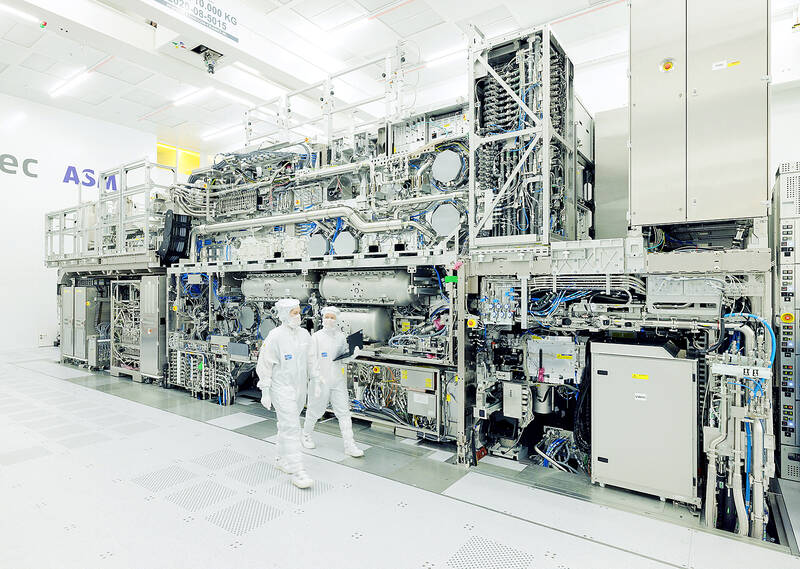

Photo: ASML / Michel de Heer via Reuters

The Netherlands has run simulations on a possible invasion to better assess the risks, they added.

Spokespeople for ASML, TSMC and the Dutch Ministry for Foreign Trade and Development Cooperation declined to comment. Spokespeople for the White House National Security Council, the US Department of Defense and the US Department of Commerce did not respond to e-mailed requests for comment.

The remote shut-off applies to Netherlands-based ASML’s line of extreme ultraviolet (EUV) machines, for which TSMC is its single biggest client. EUVs harness high-frequency light waves to print the smallest microchip transistors in existence — creating chips that have artificial intelligence uses as well as more sensitive military applications.

About the size of a city bus, an EUV requires regular servicing and updates. As part of that, ASML can remotely force a shut-off which would act as a kill switch, the people said.

The Veldhoven-based company is the world’s only manufacturer of the machines, which sell for more than 200 million euros (US$217 million) apiece.

ASML’s technology has long been subject to government interventions aimed at preventing it from falling into the wrong hands. The Netherlands prohibits the company from selling EUV machines to China, for instance, because of US fears they could lend its rival an edge in the global chip dispute.

The EUV machine has helped turn ASML into Europe’s most valuable technology stock with a market capitalization topping US$370 billion — more than double that of its client Intel Corp.

ASML has shipped more than 200 of the machines to clients outside China since they were first developed in 2016, with TSMC snatching up more of them than any other chipmaker.

EUVs require such frequent upkeep that without ASML’s spare parts they quickly stop working, the people said.

On-site maintenance of the EUVs poses a challenge because they are housed in clean rooms that require engineers to wear special suits to avoid contamination.

ASML offers certain customers joint service contracts where they do some of the routine maintenance themselves, allowing clients such as TSMC to access their own machines’ system. ASML says it cannot access its customers’ proprietary data.

TSMC chairman Mark Liu (劉德音) hinted in an interview with CNN in September last year that any invader of Taiwan would find his company’s chipmaking machines out of order.

“Nobody can control TSMC by force,” Liu said. “If there is a military invasion you will render TSMC factory non-operable.”

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.