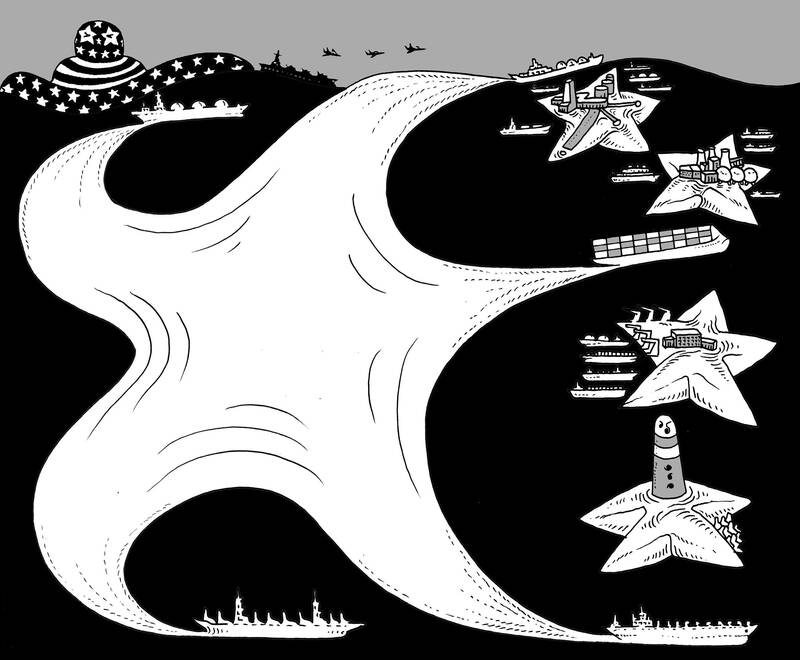

The US might still have the world’s most powerful navy, but it seems to have realized that this is no longer sufficient to reassert US supremacy over the high seas.

If US President Donald Trump’s pronouncements on shipbuilding, the Panama Canal and Greenland are anything to go by, he wants to increase US sea power on several fronts — just as China is already doing.

Beijing’s expanding influence in the world’s oceans is a challenge to Washington’s efforts to protect its interests. While the US still dominates the seas militarily, it is weaker in other maritime sectors, such as merchant shipping and shipbuilding itself, analysts said.

Illustration: Mountain People

Trump told the US Congress last week that his administration would “resurrect” the country’s nautical construction industry “including commercial shipbuilding and military shipbuilding.”

On China, he has complained that Beijing “controls” the Panama Canal and has refused to rule out military force to wrest control of a vital strategic asset.

The president has been equally blunt about wanting to take over Greenland, a Danish territory whose untapped mineral and oil reserves he covets.

He wants to tax any Chinese vessel that docks in US ports.

Sophie Quintin, a researcher at the University of Portsmouth, said Trump’s approach smacked of a return to “navalism” — a theory stressing the importance of sea power espoused by 19th-century US naval officer Alfred Mahan.

On the other hand, Trump might just be appealing to his populist voter base, the Make America Great Again (MAGA) faithful.

“It’s difficult to know if it’s the fruit of a real strategic reflection,” said Alessio Patalano, a specialist in maritime strategy at King’s College, London. “In the end, it doesn’t matter. Serving the interests of MAGA voters by restarting naval shipyards or taxing Chinese boats leads to a navalist policy.”

In any case, China understands the importance of sea power, said Nick Childs of Britain’s International Institute for Strategic Studies. At a Paris conference last month, Childs pointed to China’s rapid expansion in maritime sectors other than its own navy.

“There are the investments we’ve been hearing about in global ports, global maritime infrastructure and the weaponizing of the fishing fleet,” he said.

Washington is concerned by the expansion of Chinese shipping companies, which it sees as serving the interests of the Beijing government.

“Beijing’s economic control of port operations at strategic chokepoints across the world — many of which are part of the Maritime Silk Road initiative — pose a threat to the United States and its allies,” US think tank the Jamestown Foundation said last month.

It cited in particular two state-owned firms, COSCO and China Merchant Ports. Beijing could also exert “significant influence” on a third, privately-owned Hutchison Port Holdings, which controls two ports on the Panama Canal, it said.

However, Paul Tourret, of France’s Higher Institute of Maritime Economics, cautioned against too “simplistic” a reading of China’s maritime policy.

“COSCO, for example, follows a financial logic. It merely delivers to the United States the goods that Americans consume,” he said.

Nevertheless, pressure from Washington seems to have had some effect. Hutchison announced last week it had agreed to sell its lucrative Panama Canal ports to a US-led consortium, although it insisted this was a “purely commercial” decision.

While the US might have the world’s most powerful navy, its merchant fleet is not in such good shape, Quintin said.

“US shipping companies have significantly declined and what remains of its commercial fleet is aging,” she said.

“That has repercussions for its strategic fleet,” she added, referring to civilian ships used for military transport. “Furthermore, the shipbuilding sector is in crisis.”

“There’s no way the US can build ships quickly,” Tourret said.

“The problem with US shipbuilding is that they don’t have the know-how of the Japanese and Koreans, and they don’t have the scale of the Chinese, who churn ships out like biscuits,” Patalano said.

“When Europe is one year behind on a military program, the US is three or four years late,” said a European industry source on condition of anonymity.

Trump’s avowed desire to seize control of Greenland and Canada could also be viewed as a bid to regain US dominance over the seas.

Global heating is melting arctic ice at an alarming rate, endangering natural ecosystems and contributing to further climate change.

However, that melting could also open up the region to vessels — both commercial and military — and to oil and mineral exploration.

Those prospects have not been lost on China, Russia or the US.

“The arctic space will become increasingly important for power projection, especially for missile-launching submarines,” said Patalano, who sees these as “an essential component of deterrence.”

Here again, “the United States is lagging behind,” Quintin said. “While China is capable of deploying three icebreakers, the US Coast Guard struggles to keep its two aging vessels in service,” she said.

As the Chinese Communist Party (CCP) and its People’s Liberation Army (PLA) reach the point of confidence that they can start and win a war to destroy the democratic culture on Taiwan, any future decision to do so may likely be directly affected by the CCP’s ability to promote wars on the Korean Peninsula, in Europe, or, as most recently, on the Indian subcontinent. It stands to reason that the Trump Administration’s success early on May 10 to convince India and Pakistan to deescalate their four-day conventional military conflict, assessed to be close to a nuclear weapons exchange, also served to

China on May 23, 1951, imposed the so-called “17-Point Agreement” to formally annex Tibet. In March, China in its 18th White Paper misleadingly said it laid “firm foundations for the region’s human rights cause.” The agreement is invalid in international law, because it was signed under threat. Ngapo Ngawang Jigme, head of the Tibetan delegation sent to China for peace negotiations, was not authorized to sign the agreement on behalf of the Tibetan government and the delegation was made to sign it under duress. After seven decades, Tibet remains intact and there is global outpouring of sympathy for Tibetans. This realization

After India’s punitive precision strikes targeting what New Delhi called nine terrorist sites inside Pakistan, reactions poured in from governments around the world. The Ministry of Foreign Affairs (MOFA) issued a statement on May 10, opposing terrorism and expressing concern about the growing tensions between India and Pakistan. The statement noticeably expressed support for the Indian government’s right to maintain its national security and act against terrorists. The ministry said that it “works closely with democratic partners worldwide in staunch opposition to international terrorism” and expressed “firm support for all legitimate and necessary actions taken by the government of India

The recent aerial clash between Pakistan and India offers a glimpse of how China is narrowing the gap in military airpower with the US. It is a warning not just for Washington, but for Taipei, too. Claims from both sides remain contested, but a broader picture is emerging among experts who track China’s air force and fighter jet development: Beijing’s defense systems are growing increasingly credible. Pakistan said its deployment of Chinese-manufactured J-10C fighters downed multiple Indian aircraft, although New Delhi denies this. There are caveats: Even if Islamabad’s claims are accurate, Beijing’s equipment does not offer a direct comparison