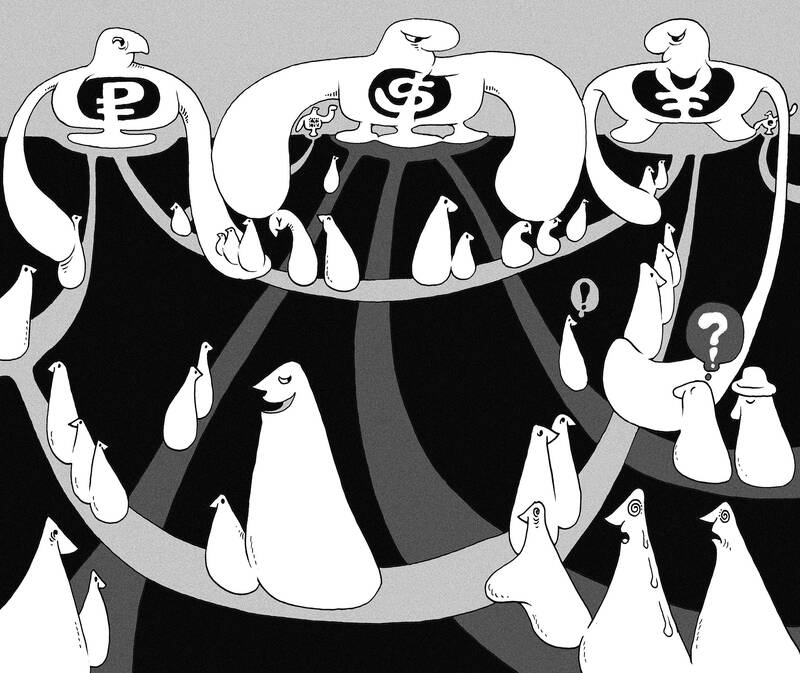

King Dollar is facing a revolt. Tired of a too-strong and newly weaponized greenback, some of the world’s biggest economies are exploring ways to circumvent the US currency.

Smaller nations, including at least a dozen in Asia, are also experimenting with de-dollarization, while corporates around the world are selling an unprecedented portion of their debt in local currencies, wary of further US dollar strength.

No one is saying the greenback is to be dethroned anytime soon from its reign as the principal medium of exchange. Calls for “peak dollar” have many times proven premature.

Illustration: Mountain People

However, it was almost unthinkable not too long ago for countries to explore payment mechanisms that bypassed the US currency or the Society for Worldwide Interbank Financial Telecommunications (SWIFT) network that underpins the global financial system.

Now, the sheer strength of the US dollar, its use under US President Joe Biden to enforce sanctions on Russia this year and new technological innovations are encouraging nations to start chipping away at its hegemony.

US Department of the Treasury officials declined to comment on these developments.

“The Biden administration made an error in weaponizing the US dollar and the global payment system,” John Mauldin, an investment strategist and president of Millennium Wave Advisors with more than three decades of markets experience, wrote in a newsletter this month.

“That will force non-US investors and nations to diversify their holdings outside of the traditional safe haven of the US,” Mauldin said.

BILATERAL PAYMENTS

Plans already under way in Russia and China to promote their currencies for international payments, including through the use of blockchain technologies, accelerated rapidly after the invasion of Ukraine. Russia, for example, began seeking remuneration for energy supplies in rubles.

Soon, the likes of Bangladesh, Kazakhstan and Laos were also stepping up negotiations with China to boost their use of the yuan. India began talking up more loudly the internationalization of the rupee and, just this month, started securing a bilateral payment mechanism with the United Arab Emirates.

However, progress appears to be slow. Yuan accounts have not gained traction in Bangladesh for example due to the nation’s wide trade deficit with China.

“Bangladesh has tried to pursue de-dollarization in trade with China, but the flow is almost one-sided,” said Salim Afzal Shawon, head of research at Dhaka-based BRAC EPL Stock Brokerage Ltd.

A major driver of those plans was the move by the US and Europe to cut off Russia from the global financial messaging system known as SWIFT. The action, described as a “financial nuclear weapon” by the French, left most major Russian banks estranged from a network that facilitates tens of millions of transactions every day, forcing them to lean on their own, much smaller version instead.

That had two implications.

First, the US sanctions on Russia stoked concern that the US dollar could more permanently become an overt political tool — a concern shared especially by China, but also beyond Beijing and Moscow. India, for example, has been developing its own homegrown payments system that would partly mimic SWIFT.

Second, the US decision to use the currency as part of a more aggressive form of economic statecraft puts extra pressure on economies in Asia to choose sides. Without any alternative payments system, they could run the risk of being compelled into compliance with, or enforcement of, sanctions they might not agree with — and losing out on trade with key partners.

“The complicating factor in this cycle is the wave of sanctions and seizures on USD holdings,” said Taimur Baig, managing director and chief economist at DBS Group Research in Singapore.

“Given this backdrop, regional steps to reduce USD reliance are unsurprising,” Baig said.

Just as officials across Asia are loath to pick a winner in US-China tussles and would prefer to keep relations with both, the US’ penalties on Russia are pushing governments to go their own way. Sometimes the action takes a political or nationalist tone — including resentment of Western pressure to adopt sanctions on Russia.

Moscow looked to convince India to use an alternative system to keep transactions moving, Myanmar’s junta spokesman said the US dollar was being used to “to bully smaller nations,” while Southeast Asian countries pointed to the episode as a reason to trade more in local currencies.

“Sanctions make it more difficult — by design — for countries and companies to remain neutral in geopolitical confrontations,” Control Risks head of global risk analysis Jonathan Wood said.

“Countries will continue to weigh economic and strategic relationships. Companies are caught more than ever in the crossfire, and face ever more complex compliance obligations and other conflicting pressures,” Wood said.

It is not just the sanctions helping to accelerate the de-dollarization trend. The US currency’s rampant gains have also made Asian officials more aggressive in their diversification attempts.

The US dollar has strengthened about 7 percent this year, on track for its biggest annual advance since 2015, a Bloomberg index of the dollar showed.

The gauge reached a record high in September as US dollar appreciation sent everything from the British pound to the Indian rupee to historic lows.

MAJOR WORRY

The US dollar’s strength is a huge headache for Asian nations who have seen prices of food purchases soar, debt-repayment burdens worsen and poverty deepen.

Sri Lanka is a case in point, defaulting on its dollar debt for the first time ever as a soaring greenback crippled the nation’s ability to pay up. Vietnamese officials at one point blamed dollar appreciation for fuel-supply struggles.

Hence moves such as India’s deal with the United Arab Emirates, which accelerates a long-running campaign to transact more in the rupee and to set up trade settlement agreements that bypass the US currency.

Meanwhile, US dollar-denominated bond sales by non-financial companies have dropped to a record low 37 percent of the global total this year. They have accounted for more than 50 percent of debt sold in any one year on several occasions in the past decade.

While all these measures might have a limited market impact short term, the end result could be an eventual weakening of demand for the US dollar. The Canadian dollar and Chinese yuan’s shares of all currency trades, for instance, are already slowly edging higher.

Technological progress is another factor facilitating efforts at moving away from the greenback.

Several economies are chipping away at US dollar use as a by-product of efforts to build new payment networks — a campaign that predates the surging greenback.

Malaysia, Indonesia, Singapore and Thailand have set up systems for transactions between each other in their local currencies rather than the US dollar. Taiwanese can pay with a QR code system that is linked to Japan.

All-in, the efforts are driving momentum further away from a Western-led system that has been the bedrock for global finance for more than half a century. What is emerging is a three-tier structure with the US dollar still very much on top, but increasing bilateral payment routes and alternative spheres such as the yuan that seek to seize on any potential US overreach.

For all the agitation and action afoot, it is unlikely the US dollar’s dominant position will be challenged anytime soon. The strength and size of the US economy remains unchallenged, Treasuries are still one of the safest ways to store capital and the US dollar makes up the lion’s share of foreign-exchange reserves.

The yuan’s share of all foreign-exchange trades, for example, could have climbed to 7 percent, but the US dollar still makes up one side of 88 percent of such transactions.

“It’s very hard to compete on the fiat front — we have the Russians doing that by forcing the use of rubles, and there’s wariness with the yuan as well,” said George Boubouras, three-decade markets veteran and head of research at hedge fund K2 Asset Management in Melbourne. “At the end of the day, investors still prefer liquid assets, and in this sense, nothing can replace the dollar.”

Nevertheless, the combination of moves away from the US dollar are a challenge to what then-French minister of the economy and finance Valery Giscard d’Estaing famously described as the “exorbitant privilege” enjoyed by the US.

The term, which he coined in the 1960s, describes how the greenback’s hegemony shields the US from exchange-rate risk and projects the nation’s economic might.

They might ultimately test the entire Bretton Woods model, a system that established the US dollar as a leader in the monetary order, which was negotiated at a hotel in a sleepy New Hampshire town at the close of World War II.

The latest efforts “do indicate that the global trade and settlement platform that we’ve been using for decades may be beginning to fracture,” said Homin Lee, Asia macro strategist at Lombard Odier in Hong Kong, whose firm oversees the equivalent of US$66 billion.

“This entire network that was born out of the Bretton Woods system — the Eurodollar market in the 1970s, and then the financial deregulation and the floating rates regime in the 1980s — this platform that we have developed so far may be beginning to shift in a more fundamental sense,” Lee said.

VALUABLE LESSON

The net result: King Dollar could still reign supreme for decades to come, but the building momentum for transactions in alternate currencies shows no sign of slowing — particularly if geopolitical wild cards continue to convince officials to go their own way.

The US government’s willingness to use its currency in geopolitical fights could ironically weaken its ability to pursue such methods as effectively in the future.

“The war in Ukraine and the sanctions on Russia will provide a very valuable lesson,” Indonesian Minister of Finance Sri Mulyani Indrawati said last month at the Bloomberg CEO Forum on the sidelines of the G20 meetings in Bali, Indonesia.

“Many countries feel they can do transactions directly — bilaterally — using their local currencies, which I think is good for the world to have a much more balanced use of currencies and payment systems,” she said.

With assistance from Finbarr Flynn, Shruti Srivastava, Sudhi Ranjan Sen, Adrija Chatterjee, Daniel Flatley, Nguyen Dieu Tu Uyen, Yujing Liu, Anirban Nag, Claire Jiao, Grace Sihombing, Philip J. Heijmans, Jeanette Rodrigues and Arun Devnath.

President William Lai (賴清德) attended a dinner held by the American Israel Public Affairs Committee (AIPAC) when representatives from the group visited Taiwan in October. In a speech at the event, Lai highlighted similarities in the geopolitical challenges faced by Israel and Taiwan, saying that the two countries “stand on the front line against authoritarianism.” Lai noted how Taiwan had “immediately condemned” the Oct. 7, 2023, attack on Israel by Hamas and had provided humanitarian aid. Lai was heavily criticized from some quarters for standing with AIPAC and Israel. On Nov. 4, the Taipei Times published an opinion article (“Speak out on the

Eighty-seven percent of Taiwan’s energy supply this year came from burning fossil fuels, with more than 47 percent of that from gas-fired power generation. The figures attracted international attention since they were in October published in a Reuters report, which highlighted the fragility and structural challenges of Taiwan’s energy sector, accumulated through long-standing policy choices. The nation’s overreliance on natural gas is proving unstable and inadequate. The rising use of natural gas does not project an image of a Taiwan committed to a green energy transition; rather, it seems that Taiwan is attempting to patch up structural gaps in lieu of

News about expanding security cooperation between Israel and Taiwan, including the visits of Deputy Minister of National Defense Po Horng-huei (柏鴻輝) in September and Deputy Minister of Foreign Affairs Francois Wu (吳志中) this month, as well as growing ties in areas such as missile defense and cybersecurity, should not be viewed as isolated events. The emphasis on missile defense, including Taiwan’s newly introduced T-Dome project, is simply the most visible sign of a deeper trend that has been taking shape quietly over the past two to three years. Taipei is seeking to expand security and defense cooperation with Israel, something officials

“Can you tell me where the time and motivation will come from to get students to improve their English proficiency in four years of university?” The teacher’s question — not accusatory, just slightly exasperated — was directed at the panelists at the end of a recent conference on English language learning at Taiwanese universities. Perhaps thankfully for the professors on stage, her question was too big for the five minutes remaining. However, it hung over the venue like an ominous cloud on an otherwise sunny-skies day of research into English as a medium of instruction and the government’s Bilingual Nation 2030