Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation.

China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom.

They prompted US President Donald Trump on Friday to announce that he would impose an additional 100 percent tariff on China and export controls on “any and all critical software.”

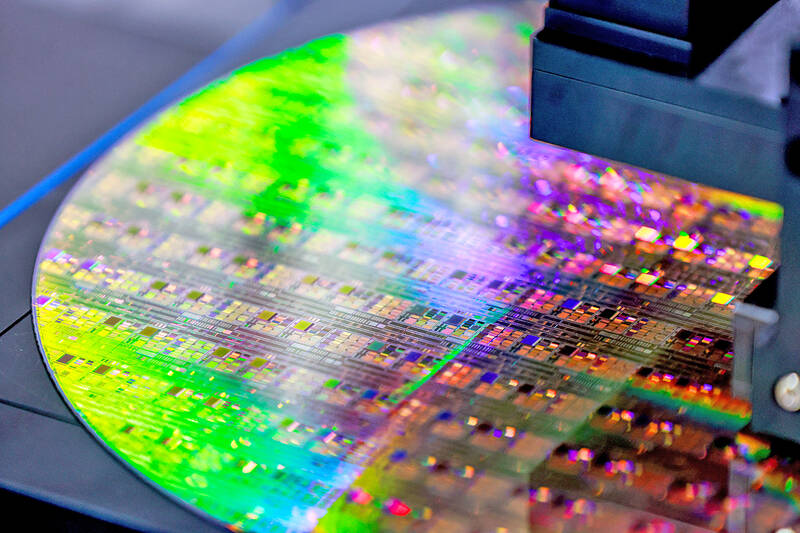

Photo: Ritchie B. Tongo, EPA

The rare earth curbs might lead to weeks-long delays in shipments for ASML Holding NV, the only manufacturer in the world of machines that make the most advanced semiconductors, a person familiar with the company said.

A senior manager at a major US chip company said the firm is still assessing potential impacts, but the clearest risk the company is facing now is an increase in the prices of rare earth-dependent magnets that are critical to the chip supply chain.

An official at another US chip company said the business is rushing to identify which of its products contain rare earths from China, and is worried that the country’s requirement for licenses would grind its supply chain to a halt.

Chipmaking machines, such as those sold by ASML and Applied Materials Inc, are especially dependent on rare earths, because they contain extremely precise lasers, magnets and other equipment that use these elements.

ASML is preparing for disruptions, particularly due to a clause in China’s new rules that requires foreign firms to seek China’s approval for re-exports of products containing its rare earths, the person familiar with ASML said.

The company declined to comment.

“Within the semiconductor value chain, China’s new export controls will likely most impact chipmakers that use rare earth-based chemicals during the chip fabrication process and toolmakers that integrate rare earth magnets into their equipment,” said Jacob Feldgoise, senior data research analyst at Georgetown University’s Center for Security and Emerging Technology.

Some have questioned how long the restrictions would last, viewing them as potential posturing ahead of a trip to Asia Trump had planned for later this month that was expected to include a meeting with Chinese President Xi Jinping (習近平). It is unclear how China would even track rare earths at such discrete levels to enforce the rules.

It is not the first time that rare earths have landed in the center of US-China trade disputes. After Trump hiked tariffs on Chinese imports earlier this year, Beijing responded by cutting off mineral exports to US companies. Officials from both sides agreed to a truce in the spring, under which Trump lowered duties and Xi’s officials agreed to resume the flow of the minerals.

The world’s biggest chipmakers — including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Samsung Electronics Co and Intel Corp — rely on ASML to produce semiconductors. TSMC did not respond to a request for comment, while Samsung and Intel declined to comment.

A White House official said the government is assessing any impact from the new rules, which were announced without notice and imposed in an apparent effort to exert control over the entire world’s technology supply chains.

The US House of Representatives Select Committee on the Chinese Communist Party panned Beijing for the move, describing the restrictions as “an economic declaration of war against the US.”

Committee Chairman John Moolenaar, a Republican, said in a statement on Thursday that China has “fired a loaded gun at the American economy.”

Germany, Europe’s biggest economy, has already introduced measures to diversify its supply of raw materials, and the German Ministry for Economic Affairs and Energy on Friday called China’s curbs a “great concern.”

The government said it is in close contact with affected companies and the European Commission to respond.

Taiwan relies mainly on the US, Japan and Europe for rare earth supplies.

The Ministry of Economic Affairs said in a statement that China’s new rare earth rules covered by the expanded ban differ from the rare earth items required in Taiwan’s semiconductor processes, so no significant impact on chip manufacturing is expected at this time.

Nevertheless, “we still need further assessment before deciding on the impact” on the chip industry, it said. “We will continue to monitor indirect impact from fluctuations in the pricing of raw materials and supply chain adjustments.”

Additional reporting by staff writer

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.