Gasoline prices are to remain unchanged this week, despite a decline in global crude oil prices last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday.

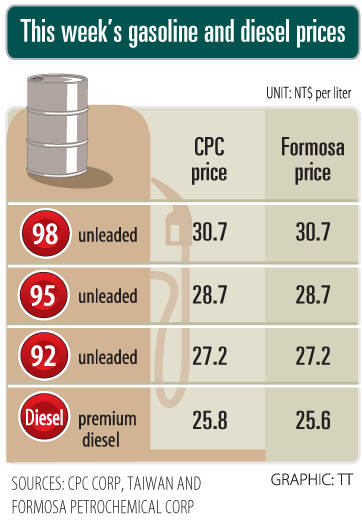

Gasoline prices at CPC and Formosa stations are to stay at NT$27.2, NT$28.7 and NT$30.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements.

However, the price of premium diesel is to drop NT$0.3 per liter to NT$25.8 per liter at CPC stations and NT$25.6 at Formosa pumps, they said.

The companies’ announcements came after international crude oil prices last week were down for two consecutive weeks ahead of a meeting between US President Donald Trump and Russian President Vladimir Putin in Alaska. The oil market was also facing pressure from plans by OPEC+ members to again raise output next month, the companies said.

Front-month Brent crude oil futures — the international oil benchmark — last week fell 1.11 percent to settle at US$65.85 per barrel on the Intercontinental Exchange, while West Texas Intermediate crude oil futures — the US oil gauge — lost 1.69 percent to US$62.80 per barrel on the New York Mercantile Exchange.

JITTERS: Nexperia has a 20 percent market share for chips powering simpler features such as window controls, and changing supply chains could take years European carmakers are looking into ways to scratch components made with parts from China, spooked by deepening geopolitical spats playing out through chipmaker Nexperia BV and Beijing’s export controls on rare earths. To protect operations from trade ructions, several automakers are pushing major suppliers to find permanent alternatives to Chinese semiconductors, people familiar with the matter said. The industry is considering broader changes to its supply chain to adapt to shifting geopolitics, Europe’s main suppliers lobby CLEPA head Matthias Zink said. “We had some indications already — questions like: ‘How can you supply me without this dependency on China?’” Zink, who also

The number of Taiwanese working in the US rose to a record high of 137,000 last year, driven largely by Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) rapid overseas expansion, according to government data released yesterday. A total of 666,000 Taiwanese nationals were employed abroad last year, an increase of 45,000 from 2023 and the highest level since the COVID-19 pandemic, data from the Directorate-General of Budget, Accounting and Statistics (DGBAS) showed. Overseas employment had steadily increased between 2009 and 2019, peaking at 739,000, before plunging to 319,000 in 2021 amid US-China trade tensions, global supply chain shifts, reshoring by Taiwanese companies and

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) received about NT$147 billion (US$4.71 billion) in subsidies from the US, Japanese, German and Chinese governments over the past two years for its global expansion. Financial data compiled by the world’s largest contract chipmaker showed the company secured NT$4.77 billion in subsidies from the governments in the third quarter, bringing the total for the first three quarters of the year to about NT$71.9 billion. Along with the NT$75.16 billion in financial aid TSMC received last year, the chipmaker obtained NT$147 billion in subsidies in almost two years, the data showed. The subsidies received by its subsidiaries —

OUTLOOK: Pat Gelsinger said he did not expect the heavy AI infrastructure investments by the major cloud service providers to cause an AI bubble to burst soon Building a resilient energy supply chain is crucial for Taiwan to develop artificial intelligence (AI) technology and grow its economy, former Intel Corp chief executive officer Pat Gelsinger said yesterday. Gelsinger, now a general partner at the US venture capital firm Playground Global LLC, was asked at a news conference in Taipei about his views on Taiwan’s hardware development and growing concern over an AI bubble. “Today, the greatest issue in Taiwan isn’t even in the software or in architecture. It is energy,” Gelsinger said. “You are not in the position to have a resilient energy supply chain, and that,