Foxconn Technology Group (富士康科技集團) yesterday said it expects any impact of new tariffs from US president-elect Donald Trump to hit the company less than its rivals, citing its global manufacturing footprint.

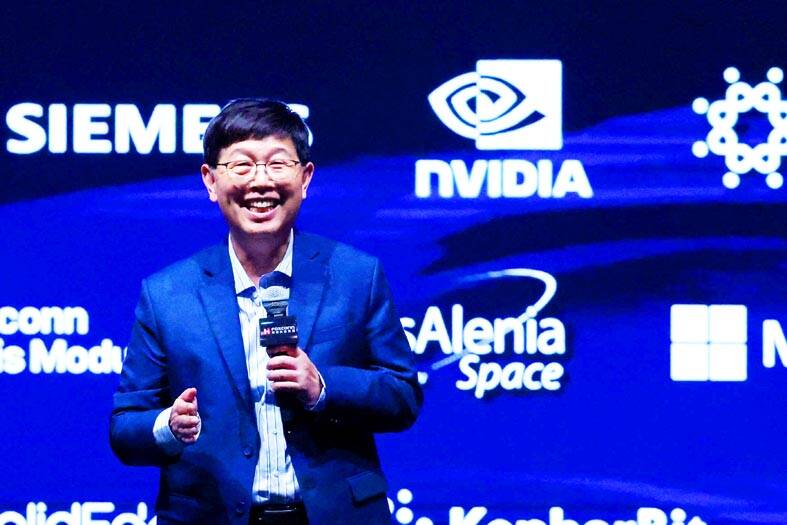

Young Liu (劉揚偉), chairman of the contract manufacturer and key Apple Inc supplier, told reporters after a forum in Taipei that it saw the primary impact of any fresh tariffs falling on its clients because its business model is based on contract manufacturing.

“Clients may decide to shift production locations, but looking at Foxconn’s global footprint, we are ahead. As a result, the impact on us is likely smaller compared to our competitors,” he said.

Photo: Reuters

Trump on Monday said that on his first day in office he would impose a 25 percent tariff on all products from Mexico and Canada and would charge goods from China an additional 10 percent tariff.

Foxconn, the world’s largest contract electronics maker, has large facilities in China, including a giant iPhone assembly plant.

However, it has been increasing its investments in other countries, such as the US, Mexico and Vietnam, as part of a supply chain diversification effort. In Mexico, it is building a large manufacturing facility to produce Nvidia Corp’s GB200 superchips.

Liu said Foxconn would only be able to share more details about the company’s US plans after Jan. 20, once Trump takes office and his policies become clearer.

“After that, we will have a corresponding strategy in place,” he said.

“What you’re seeing now is a game between nations, not yet between companies. Whether it’s 25 percent or an additional 10 percent, the outcome is uncertain as they continue to negotiate. We are constantly adapting and refining our global strategy,” Liu said.

During Trump’s previous presidency from 2017 to 2021, Foxconn announced a US$10 billion investment in Wisconsin that the company later mostly abandoned. On Tuesday, Foxconn said a subsidiary had spent US$33 million to acquire land and factory buildings in Harris County, Texas.

Foxconn will continue investing in Mexico, Liu added, as it believed the trend was moving toward regional manufacturing.

Hon Hai Precision Industry Co (鴻海精密), the flagship firm of the group, has invested US$33.03 million to buy land and a building in Texas that sources say would be used to expand the company’s artificial intelligence server production in the US.

In a statement posted on the Taiwan Stock Exchange (TWSE), where Taiwan-based Hon Hai’s shares are traded, the company on Tuesday said that subsidiary Foxconn Assembly LLC has acquired 478,036m2 of land and a building with an area of 200,200m2 in Harris County.

At an investors’ conference last month, Liu said his company would continue to invest in artificial intelligence products and electric vehicles in the US market.

According to Liu, Hon Hai has invested in the US for almost four decades and now operates 50 facilities there with a workforce of about 5,000 people that generate US$25.6 billion in annual sales.

Additional reporting by CNA

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the