The entertainment giant Paramount Global will merge with Skydance Media LLC, closing out a decades long run by the Redstone family in Hollywood and injecting desperately needed cash into a legacy studio that has struggled to adapt to a shifting entertainment landscape.

It also signals rise of a new power player, David Ellison, the founder of Skydance and son of billionaire Larry Ellison, the founder of the software company Oracle Corp.

Shari Redstone’s National Amusements Inc has owned more than three-quarters of Paramount’s Class A voting shares through the estate of her late father, Sumner Redstone. She had battled to maintain control of the company that owns CBS, which is behind blockbuster films such as “Top Gun" and “The Godfather.”

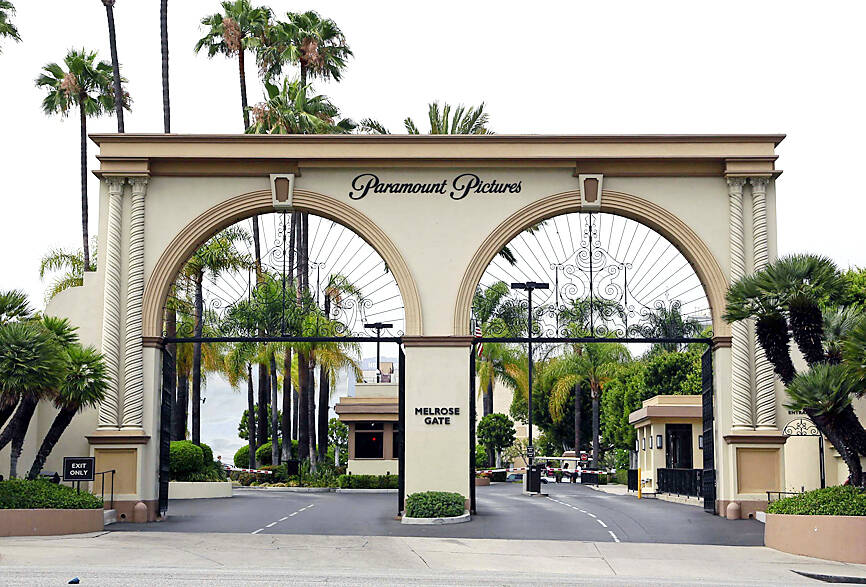

Photo: AP

Just weeks after turning down a similar agreement with Skydance, however, Redstone agreed to a deal on terms that had not changed much.

“Given the changes in the industry, we want to fortify Paramount for the future while ensuring that content remains king,” Paramount Global chair Shari Redstone said.

The new combined company is valued at around US$28 billion.

Skydance, based in Santa Monica, California, has helped produce some major Paramount hits in recent years, including Tom Cruise films like “Top Gun: Maverick” and installments of the “Mission Impossible” series.

Skydance was founded in 2010 by David Ellison and it quickly formed a production partnership with Paramount that same year. David Ellison, if the deal is approved by US regulators, will become chairman and chief executive officer of what’s being called New Paramount.

The on-again, off-again merger arrives at a tumultuous time for Paramount, which in an annual shareholder meeting in early last month laid out a restructuring plan that includes major cost cuts.

Leadership at Paramount has been volatile this year after its CEO Bob Bakish, following a number of disputes with Shari Redstone, was replaced with an “office of the C.E.O,” run by three executives. Four company directors were also replaced.

Paramount, however, has struggled to find its footing for years and its cable business has been hemorrhaging. To capture today’s growing streaming audience, the company launched Paramount+ back in 2021, but losses and debts have continued to grow.

Sumner Redstone used National Amusements, his family’s movie theater chain, to build a vast media empire that included CBS Corp and Viacom Inc, which have merged and separated a number of times over the years. Most recently, the companies re-joined forces in 2019, undoing the split consummated in 2006. The company, ViacomCBS, changed its name to Paramount Global in 2022.

Under Sumner Redstone’s leadership, Viacom became one of the nation’s media titans, home to pay TV channels MTV and Comedy Central and movie studio Paramount Pictures.

It is a company with a rich history, as well as a deep bank of media assets, and Skydance wasn’t the only one to gun for Paramount in recent months — Apollo Global Management Inc and Sony Pictures Entertainment Inc also made competing offers.

Late last year, Warner Bros Discovery Inc also made headlines for exploring a potential merger with Paramount. But by February, Warner had reportedly halted those talks.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.