Nvidia Corp CEO Jensen Huang (黃仁勳) unexpectedly unveiled the company’s next-generation graphics processing unit (GPU) architecture, codenamed Rubin, to be available in 2026, during a speech in Taipei on Sunday.

To go with the Rubin GPUs, Nvidia also plans to introduce a new-generation CPU called Vera in 2026, Huang said at the National Taiwan University Sports Center.

The company plans to launch an enhanced version of the upcoming Rubin GPUs, called Rubin Ultra, in 2027, he said.

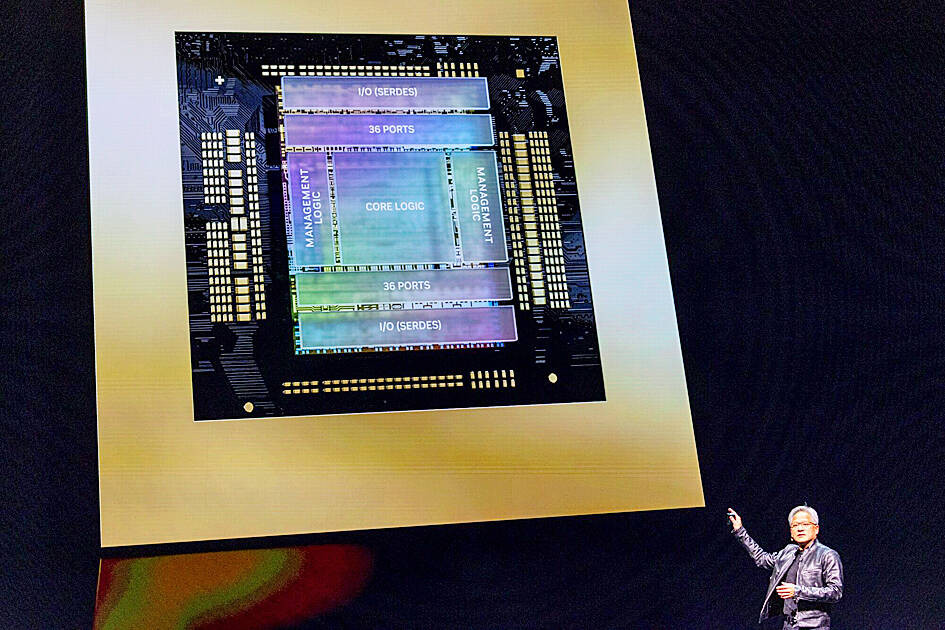

Photo: Annabelle Chih, Bloomberg

The company’s Blackwell GPU architecture, announced in March to succeed the Hopper framework, are to hit the market this year followed by the Blackwell Ultra units next year, he said.

Rubin GPUs are likely to be built using Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) most advanced 3-nanometer process technology, an upgrade from the 4-nanometer process technology used to produce the Blackwell B100 accelerators, TF International Securities Group Co (天風國際證券) analyst Kuo Ming-chi (郭明錤) wrote on X.

Nvidia would likely also adopt TSMC’s chip-on-wafer-on-substrate advanced packaging technology for the new Rubin GPUs, as it would with the B100s, Kuo said.

The Rubin GPUs would likely enter mass production in the fourth quarter of next year, he said.

“Our company is in a one-year rhythm,” Huang said. “On a one-year rhythm and we push everything, the technology limits whatever TSMC process technology pushes it to the absolute limits. Whoever’s packing technology pushes it to absolute limits. Whatever memory technology pushes it to absolute limits.”

During his speech, Huang also talked about digital humans, artificial intelligence (AI) PCs, robotics and industrial automation, and expected a larger swath of companies and government agencies to embrace AI.

In the future, "almost every interaction you have with the Internet or with a computer will likely have a generative AI running in the cloud somewhere," he said.

But as the amount of data that needs to be processed grows exponentially in the AI era, traditional computing methods cannot keep up and it’s only through Nvidia’s style of accelerated computing that firms can cut back the costs, Huang said.

He therefore outlined how some top tech companies such as Taiwan's Foxconn Technology Group (富士康科技集團) — the world's largest contract electronics manufacturer — and German industrial giant Siemens AG are using Nvidia's platforms to develop AI-powered autonomous robots.

In addition, he announced that Asustek Computer Inc (華碩), Gigabyte Technology Co (技嘉), Ingrasys Inc (鴻佰), Inventec Corp (英業達), Wiwynn Corp (緯穎), Pegatron Corp (和碩), Cloud Technology Inc (雲達) and Super Micro Computer Inc would deliver cloud, on-site, embedded and edge AI systems using Nvidia GPUs and networking chips.

“Taiwan is the home of our [Nvidia’s] treasured partners. This is, in fact, where everything Nvidia does begins. Our partners and ourselves take it to the world. Taiwan and our partnership has created the world’s AI infrastructure,” Huang said.

Additional reporting by agencies

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)