The Financial Supervisory Commission (FSC) yesterday announced a short-selling ban on the Taiwan Stock Exchange and the Taipei Exchange (TPEX), starting today, as it attempts to curb speculative trading amid “irrational declines on the stock market.”

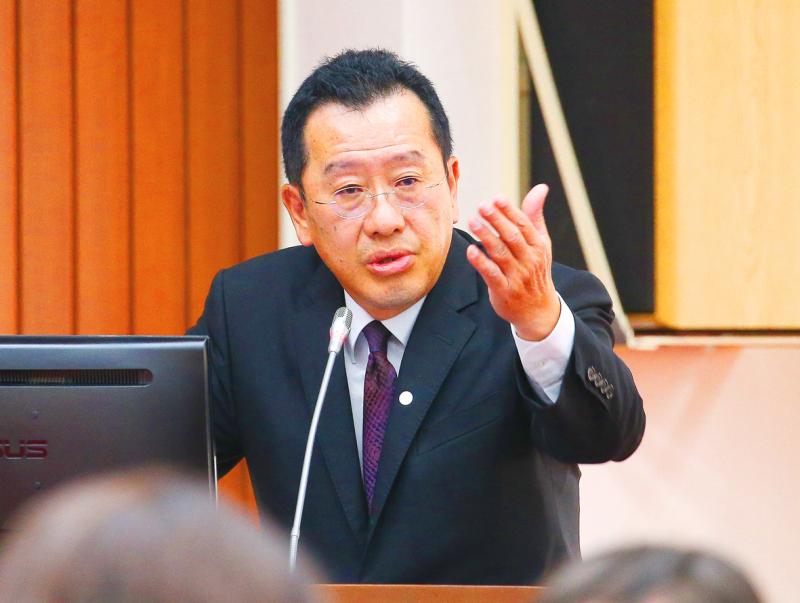

Unlike previous bans imposed in 1998, 2008 and 2015, which applied to all stocks, this ban applies only to stocks that showed a decline of 3.5 percent or more a day earlier, Securities and Futures Bureau Deputy Director Sam Chang (張振山) told a news conference in New Taipei City.

The TAIEX fell 5.83 percent and the TPEX dropped 7.53 percent yesterday, and 1,233 stocks on the two boards reported declines of more than 3.5 percent, the commission’s data showed.

Photo: CNA

Tech heavyweights Taiwan Semiconductor Manufacturing Co (台積電) and Largan Precision Co (大立光) fell 3.69 percent and 9.72 percent respectively.

Short selling is when investors borrow securities, typically from brokerages, and then sell them, expecting the price will fall, to make a profit by buying them back later for less money.

“A short-selling ban can prevent speculators from betting against financial stocks, but it may also create more fear among ordinary investors. It is difficult to foresee if the measures would help,” an analyst told the Taipei Times by telephone on the condition of anonymity.

Short selling for the 1,233 stocks would be banned today, Chang said, adding that the number of stocks subject to the new measure would vary daily.

The ban would persist for stocks that continue to fall by 3.5 percent or more, he added.

“We want to curb volatility in the local markets amid a sell-off prompted by the fear of COVID-19, allowing respite for battered equities,” Chang said. “The local market appeared irrational, but not that crazy as it was in the [2008] financial crisis.”

Given that turnover on the main board stood at NT$269.74 billion yesterday, higher than the daily average of NT$146 billion last month, it indicated that many investors still had confidence in the local market, he said.

“Average daily turnover was less than NT$50 billion during the worst period in 2008. So the situation is much better now,” Chang said.

The FSC did not say how long the short-selling ban would last, saying that it would review the ban based on the COVID-19 pandemic situation.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.