Where have you gone, Mr. Coffee? A caffeine-craving nation turns its eyes to you.

What's that you say, Mr. Coffee? You've neither left nor gone away, but it seems like that to younger consumers?

PHOTO: NY TIMES

With profound apologies to Simon and Garfunkel, not to mention Joe DiMaggio, the rewritten lyrics above summarize the rationale for a new campaign for Mr. Coffee, the line of coffee makers and related products sold by the Sunbeam Corp.

While Mr. Coffee remains the best seller by far in its category, Sunbeam wants to ensure the brand maintains its lead by attracting a younger coffee drinker. But even with the new campaign, which has a budget estimated at US$5 million for the next 12 months, some specialists in brand identity wonder whether Sunbeam may need to do more, perhaps even consider renaming the product because of the associations the name invokes.

For the first six months of this year, Mr. Coffee had a market share of 24.2 percent by unit sales and a dollar volume of US$82.3 million, according to the NPD Houseworld service of the NPD Group in Port Washington, New York, a market research company that began tracking housewares last year. Black & Decker was next with 14.9 percent and US$45 million, then Proctor Silex at 11.1 percent and US$21.5 million.

But more expensive brands like Braun and Krups, perceived as more contemporary, have been nipping at Mr. Coffee's heels among that at-home coffee drinker, if an appliance can be thought of as having heels.

And younger consumers are less familiar with Mr. Coffee than shoppers who still remember when DiMaggio introduced the brand in 1972 for a company called North American System as the first automatic-drip home coffee maker.

DiMaggio, the legendary New York Yankee outfielder, was retired for two decades when he was recruited by the founder of North American, Vincent Marotta Senior, a baseball fan. Marotta believed that to wean coffee drinkers from percolators, his new product needed a spokesman who would represent reliability and dependability. DiMaggio fit the bill because he held (and still holds) the major league record for hitting in the most consecutive games, 56.

"Certainly, there is a strong association" between Mr. Coffee and DiMaggio, "who is still recalled often by our faithful older consumer," said Mary Ann Knaus, vice president and general manager for the Sunbeam global appliances division of Sunbeam in Boca Raton, Fla. "But that's not in line with what we're trying to achieve now."

But Sunbeam faces a problem in pursuing a younger generation. Americans in their 20s and 30s have rediscovered coffee to a degree never imagined by coffee growers.

But those new coffee drinkers are leaving home to buy the beverage at coffee houses and cafes rather than remaining home to brew it with kitchen-counter appliances like Mr. Coffee.

"Starbucks isn't selling just coffee; it's selling a coffee culture and experience," said Jonah Disend, president at Redscout in New York, a corporate identity consultant.

"We forget that coffee is like a drug for many people," he added, "and what Starbucks has been so successful at is not only creating an addiction to the coffee fix but also an addiction to the ritual of purchasing that fix."

Knaus said that Sunbeam realized "coffee consumption patterns were changing, and we need to make sure we're changing along with them."

"Consumers need to know they can also personalize their coffee experiences in the home," she added, "and who better to do it than Mr. Coffee?"

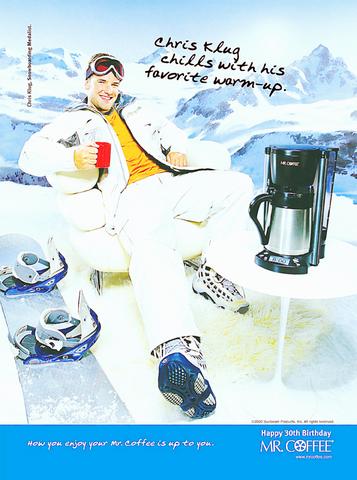

That explains the campaign's theme, "How you enjoy your Mr. Coffee is up to you." It is being brought to life by two celebrity endorsers, in a nod to the DiMaggio heritage, with perhaps more to come last year. Both are intended to appeal to consumers in their 20s through their 40s: Chris Klug, the Olympic snowboarder, an athlete like Joltin' Joe, and Carson Daly, the host of "Total Request Live" on MTV and "Last Call" on NBC.

Each is presented in print advertisements, which are running in Cooking Light, InStyle and People magazines, lounging in an easy chair, drinking coffee brewed with Mr. Coffee. Klug is on a ski slope, Daly in Times Square near his MTV studio.

"We show the Mr. Coffee experience as part of their lives," said Marc Rappin, senior vice president and group management director of the agency working for Mr. Coffee on a project basis, the New York office of Foote, Cone & Belding, part of the Interpublic Group of Companies.

"We want to make the brand younger," he added, and one way to accomplish that is to demonstrate that Mr. Coffee "fits into the busy world" of folks like Klug and Daly.

A Foote, Cone sibling, Marketing Drive, is working on promotions for the campaign. There are radio commercials, a sweepstakes, events in stores that sell Mr. Coffee and a sponsorship of an exhibit of People covers and memorabilia touring shopping malls in big markets like Atlanta, Dallas, Los Angeles and New York.

But could Sunbeam be doing more?

Sexist name

"The name is a problem, and they'll just be tinkering around the edges till it's solved," said Raleigh C. Green, a principal at Corporate Voice in New York, which specializes in online brand communications. Green said the name is sexist, because it tells the women who buy most appliances "only Mr. Coffee can bring the right coffee experience to your man."

The partners at Group 1066 in New York, a corporate identity consulting company, agree another name ought to be considered, for different reasons.

While the campaign's approach and choice of celebrities make sense, said one partner, Mike Cucka, "I'm not sure in this day and age calling it Mr. Coffee is all that helpful" because "it seems a little formal and off-putting."

The other partner, Michael Megalli, said, "It seems very old-style and conservative."

The Group 1066 partners recommend a new name that implies technological innovation and also resonates with younger consumers. If there's iMac and iPod, they ask, why not iCoffee?

Rappin at Foote, Cone acknowledged that "there are a lot of schools of thought" on the Mr. Coffee name, but added, "Think of the millions and millions of dollars it would take to establish a new brand identity."

"Yes, we'd like to contemporize the brand and give it a younger appeal, but if we change the name, we'd walk away from the heritage with our base consumers, the fact it's a market leader and a lot of other good things," Rappin said. "We want to try to get people to rethink Mr. Coffee without having to reinvent it."

To many, Tatu City on the outskirts of Nairobi looks like a success. The first city entirely built by a private company to be operational in east Africa, with about 25,000 people living and working there, it accounts for about two-thirds of all foreign investment in Kenya. Its low-tax status has attracted more than 100 businesses including Heineken, coffee brand Dormans, and the biggest call-center and cold-chain transport firms in the region. However, to some local politicians, Tatu City has looked more like a target for extortion. A parade of governors have demanded land worth millions of dollars in exchange

An Indonesian animated movie is smashing regional box office records and could be set for wider success as it prepares to open beyond the Southeast Asian archipelago’s silver screens. Jumbo — a film based on the adventures of main character, Don, a large orphaned Indonesian boy facing bullying at school — last month became the highest-grossing Southeast Asian animated film, raking in more than US$8 million. Released at the end of March to coincide with the Eid holidays after the Islamic fasting month of Ramadan, the movie has hit 8 million ticket sales, the third-highest in Indonesian cinema history, Film

Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) revenue jumped 48 percent last month, underscoring how electronics firms scrambled to acquire essential components before global tariffs took effect. The main chipmaker for Apple Inc and Nvidia Corp reported monthly sales of NT$349.6 billion (US$11.6 billion). That compares with the average analysts’ estimate for a 38 percent rise in second-quarter revenue. US President Donald Trump’s trade war is prompting economists to retool GDP forecasts worldwide, casting doubt over the outlook for everything from iPhone demand to computing and datacenter construction. However, TSMC — a barometer for global tech spending given its central role in the

Alchip Technologies Ltd (世芯), an application-specific integrated circuit (ASIC) designer specializing in server chips, expects revenue to decline this year due to sagging demand for 5-nanometer artificial intelligence (AI) chips from a North America-based major customer, a company executive said yesterday. That would be the first contraction in revenue for Alchip as it has been enjoying strong revenue growth over the past few years, benefiting from cloud-service providers’ moves to reduce dependence on Nvidia Corp’s expensive AI chips by building their own AI accelerator by outsourcing chip design. The 5-nanometer chip was supposed to be a new growth engine as the lifecycle