Until a fortnight ago, former hotel worker Jeff Lin Hai Wah had never even tasted a cup of filtered coffee.

The 23-year-old will soon be serving up tall skinny lattes and other speciality coffee varieties to customers in his new job at the first branch of Starbucks in the sprawling city of Guangzhou in southern China.

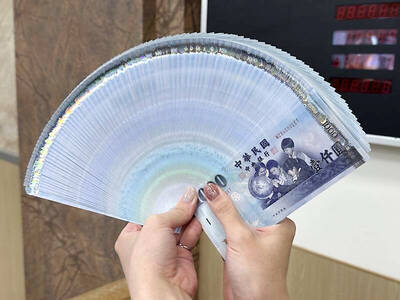

PHOTO: DPA

"I'll be pretty nervous, especially serving coffee to expatriates and tourists who have been drinking coffee all their lives," he said. "When I grew up, we only ever had tea in the house. It wasn't until two or three years ago that I had my first cup of instant coffee."

Seattle-based Starbucks is one of three Western coffee chains opening or preparing to open shops in the sprawling city of Guangzhou, where for centuries tea has been the drink of choice.

There are more than 100 of branches of Starbucks in Hong Kong, Beijing and Shanghai, but now coffee shops are branching out for the first time into China's less cosmopolitan hinterland, with the southern center of Guangzhou their first target.

The main rival to Starbucks in Hong Kong, the Hong Kong-Singapore Pacific Coffee chain, is also seeking a partner to open its first Guangzhou branch.

Ironically, however, an outsider without a foothold in Hong Kong or the mainland has beaten them by opening Guangzhou's first western-style coffee house.

Canadian chain Blenz -- which has 29 outlets in British Columbia and four in Japan -- has just opened the doors on an outlet at the base of the high-rise Citic Plaza shopping and office block.

The outlet is already doing brisk business among office workers with prices ranging from 9 yuan (about US$1) for a fresh coffee to 28 yuan (US$3.40) for a grand cafe mocca -- while local cafes nearby charge as little as 1 yuan for a cup of green tea and 3 yuan for a set lunch.

The coffee shop chains believe the growing affluence in southern China's key city of Guangzhou will provide the potential to follow in the footsteps of Beijing, Shanghai and Hong Kong.

Ernest Luk, vice president of Starbucks Coffee Asia Pacific, said, "There will be other companies that will go into the China market and into Guangzhou but I see that competition as healthy.

"Guangzhou is, as China as a whole, a tea-drinking country. Coffee culture isn't very strong. By having multiple competition, we will see the market grow faster," Luk said.

"Looking at our customers in Shanghai and Beijing, the first people who come to us are the younger crowd -- younger professional workers who were maybe exposed to our brand when they were educated overseas."

Starbucks prices will be 10 to 15 percent lower in Guangzhou than in Hong Kong but still hugely more expensive than other corner cafes and tea shops around the city.

Angela Chou, marketing manager for Starbucks Hong Kong's joint venture Coffee Concepts, said she did not believe the relatively high prices would put customers off. "We see our product as an affordable luxury," she said.

Pacific Coffee's chief operating officer Rob Naylor agreed that Guangzhou was ready to embrace coffee shops, saying, "We would like to be there and we are actively looking and talking about it."

Naylor said he believed Guangzhou had enormous potential and said he expected to see a number of overseas chains move into the city in the months ahead.

"Once it gets going and people understand what coffee culture is, the market grows rapidly," he said. "It becomes part of peoples' lifestyle choices. Its not just about coffee. It is about the experience," he said.

"The Guangzhou market is developing so rapidly. Five years ago you could say it was 50 years behind Hong Kong. Now maybe its 25 years. Who knows where well be in another year's time?"

Meanwhile, the last-minute training continues for Guangzhou Starbucks recruits, with trainees watching a subtitled video in which a top Seattle executive extols trainees to put their passion into making the perfect expresso, telling them, "You are an artist."

Karen Cheung Po Shan, 28, who was sent from Hong Kong to train the Guangzhou staff, said employees took little time getting a taste for drinking coffee, even after a lifetime of drinking tea.

Their expression when they first try it is funny to watch, she said. At first they complain it is too strong, but they gradually get used to it. Karen and her bosses at Starbucks are banking on the hope that the tea drinkers of Guangzhou will react in much the same way.

Dissident artist Ai Weiwei’s (艾未未) famous return to the People’s Republic of China (PRC) has been overshadowed by the astonishing news of the latest arrests of senior military figures for “corruption,” but it is an interesting piece of news in its own right, though more for what Ai does not understand than for what he does. Ai simply lacks the reflective understanding that the loneliness and isolation he imagines are “European” are simply the joys of life as an expat. That goes both ways: “I love Taiwan!” say many still wet-behind-the-ears expats here, not realizing what they love is being an

William Liu (劉家君) moved to Kaohsiung from Nantou to live with his boyfriend Reg Hong (洪嘉佑). “In Nantou, people do not support gay rights at all and never even talk about it. Living here made me optimistic and made me realize how much I can express myself,” Liu tells the Taipei Times. Hong and his friend Cony Hsieh (謝昀希) are both active in several LGBT groups and organizations in Kaohsiung. They were among the people behind the city’s 16th Pride event in November last year, which gathered over 35,000 people. Along with others, they clearly see Kaohsiung as the nexus of LGBT rights.

In the American west, “it is said, water flows upwards towards money,” wrote Marc Reisner in one of the most compelling books on public policy ever written, Cadillac Desert. As Americans failed to overcome the West’s water scarcity with hard work and private capital, the Federal government came to the rescue. As Reisner describes: “the American West quietly became the first and most durable example of the modern welfare state.” In Taiwan, the money toward which water flows upwards is the high tech industry, particularly the chip powerhouse Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). Typically articles on TSMC’s water demand

Every now and then, even hardcore hikers like to sleep in, leave the heavy gear at home and just enjoy a relaxed half-day stroll in the mountains: no cold, no steep uphills, no pressure to walk a certain distance in a day. In the winter, the mild climate and lower elevations of the forests in Taiwan’s far south offer a number of easy escapes like this. A prime example is the river above Mudan Reservoir (牡丹水庫): with shallow water, gentle current, abundant wildlife and a complete lack of tourists, this walk is accessible to nearly everyone but still feels quite remote.