The US Federal Reserve should be cautious on interest rate increases due to lingering risks to the US economy, one of its most influential policymakers yesterday said, appearing to signal that the chance of a hike by the end of the year was fading.

While New York Fed President William Dudley said it was “premature” to rule out a policy tightening this year, he added that negative shocks were more likely than positive ones due to the unknown fallout from Britain’s vote to leave the EU and a strong greenback.

“All three of these reasons — evidence that US monetary policy is currently only moderately accommodative, the fact that US financial conditions have been influenced by economic and financial market developments abroad, and risk management considerations — argue, at the moment, for caution in raising US short-term interest rates,” said Dudley, a close ally of Fed Chair Janet Yellen and a permanent voter on US policy.

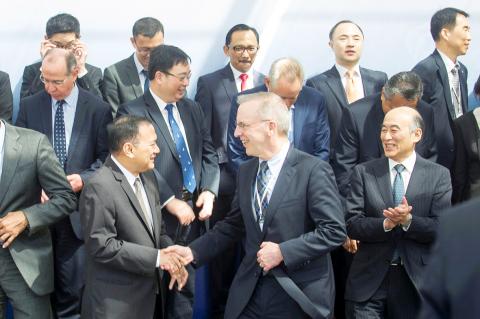

Photo: Reuters

The comments, including a reference to uncertainty around the Nov. 8 US election, suggested the central bank is leaning toward standing pat on rates until perhaps December — which would mark one year since it raised rates for the first time in nearly a decade.

Dudley applauded recent investor expectations for a less aggressive US tightening cycle going forward and warned that it was becoming increasingly clear that some post-crisis “headwinds” were likely to be permanent.

In an otherwise dovish speech to a joint New York Fed-Bank Indonesia conference in Bali, he said it was possible that the US economy would outperform expectations through year end, that financial conditions ease, or that other international risks fade.

“For these reasons, I think it is premature to rule out further monetary policy tightening this year,” he said in prepared remarks for the speech at a resort hotel.

If the economy and labor markets improve quickly, Dudley said, the Fed would react by raising rates sooner.

“If that all happens very quickly, I can definitely see the Fed raising interest rates even prior to the election possibly,” he said. “But if that all happens very slowly, then we’re going to go very slowly.”

Dudley was coy on just how many rate increases he envisioned, saying only that he expected the central bank to move at least more aggressively than current futures-market predictions for only one rate increase by the end of next year.

While the US central bank struck some confident tones in a policy statement last week, more recent data showing the US economy has expanded at an annual rate of roughly 1 percent so far this year emboldened those who think the Fed would not tighten monetary policy any time soon.

A Reuters poll of economists recently pointed to the December policy meeting as the most for an interest rate increase.

However, after weak US growth data on Friday, Fed funds rate futures are pricing in only about 30 percent chance of a rate hike by December, compared with about 50 percent early last week.

Dudley called the recent US GDP reading of 1.2 percent annualized growth for the second quarter as “sluggish,” but stuck to his expectation that the economy would rebound to about 2 percent growth over the next 18 months, an outlook he described as “positive” and “satisfactory.”

He also said he was confident inflation would rise to the Fed’s 2 percent goal in the medium term.

Dudley added that aggressive monetary easing in Japan and Europe this year boosted the US dollar and, together, helped convince the Fed it could not raise rates as aggressively as it imagined in December last year.

He said productivity in the US and around the world was “quite disappointing,” but it was up to governments and legislatures to construct the necessary reforms to make their economies more efficient.

The number of Taiwanese working in the US rose to a record high of 137,000 last year, driven largely by Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) rapid overseas expansion, according to government data released yesterday. A total of 666,000 Taiwanese nationals were employed abroad last year, an increase of 45,000 from 2023 and the highest level since the COVID-19 pandemic, data from the Directorate-General of Budget, Accounting and Statistics (DGBAS) showed. Overseas employment had steadily increased between 2009 and 2019, peaking at 739,000, before plunging to 319,000 in 2021 amid US-China trade tensions, global supply chain shifts, reshoring by Taiwanese companies and

Shiina Ito has had fewer Chinese customers at her Tokyo jewelry shop since Beijing issued a travel warning in the wake of a diplomatic spat, but she said she was not concerned. A souring of Tokyo-Beijing relations this month, following remarks by Japanese Prime Minister Sanae Takaichi about Taiwan, has fueled concerns about the impact on the ritzy boutiques, noodle joints and hotels where holidaymakers spend their cash. However, businesses in Tokyo largely shrugged off any anxiety. “Since there are fewer Chinese customers, it’s become a bit easier for Japanese shoppers to visit, so our sales haven’t really dropped,” Ito

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) received about NT$147 billion (US$4.71 billion) in subsidies from the US, Japanese, German and Chinese governments over the past two years for its global expansion. Financial data compiled by the world’s largest contract chipmaker showed the company secured NT$4.77 billion in subsidies from the governments in the third quarter, bringing the total for the first three quarters of the year to about NT$71.9 billion. Along with the NT$75.16 billion in financial aid TSMC received last year, the chipmaker obtained NT$147 billion in subsidies in almost two years, the data showed. The subsidies received by its subsidiaries —

OUTLOOK: Pat Gelsinger said he did not expect the heavy AI infrastructure investments by the major cloud service providers to cause an AI bubble to burst soon Building a resilient energy supply chain is crucial for Taiwan to develop artificial intelligence (AI) technology and grow its economy, former Intel Corp chief executive officer Pat Gelsinger said yesterday. Gelsinger, now a general partner at the US venture capital firm Playground Global LLC, was asked at a news conference in Taipei about his views on Taiwan’s hardware development and growing concern over an AI bubble. “Today, the greatest issue in Taiwan isn’t even in the software or in architecture. It is energy,” Gelsinger said. “You are not in the position to have a resilient energy supply chain, and that,