My financial education did not have the most auspicious start. I suppose I was lucky that in high school I had a class on basic investing and finance. However, I cringe when I remember that we read One Up on Wall Street, which encouraged us to go to a local mall, look for stores that had a lot of customers and consider buying their stock. Since then, financial education has become more common — but evidently not much better.

Access to financial education has never been greater, according to the Chartered Financial Analyst (CFA) Institute, which polled Gen Z on their investing habits. The Gen Z cohort — those born between 1997 and 2012 — was almost 60 percent more likely to have some financial instruction in school compared with millennials and 150 percent more likely than Gen Xers.

Yet, the survey showed that Gen Z is making some terrible investment choices. They tend to be under-diversified and over-exposed to exotic assets. Their investment practices suggest that either they are not being taught what is important or that whatever effort is being made in school is being drowned out by the lure of day-trading apps and advice from YouTube.

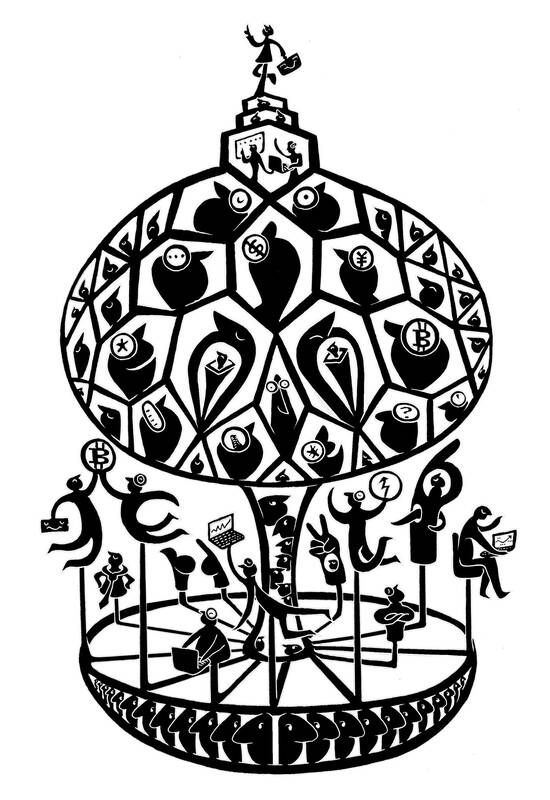

Illustration: Mountain People

It is progress that more young people are in markets. The sooner people start investing, the more time they would have to grow their wealth and be able to fully participate in and benefit from the US economy.

In addition to education, technology has made it easier to access markets with less money. Gen Zers have the highest rates of stock market participation at their age compared with early generations. In 2022, about 40 percent of under-25 year olds are in the stock market in some form (including retirement accounts), compared with only 16 percent in 1995, the US Federal Reserve’s Survey of Consumer Finances showed. However, much of that growth comes from more speculation.

After the bear markets in 2000 and 2008, young people held back on stock-picking, but once those bad markets were distant memories, new investors piled in.

The CFA survey found that one of the primary reasons young people say they invest is easy access to markets through trading platforms such as Robinhood that do not require a minimum investment.

Another big factor is FOMO. And it shows. More than half of young investors in the US own some form of cryptocurrency, making it the most popular asset in Gen Z portfolios. Indeed, an alarming 19 percent of Gen Z investors are only in cryptocurrency trading, instead of stocks or any other kind of marketable asset. About 41 percent own individual stocks, while only 35 percent buy mutual funds. It all adds up to a very risky, potentially volatile portfolio.

However, who can blame Gen Z when you consider their lived experience? They have only seen the S&P 500 rise, led by a few large stocks that outpaced the rest. They also saw some of their peers get very rich from crypto and be treated like heroes for trading meme stocks. The lure of cryptocurrency trading was especially tempting when they were locked up during the COVID-19 pandemic with stimulus money to spend. We created a generation of speculators and gave them tools that offer a video-game buzz.

Education might not have been able to completely counter the thrill of day-trading stocks and speculating on currencies with no discernible value, but it could have helped people understand the role these assets should have in a portfolio. Buying single stocks (or any commodity or currency) is better understood as speculation, because it is a bet on a single company’s value rising or falling. Speculation is a zero-sum game where you are up against professional investors who have time, years of expertise and deep pockets. While it is tempting to root for the little guy, the pros usually win.

That does not mean markets are rigged. Investing, or buying many stocks in the market, is a bet on the economy’s overall growth rather than on one stock going up or down. As the economy grows, everyone gains.

There is nothing wrong with speculation — in crypto, meme stocks or any other nontraditional asset. However, it should be appreciated it for what it is, entertainment that occasionally pays off, like gambling in a casino. It should not be one’s primary investment strategy. Index funds are not exciting, but they are often the best way to build a nest egg.

It is worth noting that most young investors report that they are putting their money into markets not for entertainment, but so that they can have a comfortable retirement, according to the CFA survey.

Younger investors are still learning, and they have less money to lose. The median financial assets of people aged 25 and younger in 2022 was US$4,000, the US Fed said. However, when the market turns and odds are it would eventually because we are headed into a more volatile era, Gen Zers, under-diversified and heavy into cryptocurrencies, are especially vulnerable to big losses. If the market turn happens relatively soon, they might shake it off and do better next time. However, if the bull market goes on for longer, the losses would be larger and could set back home-ownership and other financial rites of passage.

Either way, it is not ideal to rely on market downturns to teach each generation about the nature of market risk. Yet it is not clear what the alternative is, short of outlawing single-stock ownership for non-accredited investors. I am not ready to count out the power of education, even if it is clearly falling short right now. However, that does not mean it cannot be better and more effective. In a world where investing is more accessible and there are many compelling online videos full of bad advice, it has never been more important to get it right.

My Bloomberg Opinion colleague Matt Levine said that the major shortcoming with financial education is that it teaches the wonders of compound interest, but often fails to explain why some assets return more than others. In essence, it fails to educate us on what underlies financial markets — risk.

Allison Schrager is a Bloomberg Opinion columnist covering economics. A senior fellow at the Manhattan Institute, she is author of An Economist Walks Into a Brothel: And Other Unexpected Places to Understand Risk. This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

The Chinese Communist Party (CCP) has long been expansionist and contemptuous of international law. Under Chinese President Xi Jinping (習近平), the CCP regime has become more despotic, coercive and punitive. As part of its strategy to annex Taiwan, Beijing has sought to erase the island democracy’s international identity by bribing countries to sever diplomatic ties with Taipei. One by one, China has peeled away Taiwan’s remaining diplomatic partners, leaving just 12 countries (mostly small developing states) and the Vatican recognizing Taiwan as a sovereign nation. Taiwan’s formal international space has shrunk dramatically. Yet even as Beijing has scored diplomatic successes, its overreach

In her article in Foreign Affairs, “A Perfect Storm for Taiwan in 2026?,” Yun Sun (孫韻), director of the China program at the Stimson Center in Washington, said that the US has grown indifferent to Taiwan, contending that, since it has long been the fear of US intervention — and the Chinese People’s Liberation Army’s (PLA) inability to prevail against US forces — that has deterred China from using force against Taiwan, this perceived indifference from the US could lead China to conclude that a window of opportunity for a Taiwan invasion has opened this year. Most notably, she observes that

For Taiwan, the ongoing US and Israeli strikes on Iranian targets are a warning signal: When a major power stretches the boundaries of self-defense, smaller states feel the tremors first. Taiwan’s security rests on two pillars: US deterrence and the credibility of international law. The first deters coercion from China. The second legitimizes Taiwan’s place in the international community. One is material. The other is moral. Both are indispensable. Under the UN Charter, force is lawful only in response to an armed attack or with UN Security Council authorization. Even pre-emptive self-defense — long debated — requires a demonstrably imminent

Since being re-elected, US President Donald Trump has consistently taken concrete action to counter China and to safeguard the interests of the US and other democratic nations. The attacks on Iran, the earlier capture of deposed of Venezuelan president Nicolas Maduro and efforts to remove Chinese influence from the Panama Canal all demonstrate that, as tensions with Beijing intensify, Washington has adopted a hardline stance aimed at weakening its power. Iran and Venezuela are important allies and major oil suppliers of China, and the US has effectively decapitated both. The US has continuously strengthened its military presence in the Philippines. Japanese Prime