It was the kind of brazen PR stunt that Jack Ma (馬雲) might have dreamed up. However, this was not the flamboyant Chinese billionaire who disappeared from public view eight months ago. It was Mark Zuckerberg, bobbing up and down on a hydrofoil surfboard, clutching a US flag and exuding all the confidence of a man worth US$130 billion.

The contrast between the social media mogul’s July 4th Instagram video and the day’s big event in China could hardly have been starker. Regulators in Beijing had just hours earlier banned Didi Global Inc’s ride-hailing service from app stores, delivering their latest hammer blow to an entrepreneurial elite that once seemed destined to challenge Zuckerberg and his US peers at the top of the world’s wealth rankings.

The age of unfettered gains for China’s ultra-rich now appears to be coming to an abrupt end.

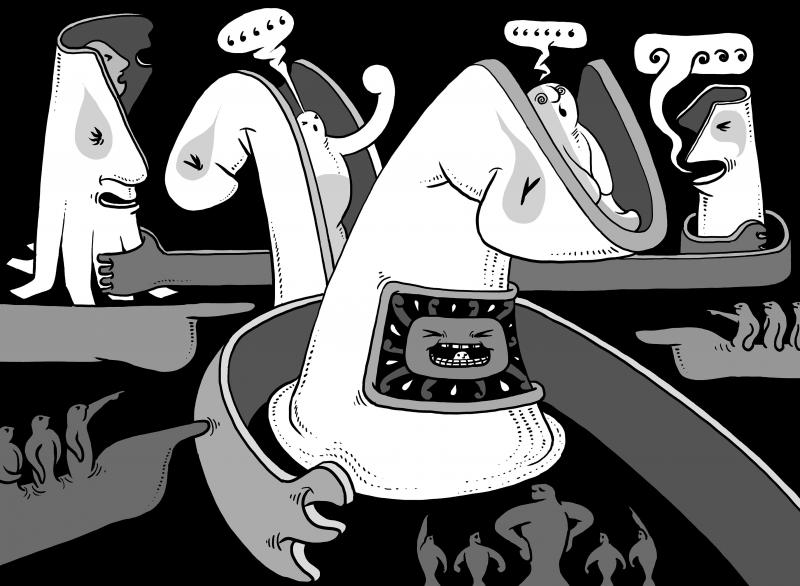

Illustration: Mountain People

Even as the world’s 10 wealthiest people added US$209 billion to their net worth in the first half of this year, China’s richest tycoons in the Bloomberg Billionaires Index saw their combined fortunes shrink by US$16 billion. Shares of their flagship companies sank by an average 13 percent during the period, the first time in at least six years they have recorded declines when the broader Chinese equity market was rising.

Didi’s stock has plunged 14 percent since its June 30 debut on the New York Stock Exchange, slashing the wealth of the company’s cofounders by almost US$800 million.

Behind the losses is a crackdown that has only intensified since November last year, when Ma’s Ant Group Co was forced to pull its blockbuster initial public offering (IPO) at the last minute. Policymakers are tightening regulations on some of the most important facets of Asia’s largest economy, from financial services to Internet platforms and the data that underpins most big businesses in modern China.

In the latest salvo, regulators unveiled new draft rules on Saturday last week that would require nearly all domestic companies to undergo a cybersecurity review before listing in a foreign country.

Beijing’s motivations for the crackdown are varied. They include concerns about anticompetitive behavior in the tech industry, risks to financial stability from lightly regulated lending platforms and the rapid proliferation of sensitive personal information in the hands of large corporations.

However, another undercurrent running through many of the government’s latest initiatives is a not-so-secret desire to rein in the power of China’s tycoons, some of whom have amassed an enormous amount of influence over the US$14 trillion economy.

As one government official familiar with the leadership’s thinking described it, Beijing wants to prevent its billionaires from becoming a force as strong as the family-run chaebol that dominate South Korea’s economy and many aspects of its politics.

Adding to Beijing’s resolve is the Chinese public’s growing concern over rising inequality. In a major speech on his economic plans in October, Chinese President Xi Jinping (習近平) acknowledged that the country’s development was “unbalanced” and said “common prosperity” should be the ultimate goal.

The upshot is a new era for the nation’s billionaires and the investors who back them. Gone are the days when tycoons like Ma could confidently bend the rules to supercharge their companies’ growth and challenge entrenched interests like state-owned banks. Outsized public personas — long seen as an asset for tech-company founders — now look like a liability.

The new playbook for China’s ultra-rich calls for more deference to the Chinese Communist Party, more charitable donations and more focus on the well-being of rank-and-file employees, even if it hurts the bottom line.

“Some of the tech companies became larger than life,” said Allan Zeman, a property tycoon who gave up his Canadian passport to become a naturalized citizen of China in 2008.

One big lesson from the crackdown: “Don’t get bigger than the government,” Zeman said, shortly after attending the Chinese Communist Party’s 100th anniversary celebration in Beijing on July 1.

Didi notwithstanding, the message appears to be getting through. Ma, who criticized Chinese financial regulators in his last public speech before Ant’s IPO was abruptly suspended, has since resurfaced only a handful of times in carefully choreographed appearances.

Colin Huang (黃崢), whose e-commerce giant Pinduoduo Inc has come under scrutiny for its relentless working schedules, has given up his roles as chairman and CEO, and donated shares worth billions of dollars. ByteDance Ltd founder Zhang Yiming (張一鳴) said in May that he would step down as CEO and spend more time on educational charity.

Wang Xing (王興), chairman of food-delivery giant Meituan, has mostly steered clear of the public spotlight since he posted a 1,100-year-old poem in May that some regarded as an implicit criticism of the government.

Wang, who later issued a clarification saying the post had been targeted at the shortsightedness of his own industry, was advised by Beijing officials to keep a low profile, people with knowledge of the matter said.

The new environment will “fundamentally change” China’s tech sector, partly because investors will become more wary of funding entrepreneurs who could end up on a collision course with Beijing, said Eric Schiffer, CEO of Patriarch Organization, a Los Angeles-based private equity firm.

US President Joe Biden has also taken aim at the billionaire class, calling for increased taxes on the rich and on Friday last week signing an executive order that aims to weaken dominance of the US’ biggest companies. The move echoed an ongoing antitrust campaign in China that has ensnared giants, including Alibaba Group Holding Ltd and archrival Tencent Holdings Ltd.

One key difference is that Chinese authorities, unrestrained by Western-style checks and balances, can act more forcefully than their US counterparts, said Angela Zhang (張湖月), director of the Centre for Chinese Law at the University of Hong Kong and author of Chinese Antitrust Exceptionalism.

Zuckerberg’s hydrofoil joyride came just a few days after a judge dismissed two monopoly lawsuits against Facebook Inc that had been filed by the US government and a coalition of states.

“In the case of China, the pendulum swings very quickly,” Zhang said.

Beijing has a variety of tools for reining in billionaires, including detention in the most extreme cases. An internal disciplinary process for party members, known as shuanggui (雙規), has been used for some tycoons in the past. Investigations by antitrust, cybersecurity and other regulators are more common ways to influence the behavior of tech giants. The government also uses “soft” methods, including state-media campaigns, Zhang said.

In the days after regulators halted Ant’s IPO, Xi visited a museum in the eastern city of Nantong that was created by Zhang Jian (張謇), a 19th-century capitalist. Xi described Zhang as a patriotic nation builder and philanthropist. Rather than disrupt the financial system with unregulated loans, he built factories and hundreds of schools.

“When you see a virtuous person, follow his example,” Xi was quoted as saying by Chinese media, calling on private entrepreneurs to “strengthen their feelings for the country and assume social responsibilities.”

While China’s crackdown has been most visible in the tech industry, the nation’s property billionaires have also come under increased pressure in recent years. Authorities have steadily restricted the industry’s access to funding in an attempt to rein in home prices and reduce systemic risks to the financial system. China Evergrande Group chairman Hui Ka Yan (許家印) has been among the biggest casualties of the campaign this year, losing US$6.7 billion, or nearly 30 percent, of his fortune as Evergrande’s stock tumbled on concerns the company faces a liquidity crunch.

A more subtle sign of billionaires’ waning influence can be seen in their shrinking share of political appointments. Data from the Hurun Report, which produces wealth rankings, shows that rich entrepreneurs accounted for 5.8 percent of delegates in the Chinese People’s Political Consultative Conference and the National People’s Congress, the lowest in at least eight years and down from 15.3 percent in 2013.

“There is an evolution in the thinking of which type of people should be within the mix,” Hurun Report chairman Rupert Hoogewerf said. “It’s becoming much harder for entrepreneurs.”

The big question is whether all of this will be good for China in the long run. One risk is that the onslaught of regulatory probes and rule changes undermines investor confidence, Zhang said. That could make it less likely that the entrepreneurs behind the next potential Alibaba or Tencent get the funding they need to make their ideas a reality. Global venture capital firms are likely to think twice about investing in Chinese companies if Beijing prevents them from listing overseas, a crucial exit route for early international backers.

Yet some of Beijing’s new policies might foster competition in the oligopolistic tech industry, clearing the way for a new class of billionaires to rise. Stricter regulations on fintech firms would help reduce systemic risks, even if they slow down innovation.

China’s crackdown on Ant won praise last month from Berkshire Hathaway Inc vice chairman Charlie Munger, who said in an interview with CNBC that the “Communists did the right thing” by letting Ma know he could not “wade into banking ... and just do whatever he pleased.”

Either way, China’s entrepreneurs will have little choice, but to embrace the “new normal,” said Chen Long (陳龍), a partner at consulting firm Plenum. “The good old days of savage growth are gone.”

Recently, China launched another diplomatic offensive against Taiwan, improperly linking its “one China principle” with UN General Assembly Resolution 2758 to constrain Taiwan’s diplomatic space. After Taiwan’s presidential election on Jan. 13, China persuaded Nauru to sever diplomatic ties with Taiwan. Nauru cited Resolution 2758 in its declaration of the diplomatic break. Subsequently, during the WHO Executive Board meeting that month, Beijing rallied countries including Venezuela, Zimbabwe, Belarus, Egypt, Nicaragua, Sri Lanka, Laos, Russia, Syria and Pakistan to reiterate the “one China principle” in their statements, and assert that “Resolution 2758 has settled the status of Taiwan” to hinder Taiwan’s

Singaporean Prime Minister Lee Hsien Loong’s (李顯龍) decision to step down after 19 years and hand power to his deputy, Lawrence Wong (黃循財), on May 15 was expected — though, perhaps, not so soon. Most political analysts had been eyeing an end-of-year handover, to ensure more time for Wong to study and shadow the role, ahead of general elections that must be called by November next year. Wong — who is currently both deputy prime minister and minister of finance — would need a combination of fresh ideas, wisdom and experience as he writes the nation’s next chapter. The world that

Can US dialogue and cooperation with the communist dictatorship in Beijing help avert a Taiwan Strait crisis? Or is US President Joe Biden playing into Chinese President Xi Jinping’s (習近平) hands? With America preoccupied with the wars in Europe and the Middle East, Biden is seeking better relations with Xi’s regime. The goal is to responsibly manage US-China competition and prevent unintended conflict, thereby hoping to create greater space for the two countries to work together in areas where their interests align. The existing wars have already stretched US military resources thin, and the last thing Biden wants is yet another war.

Since the Russian invasion of Ukraine in February 2022, people have been asking if Taiwan is the next Ukraine. At a G7 meeting of national leaders in January, Japanese Prime Minister Fumio Kishida warned that Taiwan “could be the next Ukraine” if Chinese aggression is not checked. NATO Secretary-General Jens Stoltenberg has said that if Russia is not defeated, then “today, it’s Ukraine, tomorrow it can be Taiwan.” China does not like this rhetoric. Its diplomats ask people to stop saying “Ukraine today, Taiwan tomorrow.” However, the rhetoric and stated ambition of Chinese President Xi Jinping (習近平) on Taiwan shows strong parallels with