Iran, reeling from the effects of US sanctions, a collapse in oil sales and a severe COVID-19 epidemic, is scrambling to buy food and medicine to avoid a supply crunch, but it is a struggle.

Despite such supplies being exempt from sanctions, banks and governments are reluctant to transfer or take Iranian money because they fear unwittingly breaching the complex US restrictions, five trade and finance sources have said.

An approved trade channel launched by the Swiss government, and backed by Washington — the Swiss Humanitarian Trade Agreement (SHTA) — went live in February after more than a year of work to facilitate such Iranian purchases from Swiss companies.

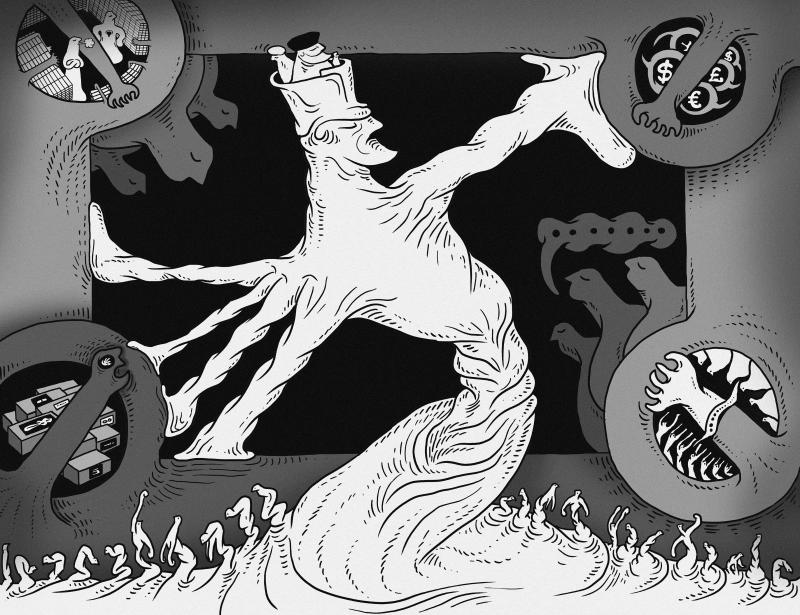

Illustration: Mountain People

Yet the Central Bank of Iran (CBI) has been unable to transfer the billions of dollars of oil export cash it had built up between 2016 and 2018 to bank accounts working with the SHTA, the five sources with knowledge of the matter said.

That money was accumulated in bank accounts in countries that Iran sold oil to — especially in Asia, with its biggest customers including South Korea and Japan — in the years after Iran signed the nuclear accord with world powers, but before US President Donald Trump’s administration withdrew and reimposed sanctions in 2018.

The funds were frozen when the sanctions, which target the CBI as well as dollar transactions with Iranian entities, were reintroduced.

As a result, international banks and their governments — whom they seek clearance from — are wary of allowing funds to be released without specific authorization from Washington for each transfer, the sources said.

The blockage illustrates how the complexity of US sanctions has made many banks, companies and countries wary of doing any business with Iran, even when exemptions exist, because breaches can involve huge financial penalties and being effectively shut out of the crucial US financial system, the sources added.

The effects have also been felt in other areas, with media previously reporting that many foreign shipping companies and insurers are unwilling to provide vessels or cover for voyages, even for commerce that has been approved.

South Korean and Japanese authorities have declined cash transfers to Switzerland by the CBI without specific US approval, said the sources, who declined to be named due to the sensitivity of the matter.

The South Korean Ministry of Foreign Affairs confirmed this.

“Under the current US sanctions, returning the money in cash is impossible,” an official said. “Any permission regarding the funds needs to be strictly authorized by the US.”

The ministry official said that Seoul had “discussed the Swiss route as another possible way of clearance [of funds],” but added that the “US hasn’t been positive about such proposals.”

It is unclear why the US might not have given specific approval for those transactions.

A Japanese Ministry of Finance official declined to comment and referred the matter to Iranian authorities.

The CBI did not respond to requests for comment.

When asked whether such transfers of funds were permitted and whether it would give specific authorizations, a US Department of the Treasury spokesperson said that the US is committed to the delivery of humanitarian goods and services to the Iranian people.

Non-US nationals can engage in the export or re-export of food, agricultural products, medicine and medical devices to Iran outside of US jurisdiction without additional authorization, provided that transactions involving the CBI are consistent with US guidance, the spokesperson added.

A US Department of State spokesperson said that the US remains committed to the success of the SHTA.

“It has never been, nor is it now, US policy to target humanitarian trade with Iran,” it added.

The Swiss government on Monday last week said that a Swiss pharmaceutical company had completed the first transaction under the new humanitarian trade channel with Iran, adding that more transactions would follow.

The SHTA needed “regular transfers of Iranian funds from abroad for its functioning,” the Swiss State Secretariat for Economic Affairs (SECO) said, adding that US authorities had given assurances that they would support such transfers.

“We are in talks with the USA and other partners on this matter. However, we cannot provide information on individual transfers,” SECO said, without further details.

SECO did not comment on how the first confirmed transaction was funded.

An Iranian official, speaking on condition of anonymity, said that Tehran had been in contact with countries where it has funds to try to transfer the money under the Swiss initiative.

“These countries have approached the US to secure its approval for such a transfer, but to no avail,” the official said.

The Geneva, Switzerland-based Bangue de Commerce et de Placements (BCP) is the only financial institution that has committed to the SHTA so far and agreed to receive Iranian funds under the scheme, the sources said.

BCP did not respond to requests for comment.

The sources said that major international trading houses are ready to supply Iran with agricultural commodities under the scheme, but only when they are certain that transactions are free of any sanctions risk.

“The big trading houses will only work inside a formal US-approved payment system,” one European grain trader said.

Adding to Iran’s food-supply woes, corn imports from main supplier Brazil have slumped.

Last year, Iran was Brazil’s second-biggest buyer of corn, but in the first half of this year, imports from the country declined to about 339,000 tonnes from 2.3 million tonnes a year earlier, Brazilian government data showed.

Tehran is facing increased competition in Brazil’s corn market from other buyers, especially Taiwan.

Brazilian sellers are also struggling to find international banks willing to process the transactions because of perceived sanctions risk, seven Brazilian trade and finance sources said.

The traders have sought to use small local banks to clear Iran-related transactions, the people said.

They have also sought to use the euro to avoid dollar transactions that would be flagged to the US Treasury, they added.

Iran pays US$10 per tonne more than other buyers to compensate for payment and logistical challenges, the Brazilian trade sources said.

“Because of the hostile policies of the United States, we have to cut down imports,” said Mehdi Ansari, head of Iran-based grain trader Tejari Ansari Group.

The US Treasury declined to comment when asked about the decline in Brazilian corn sales to Iran.

Iranian buyers made about 600,000 tonnes of advanced corn purchases from Brazil last month for the second half of this year, with payments expected to be worked out once cargoes sail, trade sources said.

However, sellers could divert vessels to other buyers if Iran cannot pay.

Brazilian traders are also using barter deals — for example, taking Iranian urea to be used as fertilizer in exchange for corn, the sources said.

Carlos Millnitz, chief executive of Brazilian chemical company Eleva Quimica, said that such deals did not breach sanctions as no money was exchanged, but “make the corn more expensive for Iran.”

However, Eleva Quimica is avoiding Iranian-flagged ships for barter exchanges after two such vessels were stranded for weeks at a Brazilian port last year when state-run oil firm Petroleo Brasileiro refused to refuel them due to US sanctions, he added.

Additional reporting by Daphne Psaledakis, Tetsushi Kajimoto, Michael Shields, Michael Hogan and Karl Plume

In the US’ National Security Strategy (NSS) report released last month, US President Donald Trump offered his interpretation of the Monroe Doctrine. The “Trump Corollary,” presented on page 15, is a distinctly aggressive rebranding of the more than 200-year-old foreign policy position. Beyond reasserting the sovereignty of the western hemisphere against foreign intervention, the document centers on energy and strategic assets, and attempts to redraw the map of the geopolitical landscape more broadly. It is clear that Trump no longer sees the western hemisphere as a peaceful backyard, but rather as the frontier of a new Cold War. In particular,

As the Chinese People’s Liberation Army (PLA) races toward its 2027 modernization goals, most analysts fixate on ship counts, missile ranges and artificial intelligence. Those metrics matter — but they obscure a deeper vulnerability. The true future of the PLA, and by extension Taiwan’s security, might hinge less on hardware than on whether the Chinese Communist Party (CCP) can preserve ideological loyalty inside its own armed forces. Iran’s 1979 revolution demonstrated how even a technologically advanced military can collapse when the social environment surrounding it shifts. That lesson has renewed relevance as fresh unrest shakes Iran today — and it should

The last foreign delegation Nicolas Maduro met before he went to bed Friday night (January 2) was led by China’s top Latin America diplomat. “I had a pleasant meeting with Qiu Xiaoqi (邱小琪), Special Envoy of President Xi Jinping (習近平),” Venezuela’s soon-to-be ex-president tweeted on Telegram, “and we reaffirmed our commitment to the strategic relationship that is progressing and strengthening in various areas for building a multipolar world of development and peace.” Judging by how minutely the Central Intelligence Agency was monitoring Maduro’s every move on Friday, President Trump himself was certainly aware of Maduro’s felicitations to his Chinese guest. Just

On today’s page, Masahiro Matsumura, a professor of international politics and national security at St Andrew’s University in Osaka, questions the viability and advisability of the government’s proposed “T-Dome” missile defense system. Matsumura writes that Taiwan’s military budget would be better allocated elsewhere, and cautions against the temptation to allow politics to trump strategic sense. What he does not do is question whether Taiwan needs to increase its defense capabilities. “Given the accelerating pace of Beijing’s military buildup and political coercion ... [Taiwan] cannot afford inaction,” he writes. A rational, robust debate over the specifics, not the scale or the necessity,