Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, after international crude oil prices fluctuated within a narrow range last week amid a mixed bag of positive and negative factors, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday.

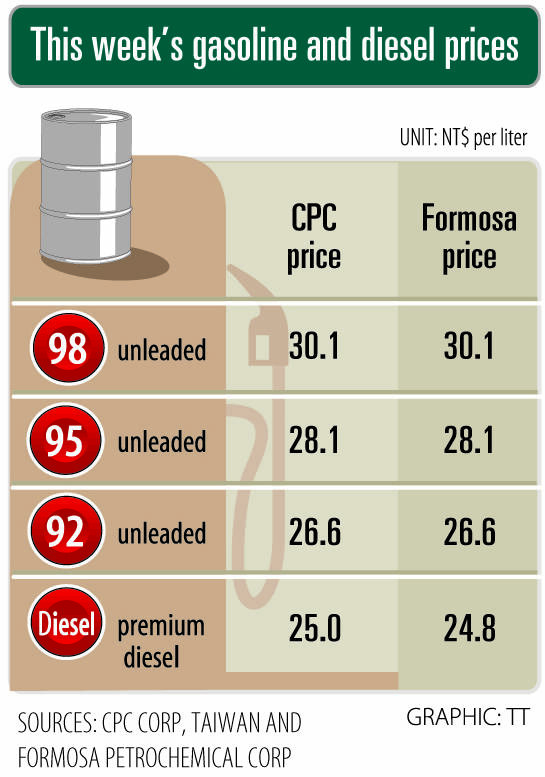

Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.6, NT$28.1 and NT$30.1 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements.

The price of premium diesel is to fall to NT$25 per liter at CPC stations and NT$24.8 at Formosa pumps, they said.

Oil market sentiment drifted last week, but average prices moved higher than the previous week, as traders weighed factors, such as the prospects of higher supply, the heightened tensions between Russia and Ukraine, Saudi Arabia’s latest airstrikes in southern Yemen and a marked increase in the US crude oil inventories in the week ended on Dec. 19, they said.

Front-month Brent crude oil futures — the international oil benchmark — last week gained 0.85 percent to settle at US$60.75 per barrel on the Intercontinental Exchange.

Meanwhile, West Texas Intermediate crude oil futures — the US oil benchmark — increased 1.02 percent to US$57.32 per barrel on the New York Mercantile Exchange.

Micron Memory Taiwan Co (台灣美光), a subsidiary of US memorychip maker Micron Technology Inc, has been granted a NT$4.7 billion (US$149.5 million) subsidy under the Ministry of Economic Affairs A+ Corporate Innovation and R&D Enhancement program, the ministry said yesterday. The US memorychip maker’s program aims to back the development of high-performance and high-bandwidth memory chips with a total budget of NT$11.75 billion, the ministry said. Aside from the government funding, Micron is to inject the remaining investment of NT$7.06 billion as the company applied to participate the government’s Global Innovation Partnership Program to deepen technology cooperation, a ministry official told the

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s leading advanced chipmaker, officially began volume production of its 2-nanometer chips in the fourth quarter of this year, according to a recent update on the company’s Web site. The low-key announcement confirms that TSMC, the go-to chipmaker for artificial intelligence (AI) hardware providers Nvidia Corp and iPhone maker Apple Inc, met its original roadmap for the next-generation technology. Production is currently centered at Fab 22 in Kaohsiung, utilizing the company’s first-generation nanosheet transistor technology. The new architecture achieves “full-node strides in performance and power consumption,” TSMC said. The company described the 2nm process as

Shares in Taiwan closed at a new high yesterday, the first trading day of the new year, as contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) continued to break records amid an artificial intelligence (AI) boom, dealers said. The TAIEX closed up 386.21 points, or 1.33 percent, at 29,349.81, with turnover totaling NT$648.844 billion (US$20.65 billion). “Judging from a stronger Taiwan dollar against the US dollar, I think foreign institutional investors returned from the holidays and brought funds into the local market,” Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺) said. “Foreign investors just rebuilt their positions with TSMC as their top target,

POTENTIAL demand: Tesla’s chance of reclaiming its leadership in EVs seems uncertain, but breakthrough in full self-driving could help boost sales, an analyst said Chinese auto giant BYD Co (比亞迪) is poised to surpass Tesla Inc as the world’s biggest electric vehicle (EV) company in annual sales. The two groups are expected to soon publish their final figures for this year, and based on sales data so far this year, there is almost no chance the US company led by CEO Elon Musk would retain its leadership position. As of the end of last month, BYD, which also produces hybrid vehicles, had sold 2.07 million EVs. Tesla, for its part, had sold 1.22 million by the end of September. Tesla’s September figures included a one-time boost in