Manufacturing giant Hon Hai Precision Industry Co (鴻海精密) yesterday announced a collaboration with ChatGPT developer OpenAI to build next-generation artificial intelligence (AI) infrastructure and strengthen its local supply chain in the US to accelerate the deployment of advanced AI systems.

Building such an infrastructure in the US is crucial for strengthening local supply chains and supporting the US in maintaining its leading position in the AI domain, Hon Hai said in a statement.

Through the collaboration, OpenAI would share its insights into emerging hardware needs in the AI industry with Hon Hai to support the company’s design and development work, as well as future production at its US sites, it said.

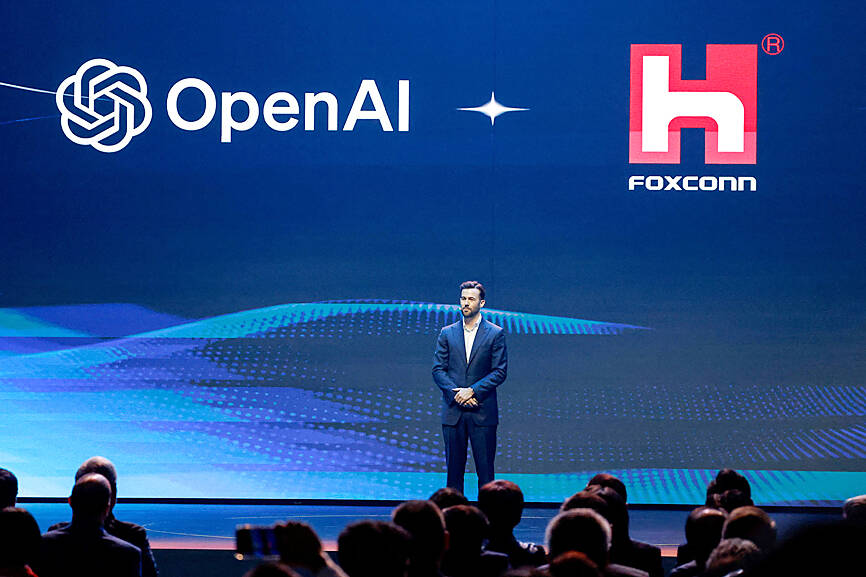

Photo: An Rong Xu, Bloomberg

The initial agreement does not include any purchase commitments or financial obligations, it added.

The collaboration will focus on developing develop multiple next-generation AI data center racks, enhancing the server rack architecture and expanding production across multiple US locations.

Hon Hai also expects to broaden its procurement to include more local chipmakers and suppliers, and to expand localized testing and assembly lines to provide a more resilient and scalable US supply chain.

Photo: Ann Wang, Reuters

Hon Hai also plans to build key components for AI data centers — including cabling, networking, cooling and power systems in the US — to support the rapid construction of high-performance computing infrastructure.

The research and development of the hardware would be carried out in San Jose, California, and could potentially be manufactured at the company’s Ohio plant, Hon Hai chairman Young Liu (劉揚偉) told Bloomberg Television on the sidelines of the company’s annual Technology Day event.

Hon Hai plans to spend an initial US$1 billion to US$5 billion to expand its US manufacturing footprint.

The company is focusing on the US and expects to be able to assemble up to 2,000 server racks per week next week, roughly doubling its current output, Liu said.

Separately, Hon Hai yesterday also announced that it would establish a joint venture in the US with Intrinsic, an Alphabet Inc subsidiary, to build future AI robot factories and use AI-enabled robotic skills to improve production efficiency in manufacturing and automotive plants.

The cooperation between the two companies in the initial phase would include assembly, testing, machine maintenance management and logistics applications, Hon Hai said in a statement.

Intrinsic’s solution would provide a general-purpose toolkit for Hon Hai and the Intrinsic team — including the Intrinsic Vision Model — to introduce a new automation approach to electronic assembly processes, the company said.

The two companies aim to drive a “step change” in electronic product assembly and broader manufacturing, transforming production for multiple generations of redesigned products through more versatile intelligent robots, and achieving full factory orchestration and automation, Hon Hai said.

Hon Hai also unveiled its new Model A electric vehicle (EV), which was primarily designed by the company’s Japanese team, Liu said.

Hon Hai plans to establish a company in Japan to produce the latest model and serve local customers, it said.

Additional reporting by Bloomberg

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.