Ta Liang Technology Co (大量), an advanced chip packaging equipment and printed circuit board (PCB) drilling machine supplier, yesterday reported a spike in net profit for the first half of the year, as strong demand for artificial intelligence (AI) applications and data centers persisted.

Net profit surged to NT$265 million (US$8.86 million) in the first half, compared with NT$9.51 million in the same period last year. Earnings per share jumped to NT$3.01 from NT$0.12.

Ta Liang expects the growth momentum to be stronger in the second half of this year, as the company has received new orders of 397 units of high-end machines, nearly tripling the 139 units it has shipped so far.

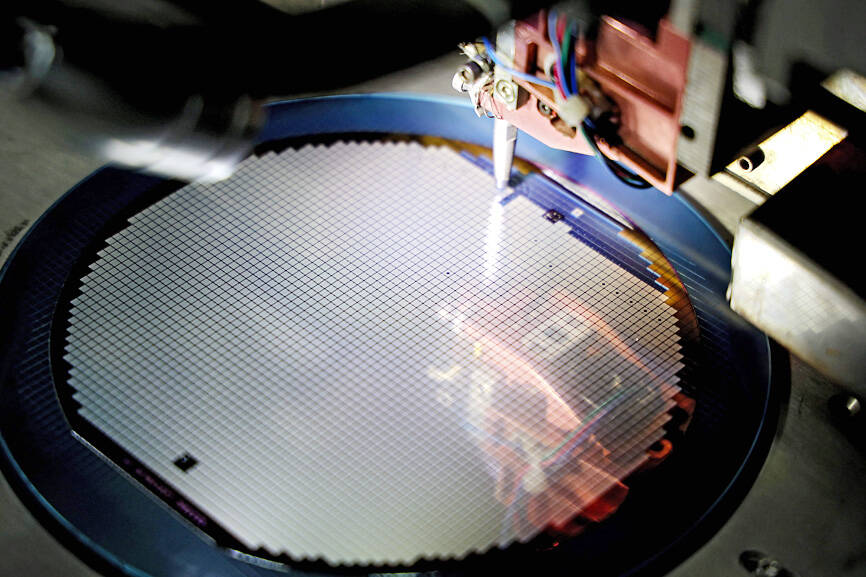

Photo: AFP

That would reflect in sequential growth of revenue in the second half, compared with NT$2.11 billion in the first half, the company said.

“We are positive about the second half outlook based on the orders received, which are higher than the first half. We are aggressively looking for new capacity as our factories are almost fully utilized, Ta Liang president Jackie Chien (簡禎祈) told an online investors’ conference yesterday.

The delivery schedule for some machines is being pushed back to the first quarter of next year due to capacity constraints, Chien said.

Ta Liang expects its new factory in Nanjing, China, to start operations later this year, he said.

The outlook for next year is also positive, attributable to the AI boom, which has stimulated increasing demand for PCBs and therefore advanced back drilling machines, Chien said.

The company plans to launch a new high-end PCB inner layer thickness metrology machine to cope with customers’ technology road maps, he said.

Ta Liang said the high-end machine’s revenue contribution climbed to 50 percent in the first half of this year, compared with 20 to 30 percent in the past. That has helped propel its gross margin to 37.03 percent in the first half from 23.24 percent a year earlier.

By business segment, PCB machines made up 90 percent of the company’s revenue in the first half. Semiconductor equipment accounted for 10 percent by supplying metrology and inspection equipment used for advanced chip-on-wafer-on-substrate, system-on-integrated chips and panel-level packaging technologies.

Ta Liang counts Taiwan Semiconductor Manufacturing Co (台積電) and ASE Technology Holding Co (日月光投控), the world’s largest chip packaging and testing service provider, as its major customers.

The company expects little impact from the US tariffs as Taiwan, China and Thailand are its major shipment destinations, Chien said.

Customers would pay the tariff costs on its edge coating machine that is to be shipped to the US customers, the company said.

Edge coating machines only contributed 5 percent to the company’s revenue.

GROWING OWINGS: While Luxembourg and China swapped the top three spots, the US continued to be the largest exposure for Taiwan for the 41st consecutive quarter The US remained the largest debtor nation to Taiwan’s banking sector for the 41st consecutive quarter at the end of September, after local banks’ exposure to the US market rose more than 2 percent from three months earlier, the central bank said. Exposure to the US increased to US$198.896 billion, up US$4.026 billion, or 2.07 percent, from US$194.87 billion in the previous quarter, data released by the central bank showed on Friday. Of the increase, about US$1.4 billion came from banks’ investments in securitized products and interbank loans in the US, while another US$2.6 billion stemmed from trust assets, including mutual funds,

AI TALENT: No financial details were released about the deal, in which top Groq executives, including its CEO, would join Nvidia to help advance the technology Nvidia Corp has agreed to a licensing deal with artificial intelligence (AI) start-up Groq, furthering its investments in companies connected to the AI boom and gaining the right to add a new type of technology to its products. The world’s largest publicly traded company has paid for the right to use Groq’s technology and is to integrate its chip design into future products. Some of the start-up’s executives are leaving to join Nvidia to help with that effort, the companies said. Groq would continue as an independent company with a new chief executive, it said on Wednesday in a post on its Web

Even as the US is embarked on a bitter rivalry with China over the deployment of artificial intelligence (AI), Chinese technology is quietly making inroads into the US market. Despite considerable geopolitical tensions, Chinese open-source AI models are winning over a growing number of programmers and companies in the US. These are different from the closed generative AI models that have become household names — ChatGPT-maker OpenAI or Google’s Gemini — whose inner workings are fiercely protected. In contrast, “open” models offered by many Chinese rivals, from Alibaba (阿里巴巴) to DeepSeek (深度求索), allow programmers to customize parts of the software to suit their

JOINT EFFORTS: MediaTek would partner with Denso to develop custom chips to support the car-part specialist company’s driver-assist systems in an expanding market MediaTek Inc (聯發科), the world’s largest mobile phone chip designer, yesterday said it is working closely with Japan’s Denso Corp to build a custom automotive system-on-chip (SoC) solution tailored for advanced driver-assistance systems and cockpit systems, adding another customer to its new application-specific IC (ASIC) business. This effort merges Denso’s automotive-grade safety expertise and deep vehicle integration with MediaTek’s technologies cultivated through the development of Media- Tek’s Dimensity AX, leveraging efficient, high-performance SoCs and artificial intelligence (AI) capabilities to offer a scalable, production-ready platform for next-generation driver assistance, the company said in a statement yesterday. “Through this collaboration, we are bringing two