Advanced Micro Devices Inc (AMD) chief executive officer Lisa Su (蘇姿丰) on Wednesday said that the chips her company gets from supplier Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) would cost more when they are produced in TSMC’s Arizona facilities.

Compared with similar parts from factories in Taiwan, the US chips would be “more than 5 percent, but less than 20 percent” in terms of higher costs, she said at an artificial intelligence (AI) event in Washington.

AMD expects its first chips from TSMC’s Arizona facilities by the end of the year, Su said.

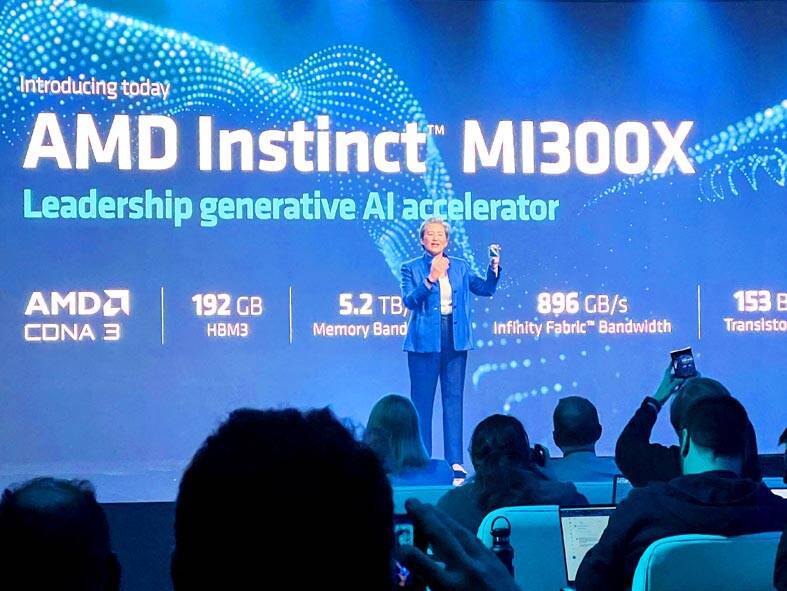

Photo: Reuters

The extra expense is worth it, because the company is diversifying the crucial supply of chips, Su said in an interview with Bloomberg Television following her onstage appearance.

That would make the industry less prone to the type of disruptions experienced during the COVID-19 pandemic.

“We have to consider resiliency in the supply chain,” she said. “We learned that in the pandemic.”

TSMC’s new Arizona plant is already comparable with those in Taiwan when it comes to the measure of yield — the amount of good chips a production run produces per batch— Su told the audience at the forum.

The event was hosted by the All-In podcast team, and a consortium of tech leaders and lawmakers known as the Hill and Valley Forum. US President Donald Trump and other administration officials also appeared at the venue to discuss the rollout of their “AI action plan.”

AMD and Nvidia Corp recently gained a reprieve on restrictions imposed on shipments of some types of AI accelerators to China.

AMD is Nvidia’s nearest rival in the market for AI accelerators, chips that help develop and run AI models.

It is still not clear how many licenses would be granted — or how long the companies would be allowed to ship the chips to the country, the biggest market for semiconductors.

Successive administrations have imposed increasingly stringent regulations on exports to China of such chips, citing national security concerns. Those rules have cost US chipmakers billions in revenue.

Su said that the policy going forward needs to be balanced. Allowing shipments to US allies would help make sure the country’s technology remains foundational to AI systems everywhere.

“It’s a tricky dribble,” she said. “I think the administration has been doing a good job of working with us.”

At the event, US Secretary of Commerce Howard Lutnick was asked about the administration’s policy on the export of AI chips.

“We are comfortable with allies buying a significant number of chips and having a large cluster,” he said.

How large those groupings of server computers are and how much access US companies have to them would be factors, he said.

JITTERS: Nexperia has a 20 percent market share for chips powering simpler features such as window controls, and changing supply chains could take years European carmakers are looking into ways to scratch components made with parts from China, spooked by deepening geopolitical spats playing out through chipmaker Nexperia BV and Beijing’s export controls on rare earths. To protect operations from trade ructions, several automakers are pushing major suppliers to find permanent alternatives to Chinese semiconductors, people familiar with the matter said. The industry is considering broader changes to its supply chain to adapt to shifting geopolitics, Europe’s main suppliers lobby CLEPA head Matthias Zink said. “We had some indications already — questions like: ‘How can you supply me without this dependency on China?’” Zink, who also

The number of Taiwanese working in the US rose to a record high of 137,000 last year, driven largely by Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) rapid overseas expansion, according to government data released yesterday. A total of 666,000 Taiwanese nationals were employed abroad last year, an increase of 45,000 from 2023 and the highest level since the COVID-19 pandemic, data from the Directorate-General of Budget, Accounting and Statistics (DGBAS) showed. Overseas employment had steadily increased between 2009 and 2019, peaking at 739,000, before plunging to 319,000 in 2021 amid US-China trade tensions, global supply chain shifts, reshoring by Taiwanese companies and

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) received about NT$147 billion (US$4.71 billion) in subsidies from the US, Japanese, German and Chinese governments over the past two years for its global expansion. Financial data compiled by the world’s largest contract chipmaker showed the company secured NT$4.77 billion in subsidies from the governments in the third quarter, bringing the total for the first three quarters of the year to about NT$71.9 billion. Along with the NT$75.16 billion in financial aid TSMC received last year, the chipmaker obtained NT$147 billion in subsidies in almost two years, the data showed. The subsidies received by its subsidiaries —

Shiina Ito has had fewer Chinese customers at her Tokyo jewelry shop since Beijing issued a travel warning in the wake of a diplomatic spat, but she said she was not concerned. A souring of Tokyo-Beijing relations this month, following remarks by Japanese Prime Minister Sanae Takaichi about Taiwan, has fueled concerns about the impact on the ritzy boutiques, noodle joints and hotels where holidaymakers spend their cash. However, businesses in Tokyo largely shrugged off any anxiety. “Since there are fewer Chinese customers, it’s become a bit easier for Japanese shoppers to visit, so our sales haven’t really dropped,” Ito