Smartphone chip designer Media-Tek Inc (聯發科) yesterday said that it would perform better than the seasonal pattern with revenue forecast to grow 2 percent quarterly, thanks to robust demand for its new flagship smartphone chip that enables PC-like artificial intelligence (AI) features on phones.

The strong demand for the new Dimensity 9400 chip this year prompted MediaTek to raise its flagship smartphone chip revenue growth to 70 percent year-on-year, up from of an earlier estimate of 50 percent growth.

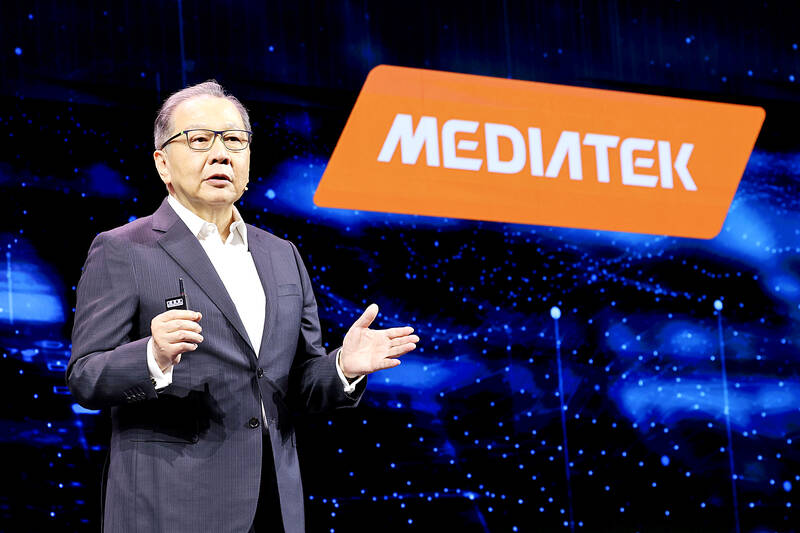

“For the fourth quarter, the strong ramp of Dimensity 9400 is expected to offset the lower seasonal demand for the mainstream and entry segments. Therefore, we expect mobile phone [platform] revenue to grow sequentially,” MediaTek vice chairman and chief executive officer Rick Tsai (蔡力行) told an online investors’ conference.

Photo: Ritchie B. Tongo, EPA-EFE

Dimensity 9400 has been better received by customers, compared with its predecessor, Dimensity 9300, in the initial adoption stage, Tsai said.

Market Share

China’s first-tier brands such as Vivo (維沃), Oppo (歐珀) and Redmi (紅米) have used the flagship chip from MediaTek in their phones, he said.

The new chip would help MediaTek elevate its market share in China to about 30 percent of premium smartphones this year, Tsai said.

With the new economic stimulus packages, MediaTek is “more comfortable with China’s economy now and going forward,” Tsai said.

“There was more uncertainty a year ago,” he added.

Tsai declined to comment if the new chip would help MediaTek reach non-Chinese brands like Samsung Electronics Co and Alphabet Inc’s Google.

Samsung adopted MediaTek’s chips in its tablets last quarter, Tsai said.

The company expects this quarter’s revenue to reach NT$126.5 billion to NT$134.5 billion (US$3.95 billion to US$4.3 billion), he said.

It posted NT$131.81 billion of revenue last quarter.

This year, revenue would expand 20 percent to 21 percent, or NT$519 billion to NT$526 billion, year-on-year surpassing the company’s mid-teens percentage growth target, MediaTek said.

Smartphone chips are the biggest revenue contributor to the company and accounted for 54 percent of its revenue last quarter.

Gross Margin

It would achieve its gross margin target range of 46 percent to 48 percent this year, the company said.

Gross margin is expected to fall this quarter to 46.6 percent to 48.5 percent, it said.

MediaTek reported a gross margin of 48.8 percent last quarter, beating its expectation of 48.5 percent.

Net profit last quarter surged 37.8 percent year-on-year to NT$25.59 billion, marking the third-highest level in all third quarters. That represented a sequential decline of 1.4 percent from NT$25.96 billion.

Earnings per share rose to NT$15.94 last quarter from NT$11.64 a year earlier, but they declined from NT$16.19 a quarter earlier.

Mercuries Life Insurance Co (三商美邦人壽) shares surged to a seven-month high this week after local media reported that E.Sun Financial Holding Co (玉山金控) had outbid CTBC Financial Holding Co (中信金控) in the financially strained insurer’s ongoing sale process. Shares of the mid-sized life insurer climbed 5.8 percent this week to NT$6.72, extending a nearly 18 percent rally over the past month, as investors bet on the likelihood of an impending takeover. The final round of bidding closed on Thursday, marking a critical step in the 32-year-old insurer’s search for a buyer after years of struggling to meet capital adequacy requirements. Local media reports

TECHNOLOGICAL RIVALRY: The artificial intelligence chip competition among multiple players would likely intensify over the next two years, a Quanta official said Quanta Computer Inc (廣達), which makes servers and laptops on a contract basis, yesterday said its shipments of artificial intelligence (AI) servers powered by Nvidia Corp’s GB300 chips have increased steadily since last month, should surpass those of the GB200 models this quarter. The production of GB300 servers has gone much more smoothly than that of the GB200, with shipments projected to increase sharply next month, Quanta executive vice president Mike Yang (楊麒令) said on the sidelines of a technology forum in Taipei. While orders for GB200 servers gradually decrease, the production transition between the two server models has been

US sports leagues rushed to get in on the multi-billion US dollar bonanza of legalized betting, but the arrest of an National Basketball Association (NBA) coach and player in two sprawling US federal investigations show the potential cost of partnering with the gambling industry. Portland Trail Blazers coach Chauncey Billups, a former Detroit Pistons star and an NBA Hall of Famer, was arrested for his alleged role in rigged illegal poker games that prosecutors say were tied to Mafia crime families. Miami Heat guard Terry Rozier was charged with manipulating his play for the benefit of bettors and former NBA player and

BETTER THAN EXPECTED: The firm’s Q3 results exceeded its projections, based on ‘the underlying strength of our core markets,’ chief financial officer Dave Zinsner said Intel Corp returned to profitability and gave an upbeat revenue forecast after PC demand grew, suggesting that it is making progress on a long and challenging comeback attempt. In the third quarter, revenue rose 3 percent to US$13.7 billion. The Santa Clara, California-based company posted its first quarterly net income since the end of 2023, with earnings per share of US$0.23, excluding some items. Analysts had estimated sales of US$13.2 billion and earnings per share of US$0.01 on average, according to data compiled by Bloomberg. Fourth-quarter sales would be roughly US$13.3 billion, the company said in a statement on Thursday. Intel shares gained about