Intel Corp returned to profitability and gave an upbeat revenue forecast after PC demand grew, suggesting that it is making progress on a long and challenging comeback attempt.

In the third quarter, revenue rose 3 percent to US$13.7 billion.

The Santa Clara, California-based company posted its first quarterly net income since the end of 2023, with earnings per share of US$0.23, excluding some items. Analysts had estimated sales of US$13.2 billion and earnings per share of US$0.01 on average, according to data compiled by Bloomberg.

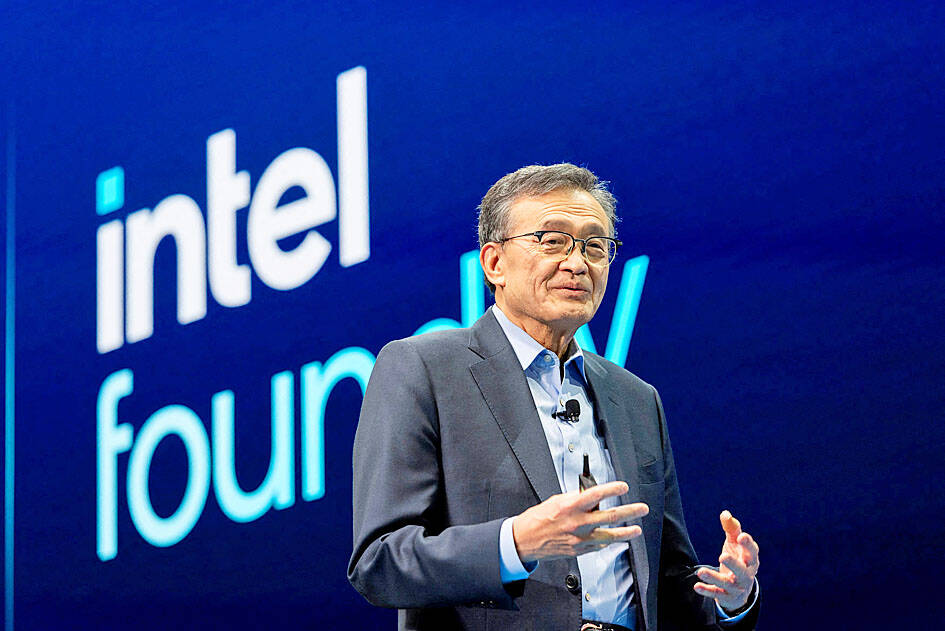

Photo: Reuters

Fourth-quarter sales would be roughly US$13.3 billion, the company said in a statement on Thursday.

Intel shares gained about 8 percent in late trading after closing at US$38.16.

“Current demand is outpacing supply, a trend we expect will persist into 2026,” Intel chief financial officer Dave Zinsner said in the statement.

The company’s third-quarter results exceeded its projections, based on “the underlying strength of our core markets,” he said.

Intel spun off its Altera programmable chip unit last month and now owns a minority stake in the business. That removed US$400 million to US$500 million in revenue from its fourth-quarter projection.

Intel’s guidance “looks better” compared with estimates if you strip out the Altera sales, Zinsner said in an interview.

The outlook signals that Intel is on the right track following a turbulent year. In the stretch of a few months, Intel chief executive officer Lip-Bu Tan (陳立武) secured an unconventional investment from the US government — a transaction brokered by the White House — and won backing from Nvidia Corp and Softbank Group Corp.

The deals with the US government and technology companies are bringing about US$15 billion of new funds that can help shore up Intel’s balance sheet. This month, the chipmaker also announced new products and manufacturing technology.

Intel on a conference call said that it repaid US$4.3 billion in debt during the third quarter, ending the period with US$30.9 billion in cash and short-term investments. Nvidia’s US$5 billion investment, announced last month, is expected to close in the current quarter.

Intel’s factories, despite falling behind the capabilities of rivals such as Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), are the most advanced plants owned and operated by any US company in its home country.

The company plans to spend about US$18 billion on new plants and equipment this year, and reduce its outlay next year. That level puts it far below what TSMC is spending.

Zinsner said that the company might now be faced with the “high-class problem” of having to spend more next year than it budgeted — to make sure it has enough supply to meet improving demand.

Intel’s client computing division had revenue of US$8.5 billion last quarter, topping the average prediction of US$8.2 billion. Data center sales were US$4.1 billion, compared with a US$3.97 billion estimate.

The Intel Foundry division — its factory unit — generated revenue of US$4.2 billion. That unit currently relies almost exclusively on Intel product divisions for orders, although it is seeking outside clients.

The business is unprofitable and finding those external customers is seen as key to turning it around. Intel Foundry had an operating loss of US$2.3 billion in the third quarter. Still, that was narrower than the US$5.8 billion loss a year earlier and better than the US$3.2 billion loss suffered in the second quarter.

“My conviction in the market potential for Intel Foundry continues to grow,” Tan said.

Shares in Taiwan closed at a new high yesterday, the first trading day of the new year, as contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) continued to break records amid an artificial intelligence (AI) boom, dealers said. The TAIEX closed up 386.21 points, or 1.33 percent, at 29,349.81, with turnover totaling NT$648.844 billion (US$20.65 billion). “Judging from a stronger Taiwan dollar against the US dollar, I think foreign institutional investors returned from the holidays and brought funds into the local market,” Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺) said. “Foreign investors just rebuilt their positions with TSMC as their top target,

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

US President Donald Trump on Friday blocked US photonics firm HieFo Corp’s US$3 million acquisition of assets in New Jersey-based aerospace and defense specialist Emcore Corp, citing national security and China-related concerns. In an order released by the White House, Trump said HieFo was “controlled by a citizen of the People’s Republic of China” and that its 2024 acquisition of Emcore’s businesses led the US president to believe that it might “take action that threatens to impair the national security of the United States.” The order did not name the person or detail Trump’s concerns. “The Transaction is hereby prohibited,”

Garment maker Makalot Industrial Co (聚陽) yesterday reported lower-than-expected fourth-quarter revenue of NT$7.93 billion (US$251.44 million), down 9.48 percent from NT$8.76 billion a year earlier. On a quarterly basis, revenue fell 10.83 percent from NT$8.89 billion, company data showed. The figure was also lower than market expectations of NT$8.05 billion, according to data compiled by Yuanta Securities Investment and Consulting Co (元大投顧), which had projected NT$8.22 billion. Makalot’s revenue this quarter would likely increase by a mid-teens percentage as the industry is entering its high season, Yuanta said. Overall, Makalot’s revenue last year totaled NT$34.43 billion, down 3.08 percent from its record NT$35.52