Walt Disney Co yesterday unveiled plans to launch a new cruise ship to set sail from Tokyo starting in fiscal 2028, adding a ninth vessel to the brand’s growing fleet.

The new ship, to be modeled after the Wish, which is the largest vessel in the group, is a partnership with Oriental Land Co (OLC), the operator of Tokyo Disneyland. It is part of a 10-year, US$60 billion expansion of Disney’s theme parks and cruise business.

Disney has five cruise ships in operation. In addition to the Tokyo-based vessel, it has plans for three others, including one that is to set sail from Singapore next year.

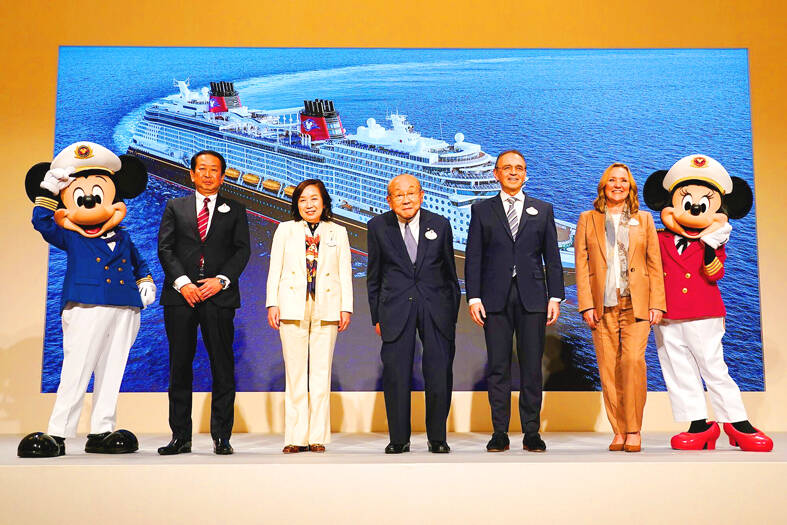

Photo: Toru Hanai

The new Tokyo-based ship, whose name was not revealed, would have a maximum capacity of 4,000 passengers and is expected to bring in about ¥100 billion (US$621.77 million) in annual sales within several years of launch, OLC said.

“To set sail from Japan will make Disney vacations at sea more accessible to Japanese guests, who we know are some of our biggest fans,” Disney Signature Experiences president Thomas Mazloum told reporters.

The cruise line expansion comes as the industry is enjoying a rebound from a global shutdown during the COVID-19 pandemic.

The Cruise Lines International Association expects the number of passengers to reach 34.7 million this year, up 17 percent from 2019.

Disney’s experiences business, which includes its domestic and international parks and cruise line, accounted for more than one-third of the company’s revenue in the March quarter and nearly 60 percent of its operating income.

The company’s stock tumbled in May after chief financial officer Hugh Johnston warned about a “global moderation” in travel in the fiscal third quarter and other impacts, including higher wages and pre-opening expenses related to two of the new cruise ships and the new vacation island, Lookout Cay.

The rising tide for Disney’s cruise lines could help offset any softness in the company’s domestic theme park business, UBS analyst John Hodulik said.

The company said its second-quarter booking occupancy is at 97 percent for all five ships.

The rapid expansion of Disney’s cruise capacity “helps derisk the medium-term outlook” for the parks business, Hodulik said.

Disney’s other recent investments include three new areas at the Tokyo DisneySea theme park, recreating the worlds of Frozen, Tangled and Peter Pan, the opening of a Frozen-themed land at Hong Kong Disneyland and a Zootopia experience in Shanghai.

The company at its D23 fan convention next month is expected to announce plans for new attractions at Disneyland in California and Walt Disney World in central Florida.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.