Taiwan’s semiconductor industry is meeting geopolitical pressure linked to the US’ concerns that most of the IC manufacturing is happening in Asia, but should still reach a mutually beneficial compromise with Washington, a former Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) executive said yesterday.

Konrad Young (楊光磊), a former TSMC R&D director, told a forum hosted by the newly established national think tank Research Institute for Democracy, Society, and Emerging Technology (DSET) in Taipei that the semiconductor industry is facing risks from US-China trade tensions-driven “geopolitics 2.0.”

According to Young, “geopolitics 2.0” is a contemporary version of what he called “geopolitics 1.0,” which took place in the 1980s when the US, feeling threatened by Japan, sought to dismantle its dominance in the semiconductor industry.

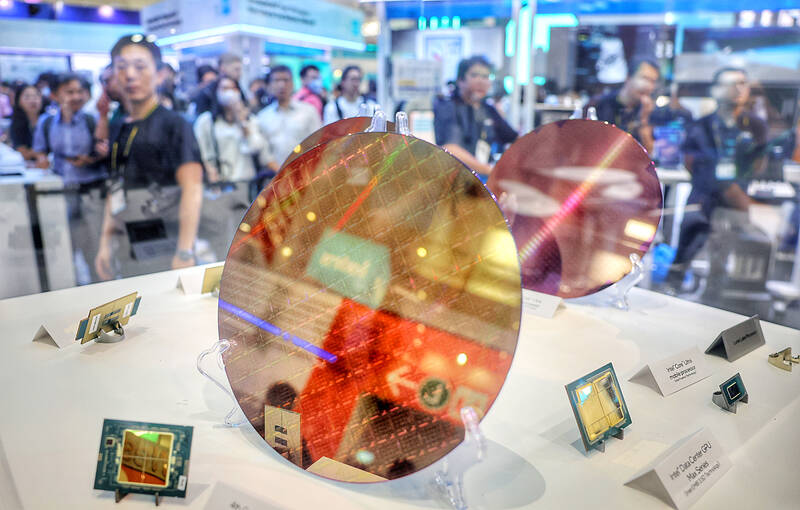

Photo: CNA

“The risk of geopolitics 2.0 also comes from the US [amid its trade frictions with China], in which there is concern that Taiwan might lose its competitive edge when [Taiwan’s companies] are asked to set up factories there,” he said.

“Recently I’ve heard that the American government is also asking [Taiwanese companies’] research and development to be moved to the US, which makes it more disconcerting,” he added.

However, Young pointed out that in the 1980s tensions arose because Japan’s products could replace what the US was producing, which meant there was little risk of Washington harming itself when it battered Japan.

“What Taiwan is facing today is different,” Young said. “American companies, including the world’s top IC companies such as Qualcomm Inc and Nvidia Corp, still need TSMC; they don’t have many alternative options.”

So the US government would not take actions that result in mutually assured destruction, Young said.

“It is now seeking relatively safe, alternative solutions, of which asking TSMC to manufacture in the US is one, but it won’t stop there, as this is still not comfortable enough for the US,” he argued, adding that comfort would be assured when the US can manage risks, an apparent one of which would be a disconnected supply chain caused by a possible war in Asia.

The US would also try to support its own companies such as Intel Corp to go into foundry business, he said.

But Young believed the hurdle of replacing Taiwan in the foundry business would be huge for the US, “much more difficult” than how it took on Japan in the 1980s.

Japan’s products were, like the US, produced in the IDM (integrated device manufacturer) model, Young said. IDM model is one that a semiconductor company designs, manufactures, and sells integrated circuits all by itself.

“Japan’s IDM model was cost-based so it was easy to be hurt by an exchange rate change,” he said, understandably referring to the 1985 Plaza Accord that triggered a large appreciation of the yen.

“Also daily life then was probably not affected by IC that much, which is different from today’s world where a high percentage of our products require chips,” he added.

Young said Taiwan should convince the US that there can be a win-win solution with the two countries occupying different but complementary segments in the IC industry.

“The US is strong in advanced research, for instance, and Taiwan can work with them on that, but mutually harmful approach should be avoided,” he advised.

Young also called for cooperation with non-US countries such as Europe, Japan, Southeast Asia, and even the Middle East that have been investing in the industry to broaden the alliance and maintain Taiwan’s edge.

JITTERS: Nexperia has a 20 percent market share for chips powering simpler features such as window controls, and changing supply chains could take years European carmakers are looking into ways to scratch components made with parts from China, spooked by deepening geopolitical spats playing out through chipmaker Nexperia BV and Beijing’s export controls on rare earths. To protect operations from trade ructions, several automakers are pushing major suppliers to find permanent alternatives to Chinese semiconductors, people familiar with the matter said. The industry is considering broader changes to its supply chain to adapt to shifting geopolitics, Europe’s main suppliers lobby CLEPA head Matthias Zink said. “We had some indications already — questions like: ‘How can you supply me without this dependency on China?’” Zink, who also

At least US$50 million for the freedom of an Emirati sheikh: That is the king’s ransom paid two weeks ago to militants linked to al-Qaeda who are pushing to topple the Malian government and impose Islamic law. Alongside a crippling fuel blockade, the Group for the Support of Islam and Muslims (JNIM) has made kidnapping wealthy foreigners for a ransom a pillar of its strategy of “economic jihad.” Its goal: Oust the junta, which has struggled to contain Mali’s decade-long insurgency since taking power following back-to-back coups in 2020 and 2021, by scaring away investors and paralyzing the west African country’s economy.

BUST FEARS: While a KMT legislator asked if an AI bubble could affect Taiwan, the DGBAS minister said the sector appears on track to continue growing The local property market has cooled down moderately following a series of credit control measures designed to contain speculation, the central bank said yesterday, while remaining tight-lipped about potential rule relaxations. Lawmakers in a meeting of the legislature’s Finance Committee voiced concerns to central bank officials that the credit control measures have adversely affected the government’s tax income and small and medium-sized property developers, with limited positive effects. Housing prices have been climbing since 2016, even when the central bank imposed its first set of control measures in 2020, Chinese Nationalist Party (KMT) Legislator Lo Ting-wei (羅廷瑋) said. “Since the second half of

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) received about NT$147 billion (US$4.71 billion) in subsidies from the US, Japanese, German and Chinese governments over the past two years for its global expansion. Financial data compiled by the world’s largest contract chipmaker showed the company secured NT$4.77 billion in subsidies from the governments in the third quarter, bringing the total for the first three quarters of the year to about NT$71.9 billion. Along with the NT$75.16 billion in financial aid TSMC received last year, the chipmaker obtained NT$147 billion in subsidies in almost two years, the data showed. The subsidies received by its subsidiaries —