Nvidia Corp on Monday unveiled its latest family of chips for powering artificial intelligence (AI) as it seeks to consolidate its position as the major supplier to an AI frenzy.

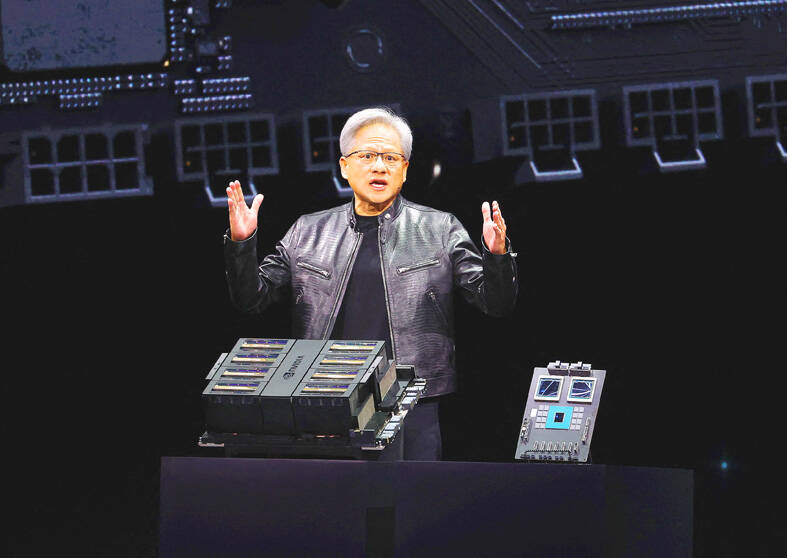

“We need bigger GPUs. So ladies and gentlemen, I would like to introduce you to a very, very big GPU,” Nvidia chief executive officer Jensen Huang (黃仁勳) said at a developers’ conference in California, referring to the graphics processors that are vital in the creation of generative AI.

The event, dubbed the “AI Woodstock” by Wedbush Securities Inc analyst Dan Ives, has become a cannot-miss date on big tech’s calendar due to Nvidia’s singular role in the AI revolution that has taken the world by storm since the introduction of ChatGPT in late 2022.

Photo: AFP

“I hope you realize this is not a concert, this is a developers’ conference,” Huang joked as he took the stage in a packed arena usually reserved for ice hockey games and concerts.

Nvidia’s powerful GPU chips and software are an integral ingredient in the creation of generative AI, with rivals like Advanced Micro Devices Inc (AMD) or Intel Corp still struggling to match the power and efficiency of the company’s blockbuster H100 product, launched in 2022.

Not letting up, Nvidia told the audience of developers and tech executives it was releasing an even more powerful processor and accompanying software, on a platform called Blackwell — named after David Blackwell, the first black academic inducted into the US National Academy of Science.

Blackwell GPUs were AI “superchips” four times as fast as the previous generation when training AI models, Nvidia said.

“The rate at which computing is advancing is insane,” Huang said.

They would also deliver 25 times the energy efficiency, Nvidia said, a key claim when the creation of AI is criticized for its ravenous needs for energy and natural resources compared with more conventional computing.

Unlike its rivals Intel, Micron Technology Inc and Texas Instruments Inc, Nvidia, like AMD, does not manufacture its own chips, but uses subcontractors, mainly Taiwan Semiconductor Manufacturing Co (台積電).

Given the geopolitical concerns with Taiwan and China, this could be a potential weak spot. The US has banned Nvidia from sending its most powerful chips to Chinese firms.

Nvidia announced other AI developments on Monday, including a platform for training humanoid robots named Project Gr00t.

Gr00t-powered robots would be designed to understand what people say and mimic their movements, learning from experience how to interact with the world, it said.

Nvidia said it was also working with Apple Inc to put AI capabilities into the newly released Vision Pro spatial computing gear.

The company also unveiled the Earth-2 cloud platform for predicting climate change, using simulation by AI supercomputers.

In addition, Nvidia announced a major expansion of its collaboration with BYD Co (比亞迪) and other Chinese electric vehicle makers.

BYD is the latest Chinese vehicle manufacturer to use Nvidia’s DRIVE Thor, an all-in-one vehicle control system that is bolstered by powerful generative AI features.

“DRIVE Thor is poised to revolutionize the automotive landscape, ushering in an era where generative AI defines the driving experience,” Nvidia said.

Thor is expected to roll out for production vehicles as early as next year, it said.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

CONCERNS: Tech companies investing in AI businesses that purchase their products have raised questions among investors that they are artificially propping up demand Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Saturday said that the company would be participating in OpenAI’s latest funding round, describing it as potentially “the largest investment we’ve ever made.” “We will invest a great deal of money,” Huang told reporters while visiting Taipei. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.” Huang did not say exactly how much Nvidia might contribute, but described the investment as “huge.” “Let Sam announce how much he’s going to raise — it’s for him to decide,” Huang said, referring to OpenAI

The global server market is expected to grow 12.8 percent annually this year, with artificial intelligence (AI) servers projected to account for 16.5 percent, driven by continued investment in AI infrastructure by major cloud service providers (CSPs), market researcher TrendForce Corp (集邦科技) said yesterday. Global AI server shipments this year are expected to increase 28 percent year-on-year to more than 2.7 million units, driven by sustained demand from CSPs and government sovereign cloud projects, TrendForce analyst Frank Kung (龔明德) told the Taipei Times. Demand for GPU-based AI servers, including Nvidia Corp’s GB and Vera Rubin rack systems, is expected to remain high,