With geopolitical tensions on the rise, globalization principles in the semiconductor industry are on the decline, meaning more countries are likely to enter the market and leave Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) facing severe challenges, TSMC founder Morris Chang (張忠謀) said on Saturday.

Addressing employees at the company’s annual sports day, Chang said globalization and free trade are on the decline, which would lead to more countries competing with TSMC.

Potential competitors include the Japanese island of Kyushu, which has abundant water and power supplies, and Singapore, which is an ideal venue for pure-play wafer foundry operators, Chang said.

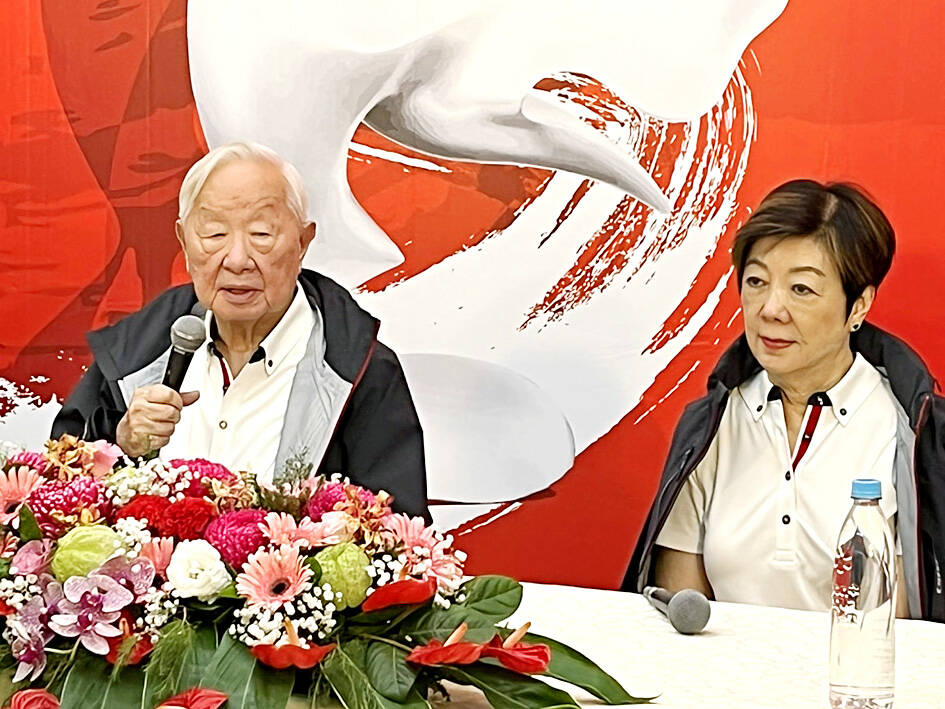

Photo: Grace Hung, Taipei Times

He said other countries could also enter the market and become critical players, challenging the Taiwanese company’s dominance.

Currently, TSMC has more than 50 percent of the global pure-play foundry market and about 90 percent of high-end chips are produced in Taiwan.

TSMC at the end of last year became the first company in the world to launch mass production of the advanced 3-nanometer process. The chipmaker is developing the more sophisticated 2-nanometer process with commercial production slated to start in 2025.

With more rivals set to emerge “over the next few years, TSMC is likely to face more significant challenges than ever before,” Chang said. “But I believe TSMC will be able to overcome the difficulties.”

Chang cited TSMC’s Open Innovation Platform (OIP), an initiative to form an intellectual property (IP) alliance with its clients, as one of the advantages the chipmaker possesses.

The initiative aims to facilitate innovation and put new processes in the semiconductor design process and its ecosystem into practice using TSMC’s IP, design implementation and design for manufacturability capabilities, and process technology and backend services, the chipmaker said on its Web site.

“A successful pure-play foundry operator needs significant intellectual property, so it will be hard for TSMC’s competitors to copy OIP,” Chang said, adding that the platform was now TSMC’s critical weapon in the global market.

Chang said that the platform aims to allow TSMC and its partners to collaborate on an equal footing and share information and benefits.

He said TSMC is keen to pour resources into research and development (R&D) and “by doing more [in R&D], TSMC can cut operating costs. OIP represents these efforts.”

Chang said last month that Taiwan and its semiconductor industry have an advantage — its engineers — referring to the company’s low employee turnover rate of only 4 to 5 percent per year.

At the company’s sports day event on Saturday, Chang said he had made the comment four years ago that TSMC’s services would likely be in demand from many countries, and that prediction had turned out to be true.

Following pressure from the US, TSMC is investing US$40 billion to build two wafer fabs in the US state of Arizona. The first one is slated to start mass production in 2025 — one year behind schedule due to a lack of skilled workers — using the 4-nanometer process, and the second is scheduled to start commercial production in 2026, using the 3-nanometer process.

Furthermore, TSMC is building a plant in Japan’s Kumamoto, which is slated to start mass production next year using the older 12, 16, 22 and 28-nanometer processes.

TSMC’s board of directors also approved a project in August that involves the company investing up to US$3.691 billion as part of a joint venture to build a semiconductor fab in Dresden, Germany, with Bosch GmbH, Infineon Technologies AG and NXP Semiconductors NV. TSMC is to own a 70 percent stake in the new company with the fab scheduled to start mass production by the end of 2027.

“Today, TSMC is the company many countries need, as concerns over national security are running deeper than ever,” Chang said.

On Saturday, TSMC chairman Mark Liu (劉德音) announced that each of the company’s non-managerial employees in Taiwan would receive a special bonus of NT$16,000 (US$497).

More than 50,000 employees would be eligible for this year’s payout, translating to a total financial commitment of more than NT$800 million in bonuses, the company said.

TSMC has scheduled an investors’ conference on Thursday to detail its third-quarter results and give guidance for the fourth quarter and for this year.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to