Taiwan’s exports of integrated circuit chips last month dropped for a sixth consecutive month on slowing global demand.

Chip exports decreased 20.8 percent from a year earlier to a four-month low of US$12.6 billion, Ministry of Finance data showed.

Taiwan is home to Apple Inc and Nvidia Corp’s go-to chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), along with a coterie of smaller, but essential chip industry players.

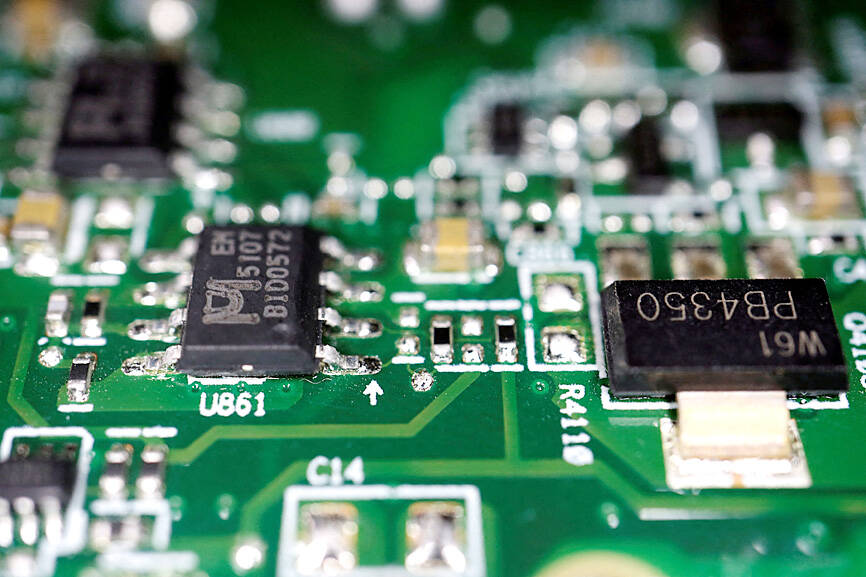

Photo: Reuters

The annual decline in chip exports was the largest since March 2009, partly amplified by a high base in June last year.

“The demand for integrated circuits continues to be weak,” the ministry said in a statement accompanying the data, as sticky inflation and continuous rate hikes by central banks have tapered the global economy.

Consumer tech firms have spent much of this year working through an inventory glut, which is expected to weigh on sales for the likes of TSMC through at least the end of the year.

Sales of smartphones have yet to resume growth after a protracted slump last year, while PC and laptop makers are also struggling to compel new purchases and continue to see double-digit declines.

US-China trade tensions have also affected Taiwan’s biggest industry. Shipments to China, including Hong Kong, which together account for more than 50 percent of Taiwan’s chip exports, fell for an eighth consecutive month, the data showed.

However, Yuanta Securities Investment Consulting Co (元大投顧) is cautiously optimistic about Taiwan’s semiconductor industry’s business outlook for this quarter.

“Looking into the third quarter, we expect handset related semiconductor supply chain to see downside risk given weaker-than-expected consumer and handset demand recovery in China,” Yuanta said in a note on Tuesday. “On the other hand, we expect PC and memory sectors to see more noticeable fundamental improvement as inventory digestion ends, with strong seasonality for consumer electronics to emerge in the third Additional reporting by staff writer

European Central Bank (ECB) President Christine Lagarde is expected to step down from her role before her eight-year term ends in October next year, the Financial Times reported. Lagarde wants to leave before the French presidential election in April next year, which would allow French President Emmanuel Macron and German Chancellor Friedrich Merz to find her replacement together, the report said, citing an unidentified person familiar with her thoughts on the matter. It is not clear yet when she might exit, the report said. “President Lagarde is totally focused on her mission and has not taken any decision regarding the end of

French President Emmanuel Macron told a global artificial intelligence (AI) summit in India yesterday he was determined to ensure safe oversight of the fast-evolving technology. The EU has led the way for global regulation with its Artificial Intelligence Act, which was adopted in 2024 and is coming into force in phases. “We are determined to continue to shape the rules of the game... with our allies such as India,” Macron said in New Delhi. “Europe is not blindly focused on regulation — Europe is a space for innovation and investment, but it is a safe space.” The AI Impact Summit is the fourth

CONFUSION: Taiwan, Japan and other big exporters are cautiously monitoring the situation, while analysts said more Trump responses ate likely after his loss in court US trading partners in Asia started weighing fresh uncertainties yesterday after President Donald Trump vowed to impose a new tariff on imports, hours after the Supreme Court struck down many of the sweeping levies he used to launch a global trade war. The court’s ruling invalidated a number of tariffs that the Trump administration had imposed on Asian export powerhouses from China and South Korea to Japan and Taiwan, the world’s largest chip maker and a key player in tech supply chains. Within hours, Trump said he would impose a new 10 percent duty on US imports from all countries starting on

STRATEGIC ALLIANCE: The initiative is aimed at protecting semiconductor supply chain resilience to reduce dependence on China-dominated manufacturing hubs India yesterday joined a US-led initiative to strengthen technology cooperation among strategic allies in a move that underscores the nations’ warming ties after a brief strain over New Delhi’s unabated purchase of discounted Russian oil. The decision aligns India closely with Washington’s efforts to build secure supply chains for semiconductors, advanced manufacturing and critical technologies at a time when geopolitical competition with China is intensifying. It also signals a reset in relations following friction over energy trade and tariffs. Nations that have joined the Pax Silica framework include Japan, South Korea, the UK and Israel. “Pax Silica will be a group of nations