JPMorgan Chase Bank NA is to take over all deposits and most of the assets of troubled First Republic Bank, the US Federal Deposit Insurance Corp (FDIC) said early yesterday.

California regulators closed First Republic and appointed the FDIC as receiver, it said in a statement.

JPMorgan Chase is to assume “all of the deposits and substantially all of the assets of First Republic Bank,” it said.

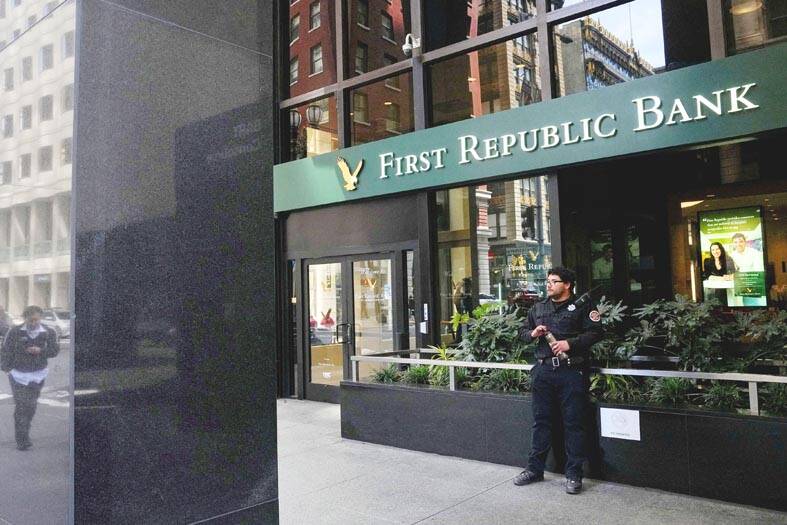

Photo: Reuters

First Republic Bank’s 84 branches in eight states were yesterday to reopen as branches of JPMorgan Chase Bank.

Regulators had been working to find a way forward before US stock markets opened yesterday.

San Francisco-based First Republic has struggled since the collapses of Silicon Valley Bank and Signature Bank in early March. They added to worries that the bank might not survive as an independent entity for much longer.

Shares in First Republic closed at US$3.51 on Friday, a fraction of the about US$170 a share it traded for a year earlier. It fell further in afterhours trading.

The bank reported total assets of US$233 billion as of March 31. At the end of last year, the US Federal Reserve ranked First Republic 14th in size among US commercial banks.

Before Silicon Valley Bank failed, First Republic had a banking franchise that was the envy of most of the industry.

Its clients — mostly the rich and powerful — rarely defaulted on their loans. The bank has made much of its money making low-cost loans to the rich, which reportedly included Meta Platforms Inc CEO Mark Zuckerberg.

Flush with deposits from the well-heeled, First Republic saw total assets more than double from US$102 billion at the end of first quarter in 2019, when its full-time workforce was 4,600.

The vast majority of First Republic’s deposits, like those in Silicon Valley and Signature Bank, were uninsured — that is, above the US$250,000 limit set by the FDIC.

That made analysts and investors worried. If First Republic were to fail, its depositors might not get all their money back.

Those fears were crystalized in the bank’s recent quarterly results.

It said that depositors pulled more than US$100 billion out of the bank during last month’s crisis.

First Republic said that it was only able to stanch the bleeding after a group of large banks stepped in to save it with US$30 billion in uninsured deposits.

Now First Republic is in need of a bigger fix.

“Getting the bank in the hands of a larger one is the best possible economic outcome,” said Steven Kelly, a researcher at the Yale School of Management Program on Financial Stability. “First Republic has lots of knowledge about its customers and has been a profitable bank for its entire history — but its business model is not stable. It needs a big bank balance sheet behind it.”

Kelly said that other options, such as government control or continuing to try to survive on its own, would see its value continue to disappear, along with credit and economic growth.

“A successful absorption into a big bank would provide a proper, stable home for the firm to continue to provide its value proposition to the economy,” Kelly said.

POWERING UP: PSUs for AI servers made up about 50% of Delta’s total server PSU revenue during the first three quarters of last year, the company said Power supply and electronic components maker Delta Electronics Inc (台達電) reported record-high revenue of NT$161.61 billion (US$5.11 billion) for last quarter and said it remains positive about this quarter. Last quarter’s figure was up 7.6 percent from the previous quarter and 41.51 percent higher than a year earlier, and largely in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$160 billion. Delta’s annual revenue last year rose 31.76 percent year-on-year to NT$554.89 billion, also a record high for the company. Its strong performance reflected continued demand for high-performance power solutions and advanced liquid-cooling products used in artificial intelligence (AI) data centers,

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,

Vincent Wei led fellow Singaporean farmers around an empty Malaysian plot, laying out plans for a greenhouse and rows of leafy vegetables. What he pitched was not just space for crops, but a lifeline for growers struggling to make ends meet in a city-state with high prices and little vacant land. The future agriculture hub is part of a joint special economic zone launched last year by the two neighbors, expected to cost US$123 million and produce 10,000 tonnes of fresh produce annually. It is attracting Singaporean farmers with promises of cheaper land, labor and energy just over the border.

US actor Matthew McConaughey has filed recordings of his image and voice with US patent authorities to protect them from unauthorized usage by artificial intelligence (AI) platforms, a representative said earlier this week. Several video clips and audio recordings were registered by the commercial arm of the Just Keep Livin’ Foundation, a non-profit created by the Oscar-winning actor and his wife, Camila, according to the US Patent and Trademark Office database. Many artists are increasingly concerned about the uncontrolled use of their image via generative AI since the rollout of ChatGPT and other AI-powered tools. Several US states have adopted