Taiwan needs to diversify its trade away from China, Minister of Finance Su Jain-rong (蘇建榮) said, citing uncertainties created by China’s “zero COVID-19” policy, and rising geopolitical tensions between Washington and Beijing.

The recent US technology curbs imposed on China have “increased the uncertainty of the market,” Su said in an interview on Friday, after the APEC finance ministers’ meetings in Bangkok.

He added that one of Taiwan’s goals is to “try to diversify our trade partners, our trade market, so that we are not going to put all our eggs in one basket.”

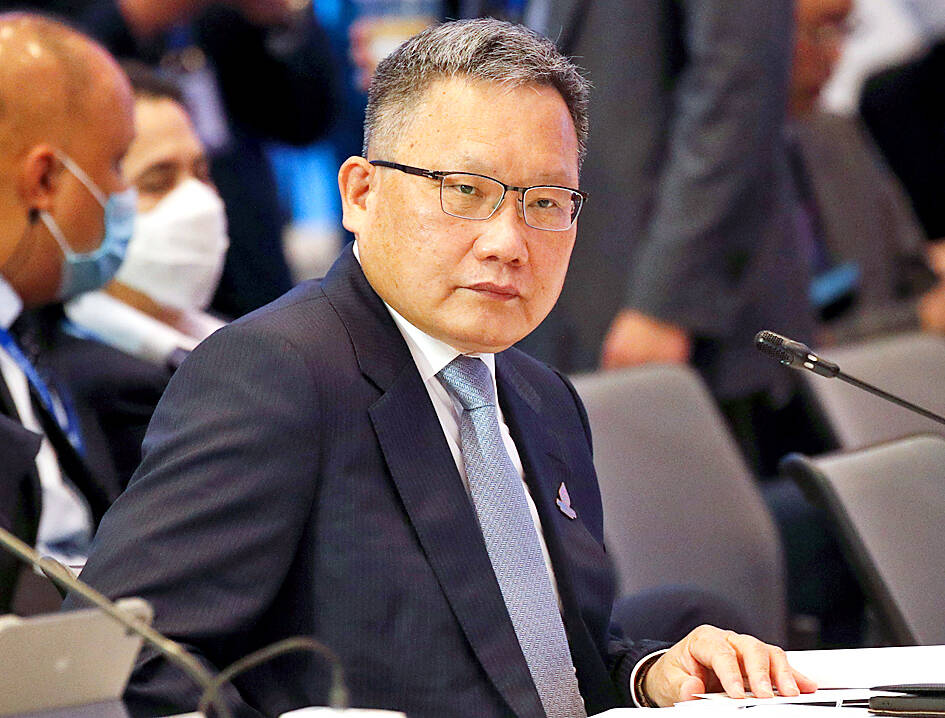

Photo: EPA-EFE

Taiwan’s trade has been pressured this year by waning demand from China and around the world, which has weighed on the export-dependent economy. Overseas shipments contracted last month for the first time since 2020, while export orders declined for the third time this year.

Officials have largely attributed the drop-off to China as COVID-19 restrictions and a property slump are depressing consumer and business confidence there.

Escalating US-China tensions have further clouded Taiwan’s outlook and rattled the global semiconductor industry. After the US announced tighter controls over chip exports to China this month, shares in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) fell the most in 28 years. TSMC makes chips for major companies that rely on the Chinese market for much of their business, while also taking in about 10 percent of its own revenue from China-based customers.

Su said he had not talked formally last week with US Deputy Secretary of the Treasury Wally Adeyemo, but said he thinks both sides are looking at the US-China relationship.

“The United States is concerned about the supply chains of advanced chips,” he added.

Taiwan’s exports to China and Hong Kong have declined over the past couple of years due to COVID-19 restrictions and US-China disputes, slipping below 40 percent of Taiwan’s total exports, the minister said.

Su said Taiwanese businesses have already started relocating factories from China to Southeast Asia — not so much in the semiconductor industry, but in machinery and other labor-intensive sectors.

Vietnam and Thailand are targets, he added.

Taiwan has been looking to diminish its dependence on China in the past few years, and has explored ways to bolster trade and investment with Southeast Asia, India, Australia and New Zealand.

Taipei last year asked to join one of the Asia-Pacific’s biggest working trade deals, although its application is still pending.

The minister also said Taiwan is looking “very carefully” at how to manage financial stability, as the New Taiwan dollar has weakened this year and as the benchmark TAIEX has tumbled nearly 30 percent so far this year.

The TAIEX closed up 0.29 percent yesterday after gaining as much as 1.6 percent earlier, the first gain in four days, after short-selling curbs were implemented.

Global funds have pulled a net US$47 billion from local equities this year, putting Taiwan on track for its biggest annual outflow in more than two decades.

The US Federal Reserve’s interest rate hikes cause “a lot of problems for financial markets around the world, not just Taiwan,” Su said.

Another issue is the increasing costs of imports — as Taiwan brings in a lot of its raw materials from abroad, imported inflation is another risk, he said.

Should the Fed continue raising rates, the “Taiwanese dollar and financial stability may be affected significantly,” Su said. “It’s not easy to handle it, but we have to face it.”

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

NATIONAL SECURITY: Intel’s testing of ACM tools despite US government control ‘highlights egregious gaps in US technology protection policies,’ a former official said Chipmaker Intel Corp has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by US sanctions, according to two sources with direct knowledge of the matter. Intel, which fended off calls for its CEO’s resignation from US President Donald Trump in August over his alleged ties to China, got the tools from ACM Research Inc, a Fremont, California-based producer of chipmaking equipment. Two of ACM’s units, based in Shanghai and South Korea, were among a number of firms barred last year from receiving US technology over claims they have

BARRIERS: Gudeng’s chairman said it was unlikely that the US could replicate Taiwan’s science parks in Arizona, given its strict immigration policies and cultural differences Gudeng Precision Industrial Co (家登), which supplies wafer pods to the world’s major semiconductor firms, yesterday said it is in no rush to set up production in the US due to high costs. The company supplies its customers through a warehouse in Arizona jointly operated by TSS Holdings Ltd (德鑫控股), a joint holding of Gudeng and 17 Taiwanese firms in the semiconductor supply chain, including specialty plastic compounds producer Nytex Composites Co (耐特) and automated material handling system supplier Symtek Automation Asia Co (迅得). While the company has long been exploring the feasibility of setting up production in the US to address

OPTION: Uber said it could provide higher pay for batch trips, if incentives for batching is not removed entirely, as the latter would force it to pass on the costs to consumers Uber Technologies Inc yesterday warned that proposed restrictions on batching orders and minimum wages could prompt a NT$20 delivery fee increase in Taiwan, as lower efficiency would drive up costs. Uber CEO Dara Khosrowshahi made the remarks yesterday during his visit to Taiwan. He is on a multileg trip to the region, which includes stops in South Korea and Japan. His visit coincided the release last month of the Ministry of Labor’s draft bill on the delivery sector, which aims to safeguard delivery workers’ rights and improve their welfare. The ministry set the minimum pay for local food delivery drivers at