Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) remained the world’s largest contract chipmaker in the second quarter of the year with a 53.4 percent share of the global pure-play foundry market, the Taipei-based market information advisory firm TrendForce Corp (集邦科技) said in a research report on Tuesday.

Despite TSMC’s market share dipping slightly from 53.6 percent in the first quarter, it was still far ahead of its rivals, TrendForce said.

TSMC continued to benefit from emerging technologies, such as high-performance computing devices, the Internet of Things and automotive electronics, as it posted US$18.15 billion in sales in the second quarter, up 3.5 percent from a quarter earlier, it said.

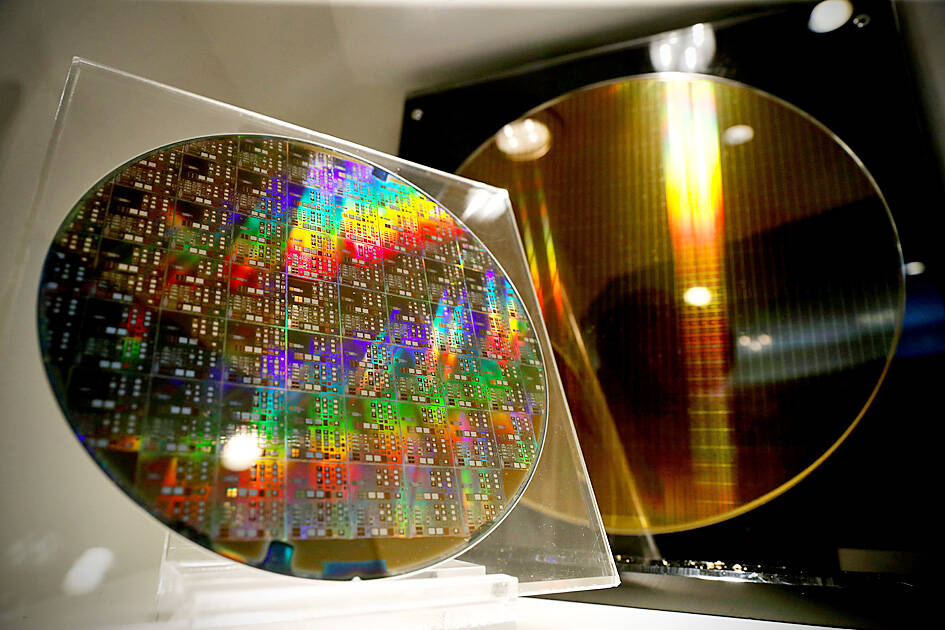

Photo: Ritchie B. Tongo, EPA-EFE

The mild quarter-on-quarter sales growth during the period from April to June reflected a relatively high comparison base in the first quarter, when TSMC raised chip prices amid a global supply shortage, TrendForce said.

South Korea’s Samsung Electronics Co placed second with a 16.5 percent global market share, as it posted US$5.59 billion in sales, up 4.9 percent from a quarter earlier, the report showed.

Taiwan’s United Microelectronics Corp (UMC, 聯電) took third spot with US$2.45 billion in sales and a 7.2 percent global share in the second quarter, TrendForce said.

UMC’s second-quarter sales rose 8.1 percent from a quarter earlier on the back of support from its 22 and 28 nanometer processes, it added.

US-based GlobalFoundries Inc was the fourth-largest contract chipmaker with a 5.9 percent global market share after posting US$1.99 billion.

China’s Semiconductor Manufacturing International Corp (SMIC, 中芯國際), which posted US$1.90 billion in sales and held a 5.6 percent global market share, placed fifth, TrendForce said.

China’s Hua Hong Semiconductor Ltd (華虹半導體) came in sixth with a 3.1 percent global market share after posting US$1.06 billion in sales, followed by Taiwan’s Powerchip Semiconductor Manufacturing Corp (力積電) with US$656 million in sales and 1.9 percent in market share, Taiwan’s Vanguard International Semiconductor Corp (世界先進) with US$520 million in sales and 1.5 percent in market share, South Korea’s Nextchip Co with US$463 million in sales and 1.4 percent in market share, and Israel’s Tower Semiconductor Ltd with US$426 million in sales and 1.3 percent in market share, TrendForce said.

The top 10 contract chipmakers posted US$33.2 billion in combined sales in the second quarter, up 3.9 percent from a quarter earlier, accounting for 98 percent of global revenue, it said.

Sales growth momentum of the 10 largest contract chipmakers showed signs of slowing in the second quarter, as global demand for consumer electronics gadgets weakened, it added.

Inventory adjustments are expected to continue to affect the pure-play foundry business in the third quarter, TrendForce said, adding that Apple Inc’s launch of a new iPhone model is expected to lend support to the sector in the third quarter.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

New vehicle sales in Taiwan plunged about 37 percent sequentially last month as the long Lunar New Year holiday and 228 Peace Memorial Day holiday cut short the number of working days, along with the lingering uncertainty over import tax cuts on US vehicles, market researcher U-Car said in a report yesterday. New car sales last month totaled 22,043, slumping from 35,073 units in January and down 19.89 percent from 37,515 in February last year, U-Car data showed. Sales of imported luxury cars, led by Mercedes-Benz, plummeted about 45 percent to 3,109 units last month from 5,663 units in the previous month,