Taiwan took the top spot in global semiconductor equipment spending in the second quarter of this year, up from third place the previous quarter, with the country’s manufacturers keen to invest in expansion, global semiconductor trade association SEMI said on Wednesday.

Taiwanese firms spent US$6.68 billion buying semiconductor equipment from the April to June period, up 37 percent from a quarter earlier, SEMI data showed.

Second-quarter spending was also up 32 percent from a year earlier, the data showed.

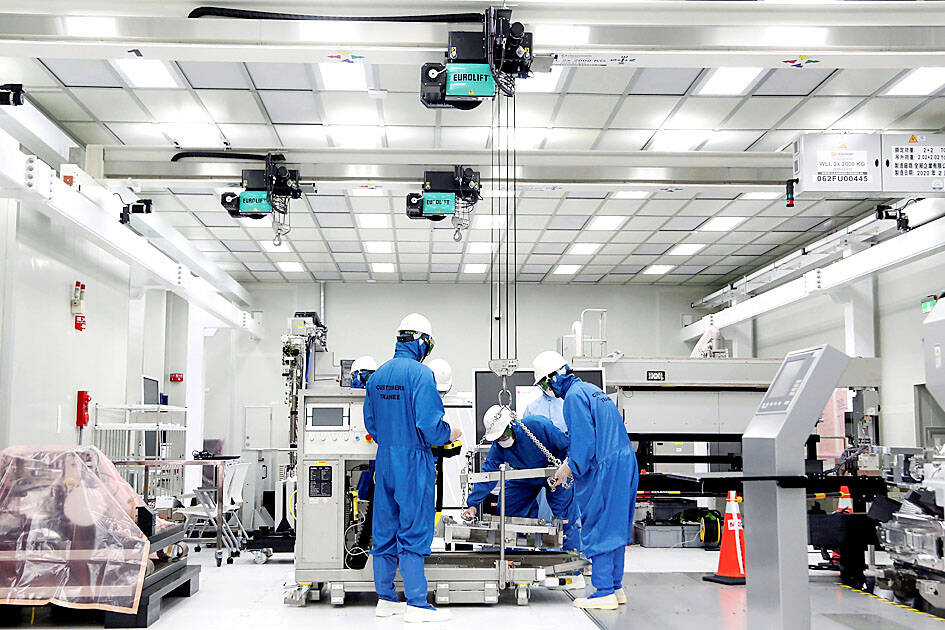

Photo: Ann Wang, Reuters

Although the second quarter is traditionally a slow season in the global semiconductor industry, many Taiwanese firms poured funds into expanding production and upgrading technology to maintain a lead over industry peers, analysts said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract chipmaker, was one of the biggest investors in equipment to develop advanced processes, they said.

TSMC plans to spend about US$40 billion in capital expenditure this year as it is about to start using a 3 nanometer process this year, while it is also developing a more sophisticated 2 nanometer process.

As demand for TSMC’s 7 nanometer and 5 nanometer processes remain solid for emerging technologies such as high-performance computing devices, 5G applications and automotive electronics, TSMC needed more capacity, analysts said.

Full capacity utilization is expected to continue until the end of the year, TSMC said.

China spent US$6.56 billion buying semiconductor equipment in the second quarter, down 13 percent from the previous quarter, and also down 20 percent from a year earlier, to take the second spot, falling from first place in the first quarter, SEMI data showed.

Analysts said the fall was largely a result of a ban imposed by the US government on selling certain types of semiconductor equipment to China, while that country’s “zero COVID” policy also hurt demand.

South Korea placed third after buying US$5.78 billion worth of semiconductor equipment, up 12 percent from the previous quarter, but down 13 percent from a year earlier, falling from the second spot in the first quarter, the data showed.

In the second quarter, global semiconductor equipment spending totaled US$26.43 billion, up 7 percent from a quarter earlier and up 6 percent from a year earlier, SEMI said.

Because pure foundry operators such as TSMC are raising production capacity, semiconductor equipment spending is expected to grow this year, said SEMI Taiwan president Terry Tsao (曹世綸), who is also the group’s global chief marketing officer.

JITTERS: Nexperia has a 20 percent market share for chips powering simpler features such as window controls, and changing supply chains could take years European carmakers are looking into ways to scratch components made with parts from China, spooked by deepening geopolitical spats playing out through chipmaker Nexperia BV and Beijing’s export controls on rare earths. To protect operations from trade ructions, several automakers are pushing major suppliers to find permanent alternatives to Chinese semiconductors, people familiar with the matter said. The industry is considering broader changes to its supply chain to adapt to shifting geopolitics, Europe’s main suppliers lobby CLEPA head Matthias Zink said. “We had some indications already — questions like: ‘How can you supply me without this dependency on China?’” Zink, who also

At least US$50 million for the freedom of an Emirati sheikh: That is the king’s ransom paid two weeks ago to militants linked to al-Qaeda who are pushing to topple the Malian government and impose Islamic law. Alongside a crippling fuel blockade, the Group for the Support of Islam and Muslims (JNIM) has made kidnapping wealthy foreigners for a ransom a pillar of its strategy of “economic jihad.” Its goal: Oust the junta, which has struggled to contain Mali’s decade-long insurgency since taking power following back-to-back coups in 2020 and 2021, by scaring away investors and paralyzing the west African country’s economy.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) received about NT$147 billion (US$4.71 billion) in subsidies from the US, Japanese, German and Chinese governments over the past two years for its global expansion. Financial data compiled by the world’s largest contract chipmaker showed the company secured NT$4.77 billion in subsidies from the governments in the third quarter, bringing the total for the first three quarters of the year to about NT$71.9 billion. Along with the NT$75.16 billion in financial aid TSMC received last year, the chipmaker obtained NT$147 billion in subsidies in almost two years, the data showed. The subsidies received by its subsidiaries —

BUST FEARS: While a KMT legislator asked if an AI bubble could affect Taiwan, the DGBAS minister said the sector appears on track to continue growing The local property market has cooled down moderately following a series of credit control measures designed to contain speculation, the central bank said yesterday, while remaining tight-lipped about potential rule relaxations. Lawmakers in a meeting of the legislature’s Finance Committee voiced concerns to central bank officials that the credit control measures have adversely affected the government’s tax income and small and medium-sized property developers, with limited positive effects. Housing prices have been climbing since 2016, even when the central bank imposed its first set of control measures in 2020, Chinese Nationalist Party (KMT) Legislator Lo Ting-wei (羅廷瑋) said. “Since the second half of