The central bank said its recent discussions about shortening mortgage periods would not affect first-time home buyers or urban renewal projects, but would be aimed at corporate buyers and multiple home owners, who are already subject to selective credit controls.

The central bank made the clarification in a statement on Saturday to calm fears that it would shorten mortgages from 30 years to 20 years during its June policy meeting in another bid to cool the housing market.

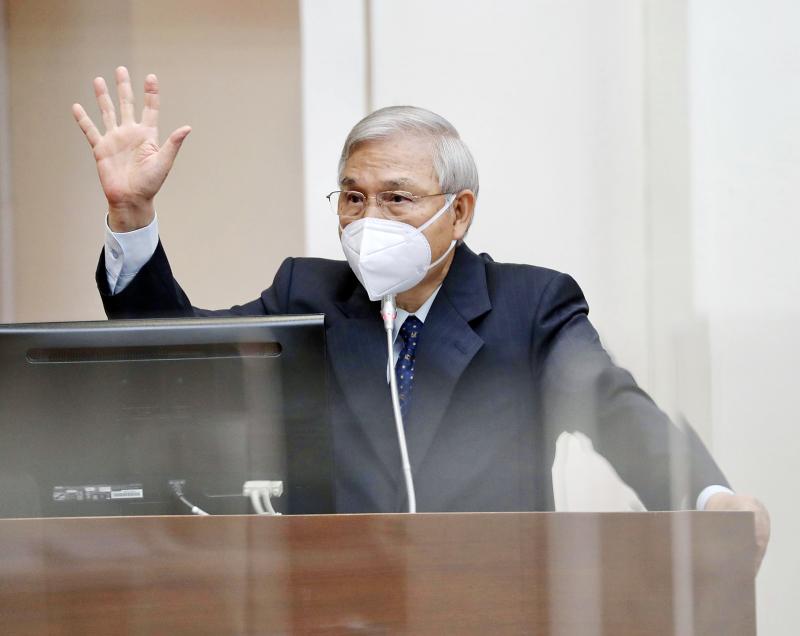

Central bank Governor Yang Chin-long (楊金龍) had told a meeting of the legislature’s Finance Committee on Thursday that there was still room for improvement regarding efforts to regulate real-estate financing, especially in areas with evident price hikes.

Photo: CNA

“House loans remain high, though stable,” Yang told lawmakers, adding that he was considering further selective credit controls, such as tightening mortgage terms and lowering loan-to-value ratios.

Property analysts said the proposed measures, if realized, would hit young first-home buyers the hardest, as their monthly mortgage payments could inflate significantly and many might default, wreaking havoc on the nation’s financial system.

People with 30-year mortgages of NT$10 million (US$335,412) would have to pay NT$49,413 per month, up from NT$35,724 at present, if they are switched to a 20-year mortgage scheme with an annual interest rate of 1.75 percent, senior property broker Lee Tung-rong (李同榮) said.

Shortening mortgage periods is a policy tool under consideration that would not apply to first-time home buyers, who have been excluded from its previous four macro-prudential measures, the central bank said.

Fresh selective credit controls, if deemed necessary at the board meeting on June 16, would only target corporate buyers, houses in hotspots and people who have third home mortgages, the central bank said.

Hotspots refer to the six special municipalities: Taipei, New Taipei City, Taoyuan, Taichung, Tainan and Kaohsiung, as well as Hsinchu City and Hsinchu County.

The central bank has banned grace periods for home purchases in those areas and is considering whether to cut their loan-to-value ratios, Yang said.

Lower loan-to-value ratios proved effective in cooling property fever years ago, he said, adding that stricter mortgages would also make home owners more cautious when planning their finances.

Several board members at the central bank’s March meeting said that housing price hikes bolster inflationary pressures, and the popular belief that owning real estate is the best defense against inflation suggests a need for policy intervention before it is too late.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the