US stocks on Friday extended their rally and the S&P 500 and the NASDAQ Composite indices scored their biggest weekly percentage gains since the US elections in early November last year, boosted by optimism over earnings, stimulus talks and progress on vaccine rollouts.

The Dow Jones Industrial Average and S&P 500 rose for a fifth straight session in their longest streak of gains since August last year, while the S&P 500 and NASDAQ posted record closing highs for a second day in a row.

A smaller-than-expected rebound in the US labor market last month highlighted the need for more government aid.

The US Department of Labor on Friday reported a 49,000 increase in non-farm payrolls last month, but job losses in manufacturing and construction.

US President Joe Biden and his Democratic allies in the US Congress moved ahead with their US$1.9 trillion COVID-19 relief package as lawmakers approved a budget plan that would allow them to muscle Biden’s plan through in the coming weeks without Republican support.

“The upcoming package of stimulus is going to be big,” said Alan Lancz, president of Alan Lancz & Associates Inc, an investment advisory firm based in Toledo, Ohio.

“You have a situation where there’s a lot of cash on sidelines and bonds have really underperformed, so that’s helped some sectors that have really done poorly,” he said.

Upbeat earnings this week have also supported investor optimism. So far, stronger-than-expected corporate results in the fourth quarter have driven up analysts’ expectations, and S&P 500 companies are on track to post earnings growth for the period instead of a decline as initially expected.

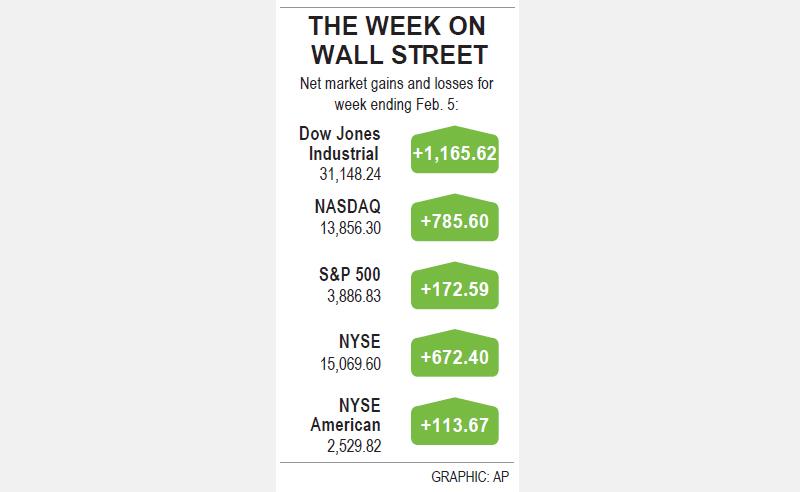

The Dow Jones Industrial Average on Friday rose 92.38 points, or 0.3 percent, to 31,148.24, the S&P 500 gained 15.09 points, or 0.39 percent, at 3,886.83 and the NASDAQ Composite added 78.55 points, or 0.57 percent, at 13,856.30.

For the week, the S&P 500 gained 4.65 percent, the NASDAQ added 6.01 percent and the Dow increased 3.89 percent. The small-cap Russell 2000 index rose 7.7 percent for the week, its biggest weekly percentage gain since the week that ended on June 5 last year.

The CBOE Volatility index fell and had its biggest weekly point drop since the week that ended on Nov. 6 last year.

The S&P 500 technology index ended down 0.2 percent after hitting a record high earlier in the session.

Johnson & Johnson rose 1.5 percent after the drugmaker said it had asked US health regulators to authorize its single-dose COVID-19 vaccine for emergency use.

Shares of GameStop Corp, caught in a social media-hyped trading frenzy, rose 19.2 percent on Friday, after online broker Robinhood lifted all the buying curbs imposed at the height of the battle between amateur investors and Wall Street hedge funds.

Clover Health Investments Corp shares ended up 5.7 percent. It said it would cooperate with a request from the US Securities and Exchange Commission. US regulators are following up on a report about Clover by short-selling specialist Hindenburg Research.

Advancing issues outnumbered declining ones on the New York Stock Exchange by a 2.33-to-1 ratio; on NASDAQ, a 1.94-to-1 ratio favored advancers.

The S&P 500 posted 34 new 52-week highs and no new lows; the NASDAQ Composite recorded 286 new highs and four new lows.

Volume on US exchanges was 13.65 billion shares, compared with the 15.5 billion average for the full session over the past 20 trading days.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the