US stock indices dropped, closing out the Friday session with the biggest weekly fall since October last year, as investors gauged the ramifications of Johnson & Johnson’s (J&J) COVID-19 vaccine trial results, while a standoff between Wall Street hedge funds and small, retail investors added to volatility.

Johnson & Johnson fell 3.56 percent as one of the biggest weights on the Dow and S&P500 after the drugmaker said that its single-dose vaccine was 72 percent effective in preventing COVID-19 in the US, with a lower rate of 66 percent observed globally.

The results compare with the high bar set by two authorized vaccines from Pfizer Inc/BioNTech SE and Moderna Inc, which were about 95 percent effective in preventing symptomatic illness in key trials when given in two doses. Moderna shares climbed 8.53 percent, while Pfizer shares edged up 0.11 percent.

Photo: AP

Worries of a short squeeze that began earlier in the week resurfaced after an army of retail investors returned to trade shares in stocks such as GameStop Corp and Koss Corp, which shot higher after brokers including Robinhood Markets Inc eased some of the restrictions they had placed on trading.

“The overall picture is that if there is any bad news that suggests or indicates there could be a longer hibernation period for us to be indoors and not consuming or spending, that tends to set the market back and a lot of people sit on the sidelines, particularly with that news,” said Sylvia Jablonski, chief investment officer at Defiance ETFs in New York. “Then what is going on with [Gamestop] and all that stuff, people are a little afraid to trade.”

The surge in volatility has led to a huge increase in volume, totaling more than 20 billion shares in each of the past two sessions across US exchanges for the most active trading days on record going back to 2014, Refinitiv data showed.

Volume across US exchanges on Friday was 17.13 billion shares, compared with the 15.26 billion average for the full session over the past 20 trading days.

The US Securities and Exchange Commission said that it was closely monitoring any potential wrongdoing, regarding brokerages and social media traders.

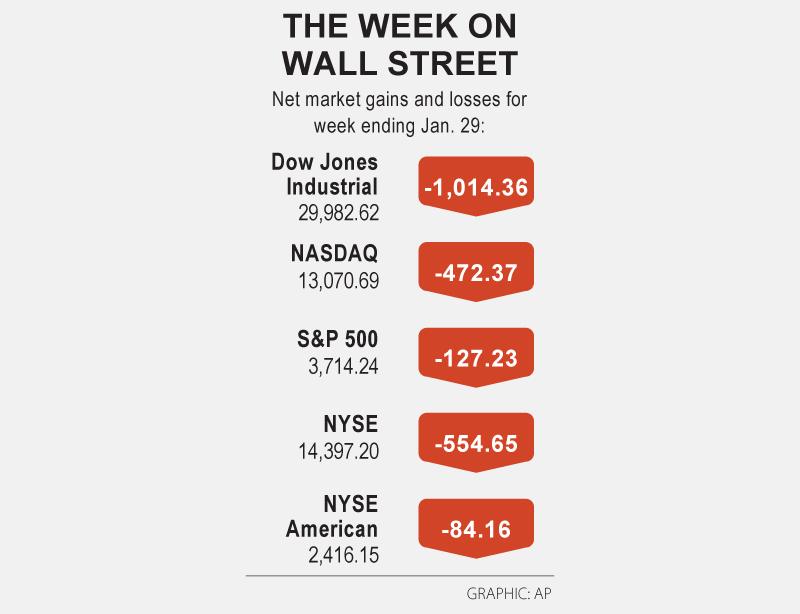

The Dow Jones Industrial Average fell 620.74 points, or 2.03 percent, to 29,982.62, the S&P 500 lost 73.14 points, or 1.93 percent, to 3,714.24 and the NASDAQ Composite dropped 266.46 points, or 2 percent, to 13,070.69.

All three main indices recorded their biggest weekly fall since the end of October, as the Dow lost 3.27 percent, the S&P fell 3.31 percent and the NASDAQ declined 3.49 percent.

Both the S&P 500 and Dow closed below their 50-day moving average, seen as a technical support level.

Market participants have speculated that volatility caused by the short squeezes have led to investor favorites including Apple Inc coming under pressure as hedge funds sell to cover billions of US dollars in losses.

Apple shares declined 3.74 percent, while Microsoft Inc fell 2.92 percent.

However, while concerns about rising COVID-19 cases and bumpy vaccine rollouts kept investors leery about a pullback and an increase in volatility in the near-term, the start to quarterly earnings has eased some concern about stretched stock valuations.

Of the 184 companies in the S&P 500 that had reported earnings through Friday morning, 84.2 percent topped analysts’ expectations, well above the 75.5 percent beat rate for the past four quarters, Refinitiv data showed.

Honeywell International lost 3.68 percent after it posted a 13 percent fall in quarterly profit.

Declining issues outnumbered advancing ones on the NYSE by a 2.88-to-1 ratio; on the NASDAQ, a 2.38-to-1 ratio favored decliners.

The S&P 500 posted seven new 52-week highs and no new lows, while the NASDAQ Composite recorded 64 new highs and 16 new lows.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.