Nearly 300 financial companies plan to spend NT$3.032 billion (US$101.3 million) subsidizing domestic trips for employees from this month to the end of the year to help boost the economy, the Financial Supervisory Commission (FSC) said yesterday.

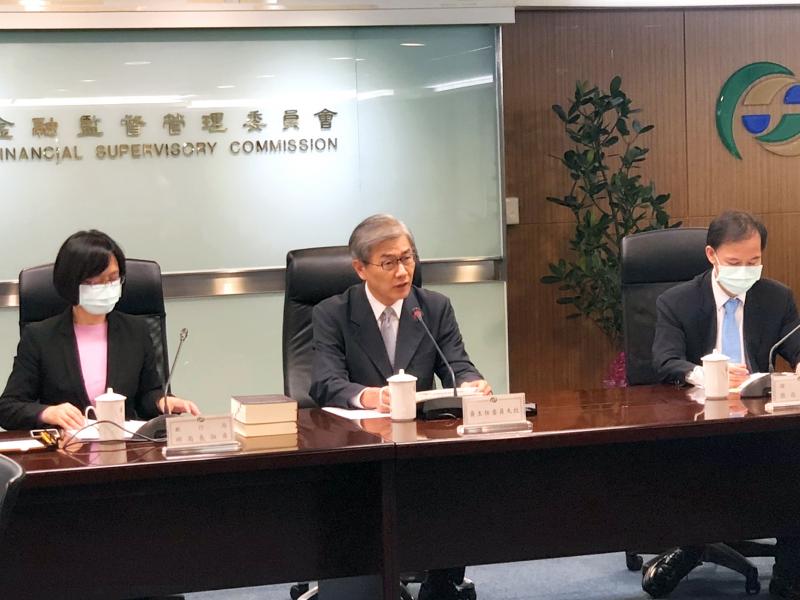

The 287 companies include 36 banks, 41 insurance companies, 68 securities brokerages, 39 securities investment trust firms, 84 securities investment consulting companies, 15 futures traders and four accounting firms, FSC Chairman Thomas Huang (黃天牧) said.

Banks plan to spend NT$1.36 billion, the highest among all industries, followed by insurers with NT$1.35 billion, securities companies with NT$185 million and accounting firms with NT$67 million, the commission said.

Photo: Kelson Wang, Taipei Times

A total of 600,000 employees are expected to benefit from the subsidies, Huang said.

Many firms had planned to organize overseas trips for their employees, or hold conferences and employee training courses abroad, Huang said.

In light of the nation’s stable epidemic situation compared with other countries, they have decided to hold these events domestically, he said.

Fubon Financial Holding Co (富邦金控) yesterday said it would spend NT$700 million on domestic travel and training programs for its 58,000 employees.

The company’s insurance unit, Fubon Life Insurance Co (富邦人壽), plans to spend NT$220 million on similar endeavors, it added.

Lin Yuan Group (霖園集團) — which owns Cathay Financial Holdings Co (國泰金控), Cathay Real Estate Co (國泰建設) and Cathay General Hospital (國泰綜合醫院) — last month announced that it would spend NT$440 million to subsidize domestic trips and other events for its 50,000 employees.

Meanwhile, a survey released yesterday by MasterCard showed that 45 percent of respondents are willing to travel locally within three months after the government eases restrictions on social distancing, while more than 50 percent would spend between NT$5,000 and NT$8,000 on domestic trips.

The survey indicated that most respondents are conservative about taking trips abroad as border controls remain in place in many countries.

For those who are willing to travel overseas, up to 70 percent said they would prioritize countries where virus infections have slowed down, the survey said.

In other news, the FSC yesterday said that 22 life insurance companies have trimmed their interest rates on policy loans by 50 basis points for the next six months.

The move is aimed at easing the financial burden on people affected by the virus, such as medical staff, COVID-19 patients or furloughed workers, Huang said.

The policy loans offered by life insurers totaled NT$614.7 billion at the end of April, and the rate cuts would lead to a NT$1.5 billion dip in insurers’ interest income this year, the commission said.

KEEPING UP: The acquisition of a cleanroom in Taiwan would enable Micron to increase production in a market where demand continues to outpace supply, a Micron official said Micron Technology Inc has signed a letter of intent to buy a fabrication site in Taiwan from Powerchip Semiconductor Manufacturing Corp (力積電) for US$1.8 billion to expand its production of memory chips. Micron would take control of the P5 site in Miaoli County’s Tongluo Township (銅鑼) and plans to ramp up DRAM production in phases after the transaction closes in the second quarter, the company said in a statement on Saturday. The acquisition includes an existing 12 inch fab cleanroom of 27,871m2 and would further position Micron to address growing global demand for memory solutions, the company said. Micron expects the transaction to

Nvidia Corp’s GB300 platform is expected to account for 70 to 80 percent of global artificial intelligence (AI) server rack shipments this year, while adoption of its next-generation Vera Rubin 200 platform is to gradually gain momentum after the third quarter of the year, TrendForce Corp (集邦科技) said. Servers based on Nvidia’s GB300 chips entered mass production last quarter and they are expected to become the mainstay models for Taiwanese server manufacturers this year, Trendforce analyst Frank Kung (龔明德) said in an interview. This year is expected to be a breakout year for AI servers based on a variety of chips, as

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)