The demise of the coal industry left the US’ Appalachian region in tatters, with lost jobs, spoiled water and countless kilometers of abandoned underground mines.

Now entrepreneurs are eyeing the rural region with ambitious visions to rebuild its economy by converting old mines into solar power systems and data centers that could help fuel the increasing power demands of the artificial intelligence (AI) boom.

One such project is underway by a non-profit team calling itself Energy DELTA (Discovery, Education, Learning and Technology Accelerator) Lab, which is looking to develop energy sources on about 26,305 hectares of old coal land in southwest Virginia.

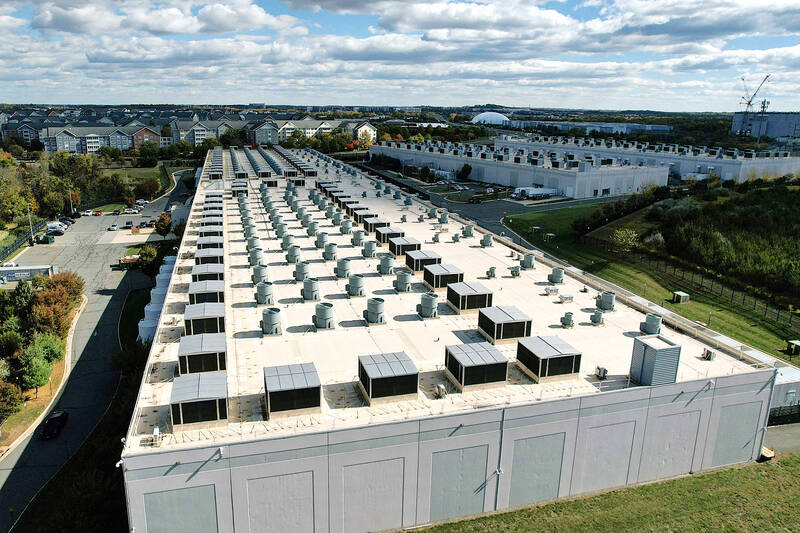

Photo: Reuters

Will Clear and Will Payne, who help manage Energy DELTA Lab, said they imagine building a massive 182 hectare data center ridge on top of old mining lands that could be powered and cooled using the billions of liters of water that naturally replenish below.

Unlike in some neighboring areas, there is no acid mine drainage, which deposits sulfuric acid and heavy metals from exposed mine rock faces, rendering water unusable, Payne said.

The difference has to do with geology, as the Wise County coal fields lack the mineral pyrite, a key culprit in acid mine drainage, he said.

“So, the water quality is there. Obviously, the cost to use, to circulate this water is low,” Payne said.

In support, a handful of localities, including Wise County, have a special tax rate on data center equipment and resolutions aimed at welcoming regional data center investments.

Payne said that their plan could meet with resistance in an area hard-hit by coal’s decline.

“Anyone looking at expanding in the region, there is skepticism, because there have been so many stories of promises made, but not kept,” Payne said at Squabble State Hard Cider & Spirits, a cider-making business he and Clear run near the state border with Tennessee.

Appalachia was once the heart of the nation’s coal industry, whose decline destroyed local communities.

Amid issues of cost, worker health and the fossil fuel’s contributions to global warming, coal has been dropping as a top source of US fuel for decades.

“If you go through coal mining communities, they’re ghost towns,” United Mine Workers of America director of communications Erin Bates said. “The number of bankruptcies that have happened in the last three decades have destroyed these communities.”

Financially, the data center ridge vision is ambitious. Constructing an average-sized data center facility can cost US$500 million to US$2 billion, Allianz SE said.

The entrepreneurs hope to prove the feasibility of their idea to Texas-based Energy Transfer, which owns the land in question. The land is managed by Penn Virginia Operating Co.

“They’re willing to think about the future, whereas others maybe just don’t have the time or don’t have the interest,” Payne said.

Energy Transfer did not respond to interview requests.

Other coal mine repurposing projects are seeing success, at least on a local scale.

The Mineral Gap Data Center, also in Wise County, came online in 2023 and touts itself as the first abandoned mine land to be converted to solar in the state.

In Martin County, Kentucky, a utility-scale solar project on an old mine site that powers about 18,000 homes, came online this month.

The Nature Conservancy, a nonprofit group, is a partner in a 10-megawatt solar project in Wise County built on the former Indian Creek Surface Mine. Start of construction is planned for next year.

The nonprofit is working on a broader conservation effort spanning more than 101,171 hectares in Virginia, Kentucky and Tennessee that could include additional solar development, said Brad Kreps, the Conservancy’s Clinch Valley Program director.

“Our projects are definitely among the first that are moving forward in central Appalachia,” Kreps said.

Building new data centers would need on-site renewable energy to be viable, said Jean Su of the Center for Biological Diversity, a nonprofit group.

However, Su questioned building data centers.

“That should be up to every single jurisdiction to have that type of public interest test to figure out whether it is actually serving their constituency or not — understanding environmental harms, water issues and drainage,” Su said.

Environmental groups criticize the expansion of data centers, which strain power grids and likely require significantly more energy than can be made available.

Some critics such as Bates say data centers might not bring the jobs the area desperately needs, but Payne maintains there would be work for local residents.

A typical data center can add up to 1,500 workers on-site during construction and employ about 50 full-time workers when up and running, a Virginia state report said last year.

Based on average spending by the industry from 2021 to 2023, overall the data center industry is estimated to contribute 74,000 jobs, US$5.5 billion in labor income and US$9.1 billion in GDP to Virginia’s economy each year — mostly in the construction phase, the report said.

Those estimates were just 1 percent more than total statewide employment, income and Virginia GDP for those years, it found.

Nationwide, the number of people working in data centers grew from 306,000 to 501,000 between 2016 and 2023, according to the US Bureau of Labor Statistics.

Meanwhile, US President Donald Trump’s administration is aiming to reverse the decline of coal use, largely to help fuel AI systems.

In October, the US Department of Energy announced it would make US$100 million available to refurbish and modernize coal-fired power plants.

The mining community would be pleased with almost any job-creating solution, Bates said.

“If a battery plant wants to open up, or any kind of plant wants to open up [in] those areas that’s going to help the areas thrive and not be so devastated as they currently are, we’re absolutely going to welcome it,” she added.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

CONCERNS: Tech companies investing in AI businesses that purchase their products have raised questions among investors that they are artificially propping up demand Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Saturday said that the company would be participating in OpenAI’s latest funding round, describing it as potentially “the largest investment we’ve ever made.” “We will invest a great deal of money,” Huang told reporters while visiting Taipei. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.” Huang did not say exactly how much Nvidia might contribute, but described the investment as “huge.” “Let Sam announce how much he’s going to raise — it’s for him to decide,” Huang said, referring to OpenAI

The global server market is expected to grow 12.8 percent annually this year, with artificial intelligence (AI) servers projected to account for 16.5 percent, driven by continued investment in AI infrastructure by major cloud service providers (CSPs), market researcher TrendForce Corp (集邦科技) said yesterday. Global AI server shipments this year are expected to increase 28 percent year-on-year to more than 2.7 million units, driven by sustained demand from CSPs and government sovereign cloud projects, TrendForce analyst Frank Kung (龔明德) told the Taipei Times. Demand for GPU-based AI servers, including Nvidia Corp’s GB and Vera Rubin rack systems, is expected to remain high,