The global server market is expected to grow 12.8 percent annually this year, with artificial intelligence (AI) servers projected to account for 16.5 percent, driven by continued investment in AI infrastructure by major cloud service providers (CSPs), market researcher TrendForce Corp (集邦科技) said yesterday.

Global AI server shipments this year are expected to increase 28 percent year-on-year to more than 2.7 million units, driven by sustained demand from CSPs and government sovereign cloud projects, TrendForce analyst Frank Kung (龔明德) told the Taipei Times.

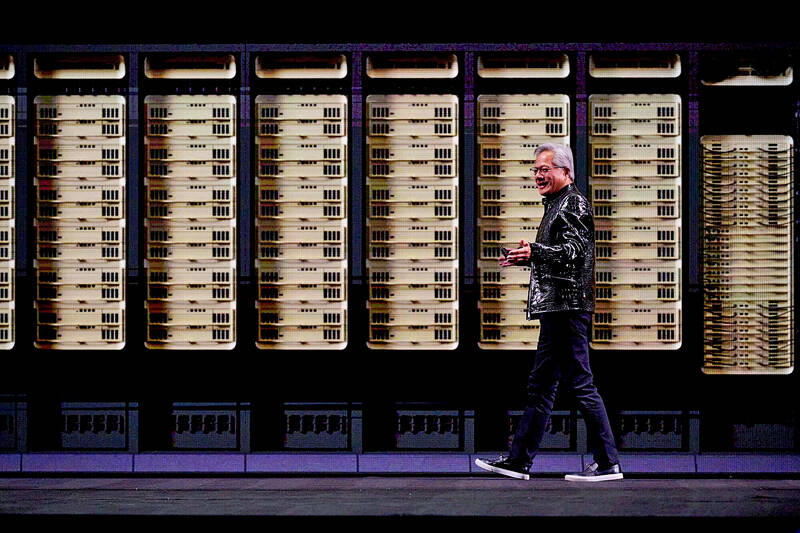

Demand for GPU-based AI servers, including Nvidia Corp’s GB and Vera Rubin rack systems, is expected to remain high, while CSPs would invest in in-house application-specific integrated circuit (ASIC) development, which is also expected to drive demand for AI training and inference, Kung said.

Photo: Bloomberg

Capital expenditures by the five largest CSPs — Google, Amazon Web Services, Meta Platforms Inc, Microsoft Corp and Oracle Corp — are expected to rise 40 percent year-on-year this year, TrendForce said in a separate report released on Tuesday last week.

Google and Microsoft are expected to lead the expansion of general-purpose server procurement to handle the surge in daily inference workloads generated by services such as Microsoft’s Copilot and Google’s Gemini, it said.

In addition to large-scale infrastructure expansion, part of the spending is expected to be earmarked for replacement of general-purpose servers purchased during the 2019 to 2021 cloud investment boom, the researcher said.

However, the share of ASIC-based AI servers is expected to rise to 27.8 percent as Google and Meta ramp up in-house chip development, with shipments of ASIC-based systems forecast to grow faster than those of GPU-based servers, TrendForce said.

Google, in particular, is investing more heavily in its own ASICs than most other CSPs and is emerging as a key market player, it said.

Its tensor processing units, which support Google Cloud Platform services, are also increasingly being sold to external customers such as AI start-up Anthropic PBC, it said.

The growth in the global server market this year would be driven by continued momentum in AI servers, with the rapid expansion of AI inference applications in particular fueling rising demand for storage and edge AI servers, Kung said.

Meanwhile, as demand for AI inference continues to grow rapidly across end devices and industrial applications, it is expected to reshape the computing power structure, which is still heavily skewed toward training workloads, he said.

Inference-based AI servers are expected to account for 44 percent of total AI server shipments this year, with the share projected to rise above 50 percent by 2029, he said.

As CSPs and enterprises expand AI applications across endpoints, the market is expected to develop along two main tracks, Kung said.

The first involves broader deployment of GPU-based systems, such as Nvidia’s platforms, as well as in-house ASIC rack solutions to support large language model training and generative AI inference, he said.

The other track is the growing adoption of more distributed, edge-oriented AI server architectures — such as MGX platforms — designed to support real-time inference workloads closer to data sources, he added.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.