Bayer, the German chemical and drug giant that makes aspirin and Alka-Seltzer, said on Monday that it would buy the over-the-counter (OTC) drug business of the Swiss pharmaceuticals company Roche in a deal worth about US$2.95 billion that would create a world leader in non-prescription medicines.

If the deal is approved by antitrust officials in Europe and the US, the enlarged Bayer consumer health care unit would continue to be based in Morristown, New Jersey, and be led by Gary Balkema, the president of Bayer Healthcare. The combined operations would have 6,700 employees in 120 countries.

Roche, whose main OTC products, like Rennie antacid and Supradyn vitamins, are known mainly outside the US, had put the non-prescription business on the market in order to focus on its pharmaceuticals and medial diagnostics business.

Its leading prescription drugs include Pegsys and Copegus, sold as a combination treatment for hepatitis C, Fuzeon, an AIDS drug, and Herceptin, for breast cancer.

For Bayer, whose pharmaceuticals business has stumbled, the move gives the company more clout in over-the-counter treatments and greater geographical balance in that business, which Bayer executives expect to reach 2.4 billion euros (SU$2.98 billion) after the merger.

In consumer health products, including nutritional products and vitamins, the bigger Bayer would rank behind Johnson & Johnson, GlaxoSmithKline, Procter & Gamble and Novartis. But in OTC alone, it would be third, after Johnson & Johnson and GlaxoSmithKline.

"It is our stated goal to expand our OTC business further and to become the No. 1 worldwide," Bayer's chief executive, Werner Wenning, said in a statement. "With the acquisition, we have taken a big step closer towards our goal."

Investors, though, indicated doubts about Bayer's strategy and its ability to finance the deal, which is to be paid for at least in part from the company's cash flow.

Standard & Poor's lowered Bayer's long-term debt to A from A+, on questions about the deal's affect on the company's ability to meet debt obligations.

Moody's Investors Service, however, affirmed its A3 rating for Bayer, citing the deal's ability to strengthen the company's position in consumer healthcare, a business with high profit margins.

Analysts said the transaction could help counter possible negative effects from Bayer's plans to spin off its Lanxess chemicals unit, which represents about 20 percent of the company's sales.

The deal also reduces emphasis on Bayer's pharmaceuticals business, which has had trouble with developing new drugs. Its leading antibiotic, Ciprol, has been losing market share to generic drugs.

And it is still grappling with thousands of lawsuits by people who said they suffered side effects from Bayer's cholesterol treatment, Baycol, which the company withdrew from the market in 2001.

Bayer said that the acquisition would incur one-time charges of some 300 million euros and reduce earnings per share by 0.25 euros next year, but that it expected a positive effect on results in 2006 and cost savings of 100 million euros to 120 million euros over the next three years.

Under the deal, Bayer will buy out Roche's half of the companies' joint venture in the US, which include marketing the nonprescription painkiller Alleve.

LIMITS: While China increases military pressure on Taiwan and expands its use of cognitive warfare, it is unwilling to target tech supply chains, the report said US and Taiwan military officials have warned that the Chinese People’s Liberation Army (PLA) could implement a blockade within “a matter of hours” and need only “minimal conversion time” prior to an attack on Taiwan, a report released on Tuesday by the US Senate’s China Economic and Security Review Commission said. “While there is no indication that China is planning an imminent attack, the United States and its allies and partners can no longer assume that a Taiwan contingency is a distant possibility for which they would have ample time to prepare,” it said. The commission made the comments in its annual

DETERMINATION: Beijing’s actions toward Tokyo have drawn international attention, but would likely bolster regional coordination and defense networks, the report said Japanese Prime Minister Sanae Takaichi’s administration is likely to prioritize security reforms and deterrence in the face of recent “hybrid” threats from China, the National Security Bureau (NSB) said. The bureau made the assessment in a written report to the Legislative Yuan ahead of an oral report and questions-and-answers session at the legislature’s Foreign Affairs and National Defense Committee tomorrow. The key points of Japan’s security reforms would be to reinforce security cooperation with the US, including enhancing defense deployment in the first island chain, pushing forward the integrated command and operations of the Japan Self-Defense Forces and US Forces Japan, as

‘TROUBLEMAKER’: Most countries believe that it is China — rather than Taiwan — that is undermining regional peace and stability with its coercive tactics, the president said China should restrain itself and refrain from being a troublemaker that sabotages peace and stability in the Indo-Pacific region, President William Lai (賴清德) said yesterday. Lai made the remarks after China Coast Guard vessels sailed into disputed waters off the Senkaku Islands — known as the Diaoyutai Islands (釣魚台) in Taiwan — following a remark Japanese Prime Minister Sanae Takaichi made regarding Taiwan. Takaichi during a parliamentary session on Nov. 7 said that a “Taiwan contingency” involving a Chinese naval blockade could qualify as a “survival-threatening situation” for Japan, and trigger Tokyo’s deployment of its military for defense. Asked about the escalating tensions

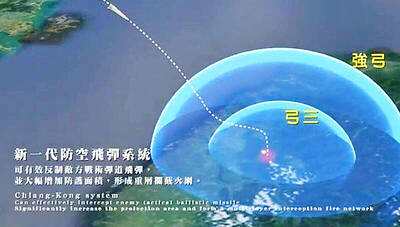

INTERCEPTION: The 30km test ceiling shows that the CSIST is capable of producing missiles that could stop inbound missiles as they re-enter the atmosphere Recent missile tests by the Chungshan Institute of Science and Technology (CSIST) show that Taiwan’s missiles are capable of intercepting ballistic missiles as they re-enter the atmosphere and pose a significant deterrent to Chinese missile threats, former Hsiung Feng III missile development project chief engineer Chang Cheng (張誠) said yesterday. The military-affiliated institute has been conducting missile tests, believed to be related to Project Chiang Kung (強弓) at Pingtung County’s Jiupeng Military Base, with many tests deviating from past practices of setting restriction zones at “unlimited” and instead clearly stating a 30.48km range, Chang said. “Unlimited” restrictions zones for missile tests is