The sight of foreign faces in Ulan Bator used to turn heads. Now, they are two-a-penny as the once remote Mongolian capital is quickly becoming a hotspot for international investors. If successfully exploited, the country’s rich mineral deposits could see its economy more than double over the next two decades.

However, impinging on that rosy picture is the tricky question of water availability. The Central Asian country suffers from extremes in seasonal runoff, local water stress and chronic deficits.

“In the coming two decades, water demand is expected to triple even as water suppliers are shrinking,” according to 2030 Water Resources Group, which predicts a 244,000m3 per day water deficit by the end of the next decade.

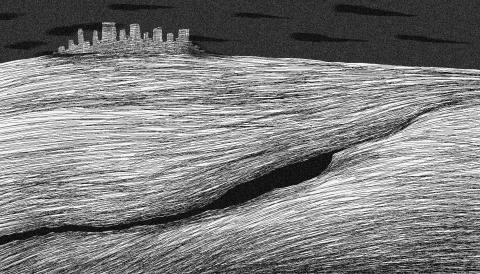

The link between water stress and mineral exploitation is where much of the concern lies. A substantial proportion of Mongolia’s copper and gold reserves happen to be found in its driest spot: South Gobi. Rainfall in the desert area ranges between zero and a measly 50mm per year.

A range of potential infrastructure options is on the table: One of the most ambitious would see Mongolia pump in water via a 600km pipeline from the Orphon River in its northern region. Yet at US$550 million, the project’s price tag puts its viability in doubt.

Desalination represents another outside option. However, question marks hang over whether landlocked Mongolia has the deep pockets or the hydrological conditions to make that happen.

For the moment, the onus is on mining companies making their operations as water-efficient as possible. For example, the World Bank-backed International Financial Corporation recently initiated a water-management program with most of the major mining operators in South Gobi. Among its early products is a pilot training package for companies on best practices.

“There’s a lot to be shared and gained by visiting each other’s projects and setting among ourselves the height of each other’s bar,” said Mark Newby, environment manager for Rio Tinto’s huge Oyu Tolgoi copper and gold mine in South Gobi.

Oyu Tolgoi, which came on stream last year, is touted as a benchmark for the industry. The US$6.2 billion project draws all its water from a 560km2 aquifer about 400m below the desert’s surface. More than two-thirds of its water use is reclaimed, recycled and then reused. High-efficiency tailings thickeners and reclaim processes account for the largest proportion of water savings at the mine, which employs a zero-water discharge policy.

From the beginning, Rio Tinto realized that water efficiency would make or break the project, Newby said.

“[Water is] a fossil resource and if it’s to be used up unreasonably quickly, then that just ends the mine life earlier,” he said.

The mine is expected to use up one-fifth of the aquifer’s 6.8 billion cubic meters during its projected 27-year lifespan, according to Rio Tinto’s calculations.

Campaign groups say that Oyu Tolgoi could jeopardize local water availability, but Rio Tinto maintains that an impermeable layer above its main aquifer separates the brackish water that it extracts from the cleaner, shallower water on which locals depend. The company has also installed sensors in more than 30 area wells and has trained local herders in their use, promising them real-time data on water levels.

Local concerns surrounding Rio Tinto’s mine reveal an additional concern regarding mineral extraction’s impact on agriculture.

Mongolia’s southern and central zones occupy terrain traditionally used by nomadic herdsmen. Diverting already scarce water resources to mining could imperil their livelihoods, analysts say.

Similarly, water scarcity threatens the production of irrigated food crops, especially in Mongolia’s central zone, which provides Ulan Bator with much of its food.

Shifting agricultural production to the country’s east and west regions, where water resources are more plentiful, represents one potential solution, but again, a more obvious and more immediate answer is to promote water efficiency.

Among 2030 Water Resources Group’s early recommendations is an increase in the use of drip and sprinkler irrigation, coupled with improvements in fertilizer balance and pest control.

The most pressing water-related headache facing Mongolia relates to Ulan Bator. With about 1.3 million people, the capital is home to more than two-fifths of the nation’s population. Its infrastructure is already under huge strain, with access to clean water and sanitation facilities among the chief problems. Rural-urban migration is set to exacerbate these further in the coming years.

“In a high-growth scenario, Ulan Bator could potentially run out of water between 2015 and 2021, which is not that far off”, said Alex Mung, head of the World Economic Forum’s Water Initiative and an adviser to 2030 Water Resources Group.

Mung sees a key role for private water companies in terms of knowledge-sharing and the cofinancing of vital water infrastructure. He cites the example of South Africa, where municipal governments are offering private operators financial incentives to reduce leaks. The companies are remunerated according to their ability to stem water losses.

The traditional availability of water means many Mongolian firms have yet to grasp the urgency of the problem, Mung said. Fixing that will require a concerted awareness-raising effort.

Learning to collaborate within the business sector and with government is another imperative, Mung added.

“The more we can do together, the better it will be for everyone and overall for Mongolia,” he said.

Recently, China launched another diplomatic offensive against Taiwan, improperly linking its “one China principle” with UN General Assembly Resolution 2758 to constrain Taiwan’s diplomatic space. After Taiwan’s presidential election on Jan. 13, China persuaded Nauru to sever diplomatic ties with Taiwan. Nauru cited Resolution 2758 in its declaration of the diplomatic break. Subsequently, during the WHO Executive Board meeting that month, Beijing rallied countries including Venezuela, Zimbabwe, Belarus, Egypt, Nicaragua, Sri Lanka, Laos, Russia, Syria and Pakistan to reiterate the “one China principle” in their statements, and assert that “Resolution 2758 has settled the status of Taiwan” to hinder Taiwan’s

Singaporean Prime Minister Lee Hsien Loong’s (李顯龍) decision to step down after 19 years and hand power to his deputy, Lawrence Wong (黃循財), on May 15 was expected — though, perhaps, not so soon. Most political analysts had been eyeing an end-of-year handover, to ensure more time for Wong to study and shadow the role, ahead of general elections that must be called by November next year. Wong — who is currently both deputy prime minister and minister of finance — would need a combination of fresh ideas, wisdom and experience as he writes the nation’s next chapter. The world that

Can US dialogue and cooperation with the communist dictatorship in Beijing help avert a Taiwan Strait crisis? Or is US President Joe Biden playing into Chinese President Xi Jinping’s (習近平) hands? With America preoccupied with the wars in Europe and the Middle East, Biden is seeking better relations with Xi’s regime. The goal is to responsibly manage US-China competition and prevent unintended conflict, thereby hoping to create greater space for the two countries to work together in areas where their interests align. The existing wars have already stretched US military resources thin, and the last thing Biden wants is yet another war.

Since the Russian invasion of Ukraine in February 2022, people have been asking if Taiwan is the next Ukraine. At a G7 meeting of national leaders in January, Japanese Prime Minister Fumio Kishida warned that Taiwan “could be the next Ukraine” if Chinese aggression is not checked. NATO Secretary-General Jens Stoltenberg has said that if Russia is not defeated, then “today, it’s Ukraine, tomorrow it can be Taiwan.” China does not like this rhetoric. Its diplomats ask people to stop saying “Ukraine today, Taiwan tomorrow.” However, the rhetoric and stated ambition of Chinese President Xi Jinping (習近平) on Taiwan shows strong parallels with