The latest buzzword in the globalization debate is outsourcing. Suddenly Americans -- long champions of globalization -- seem concerned about its adverse effects on their economy. Its ardent defenders are, of course, untroubled by the loss of jobs. They stress that outsourcing cuts costs -- just like a technological change that improves productivity, thus increasing profits -- and what is good for profits must be good for the American economy.

The laws of economics, they assert, ensure that in the long run there will be jobs for everyone who wants them, so long as government does not interfere in market processes by setting minimum wages or ensuring job security, or so long as unions don't drive up wages excessively. In competitive markets, the law of demand and supply ensures that eventually, in the long run, the demand for labor will equal the supply -- there will be no unemployment. But as Keynes put it so poignantly, in the long run, we are all dead.

Those who summarily dismiss the loss of jobs miss a key point: the US' economy has not been performing well. In addition to the trade and budget deficits, there is a jobs deficit. Over the past three and a half years, the economy should have created some 4 million to 6 million jobs to provide employment for new entrants into the labor force. In fact, more than 2 million jobs have been destroyed -- the first time since Herbert Hoover's presidency at the beginning of the Great Depression that there has been a net job loss in the US economy over the term of an entire presidential administration.

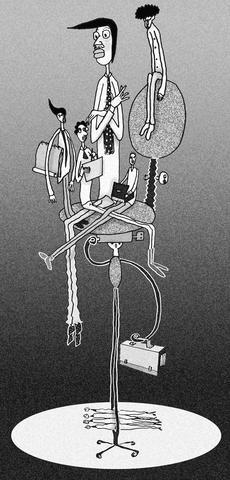

ILLUSTRATION MOUNTAIN PEOPLE

At the very least, this shows that markets by themselves do not quickly work to ensure that there is a job for everyone who wishes to work. There is an important role for government in ensuring full employment -- a role that the administration of US President George W. Bush has badly mismanaged. Were unemployment lower, the worries about outsourcing would be less.

But there is, I think, an even deeper reason for concerns about outsourcing of, say, high-tech jobs to India: It destroys the myth -- which has been a central tenet of the globalization debate in the US and other advanced industrial countries -- that workers should not be afraid of globalization.

Yes, apologists of outsourcing say, rich countries will lose low-skilled jobs in areas like textiles to low-wage labor in China and elsewhere. But this is supposedly a good thing, not a bad thing, because the US should be specializing in its areas of comparative advantage, involving skilled labor and advanced technology. What is required is "upskilling," improving the quality of education, especially in science and technology.

But this argument no longer seems convincing. The US is producing fewer engineers than China and India, and, even if engineers from those developing countries are at some disadvantage, either because of training or location, that disadvantage is more than offset by wage differentials. American and rich country engineers and computer specialists will either have to accept a wage cut and/or they will be forced into unemployment and/or to seek other employment -- almost surely at lower wages.?

If the US' highly trained engineers and computer specialists are unable to withstand the onslaught of outsourcing, what about those who are even less trained? Yes, the US may be able to maintain a competitive advantage at the very top, the breakthrough research, the invention of the next laser. But a majority of even highly trained engineers and scientists are involved in what is called "ordinary science," the important, day-to-day improvements in technology that are the basis of long-term increases in productivity -- and it is not clear that the US has a long-term competitive advantage here.

Two lessons emerge from the outsourcing debate. First, as the US grapples with the challenges of adjusting to globalization, it should be more sensitive to the plight of developing countries, which have far fewer resources to cope. After all, if the US, with its relatively low level of unemployment and social safety net, finds it must take action to protect its workers and firms against competition from abroad -- whether in software or steel -- such action by developing countries is all the more justified.

Second, the time for the US to worry is now. Many of globalization's advocates continue to claim that the number of jobs outsourced is relatively small. There is controversy, of course, about the eventual size, with some claiming that as many as one job in two might eventually be outsourced, others contending that the potential is much more limited. Haircuts, like a host of other activities requiring detailed local knowledge, cannot be outsourced.

But even if the eventual numbers are limited, there can be dramatic effects on workers and the distribution of income. Growth will be enhanced, but workers may be worse off -- and not just those who lose their jobs. This has, indeed, already happened in some developed countries: In the 10 years that have passed since the signing of the North American Free Trade Agreement, average real wages in the US have actually declined.

Putting one's head in the sand and pretending that everyone will benefit from globalization is foolish. The problem with globalization today is precisely that a few may benefit and a majority may be worse off, unless government takes an active role in managing and shaping it. This is the most important lesson of the ongoing debate over outsourcing.

Joseph Stiglitz is professor of economics at Columbia University and a member of the Commission on the Social Dimensions of Globalization. He received the Nobel Prize in Economics in 2001.

Copyright: Project Syndicate

The image was oddly quiet. No speeches, no flags, no dramatic announcements — just a Chinese cargo ship cutting through arctic ice and arriving in Britain in October. The Istanbul Bridge completed a journey that once existed only in theory, shaving weeks off traditional shipping routes. On paper, it was a story about efficiency. In strategic terms, it was about timing. Much like politics, arriving early matters. Especially when the route, the rules and the traffic are still undefined. For years, global politics has trained us to watch the loud moments: warships in the Taiwan Strait, sanctions announced at news conferences, leaders trading

The saga of Sarah Dzafce, the disgraced former Miss Finland, is far more significant than a mere beauty pageant controversy. It serves as a potent and painful contemporary lesson in global cultural ethics and the absolute necessity of racial respect. Her public career was instantly pulverized not by a lapse in judgement, but by a deliberate act of racial hostility, the flames of which swiftly encircled the globe. The offensive action was simple, yet profoundly provocative: a 15-second video in which Dzafce performed the infamous “slanted eyes” gesture — a crude, historically loaded caricature of East Asian features used in Western

Is a new foreign partner for Taiwan emerging in the Middle East? Last week, Taiwanese media reported that Deputy Minister of Foreign Affairs Francois Wu (吳志中) secretly visited Israel, a country with whom Taiwan has long shared unofficial relations but which has approached those relations cautiously. In the wake of China’s implicit but clear support for Hamas and Iran in the wake of the October 2023 assault on Israel, Jerusalem’s calculus may be changing. Both small countries facing literal existential threats, Israel and Taiwan have much to gain from closer ties. In his recent op-ed for the Washington Post, President William

A stabbing attack inside and near two busy Taipei MRT stations on Friday evening shocked the nation and made headlines in many foreign and local news media, as such indiscriminate attacks are rare in Taiwan. Four people died, including the 27-year-old suspect, and 11 people sustained injuries. At Taipei Main Station, the suspect threw smoke grenades near two exits and fatally stabbed one person who tried to stop him. He later made his way to Eslite Spectrum Nanxi department store near Zhongshan MRT Station, where he threw more smoke grenades and fatally stabbed a person on a scooter by the roadside.