European shares on Friday ended the week down roughly US$1.5 trillion in their worst weekly performance since the 2008 financial crisis as the rapid spread of COVID-19 outside of China saw sustained selling on fears of a recession.

The pan-European STOXX 600 on Friday dropped 15.22 points, or 3.9 percent, to 374.24, plunging 12.6 percent from a close of 428.07 on Feb. 21 and 13.2 percent from a record high on Feb. 19.

“The move today and the week-over-week move is driven by systematic, self-enforcing flows. We have seen a significant amount of position reduction [this week],” Union Asset Management Holding AG head of investment strategy Philipp Brugger said.

All European subsectors were well in the red, with chemicals, insurance and telecom leading losses for the day, shedding more than 4 percent each.

Germany’s BASF SE was among the biggest percentage losers in the chemical subindex after it warned that earnings could drop further this year.

Travel and leisure stocks underperformed their peers by a wide margin over the week, dropping about 18 percent.

Airlines were the worst hit, with the situation intensified after British Airways owner International Consolidated Airlines Group SA said that its earnings would take a hit this year as passenger numbers tumbled.

The stock fell 8.4 percent on the day, with Easyjet PLC, Societe Air France SA and Deutsche Lufthansa AG dropping between 0.9 percent and 6.4 percent.

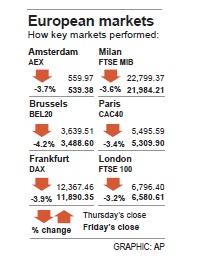

Milan, Italy-listed shares fell 3.6 percent. The number of people infected in Italy, Europe’s worst-hit country, surpassed 850 on Friday.

As the number of cases in Germany rose to 60, the DAX on Friday dropped 477.11 points, or 3.9 percent, to 11,890.35, plummeting 12.4 percent from 13,579.33 a week earlier.

Insurer Munich Re Group was among the worst performers for the day after its fourth-quarter profit dropped.

French publisher Lagardere SCA bottomed out the STOXX 600 after reporting lower revenue for last year. The firm also appointed former French president Nicolas Sarkozy to its advisory board.

Engine maker Rolls-Royce Holdings PLC was among the few gainers, ending up 3.2 percent after saying that it was well-placed to deal with disruptions caused by the epidemic.

While investors have ramped up expectations for a eurozone rate cut as soon as June in response to the virus, two European Central Bank (ECB) policymakers on Friday said that the bank does not need to take immediate action in response to the epidemic.

“The ECB situation has the additional challenge that they do not have so much powder left, and in general the threshold for them to move on an interest rate side is really high,” Brugger said.

The WHO warned that the virus had pandemic potential and ratings agency Moody’s Investors Service said that it would trigger a global recession in the first half of this year.

Additional reporting by staff writer

The demise of the coal industry left the US’ Appalachian region in tatters, with lost jobs, spoiled water and countless kilometers of abandoned underground mines. Now entrepreneurs are eyeing the rural region with ambitious visions to rebuild its economy by converting old mines into solar power systems and data centers that could help fuel the increasing power demands of the artificial intelligence (AI) boom. One such project is underway by a non-profit team calling itself Energy DELTA (Discovery, Education, Learning and Technology Accelerator) Lab, which is looking to develop energy sources on about 26,305 hectares of old coal land in

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

Netflix on Friday faced fierce criticism over its blockbuster deal to acquire Warner Bros Discovery. The streaming giant is already viewed as a pariah in some Hollywood circles, largely due to its reluctance to release content in theaters and its disruption of traditional industry practices. As Netflix emerged as the likely winning bidder for Warner Bros — the studio behind Casablanca, the Harry Potter movies and Friends — Hollywood’s elite launched an aggressive campaign against the acquisition. Titanic director James Cameron called the buyout a “disaster,” while a group of prominent producers are lobbying US Congress to oppose the deal,

Two Chinese chipmakers are attracting strong retail investor demand, buoyed by industry peer Moore Threads Technology Co’s (摩爾線程) stellar debut. The retail portion of MetaX Integrated Circuits (Shanghai) Co’s (上海沐曦) upcoming initial public offering (IPO) was 2,986 times oversubscribed on Friday, according to a filing. Meanwhile, Beijing Onmicro Electronics Co (北京昂瑞微), which makes radio frequency chips, was 2,899 times oversubscribed on Friday, its filing showed. The bids coincided with Moore Threads’ trading debut, which surged 425 percent on Friday after raising 8 billion yuan (US$1.13 billion) on bets that the company could emerge as a viable local competitor to Nvidia