Asustek Computer Inc (華碩), the world’s fourth-largest PC vendor by shipments, might be entering one of its toughest operating periods this year after its ambition to branch out into multiple areas backfired and its core businesses face industry headwinds.

The company’s performance might hit a trough this quarter, after it last quarter posted its lowest net income in 23 quarters at NT$3.65 billion (US$121.18 million).

Asustek CEO Jerry Shen (沈振來) on May 11 attributed the decline to appreciation of the New Taiwan dollar; rising component costs for notebook computers and smartphones; and a product transition ahead of a new smartphone launch.

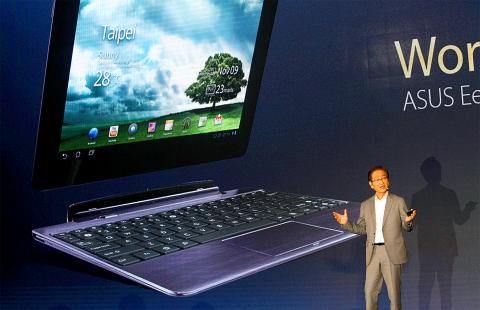

Photo: Chiang Ying-ying, AP

However, the company’s challenges are much bigger than that.

On May 8, Asustek chief operating officer and board member S.Y. Hsu (許先越) tendered his resignation to Shen, chairman Jonney Shih (施崇棠) and chief strategy officer Ted Hsu (徐世昌) via e-mail after more than 20 years at the company.

S.Y. Hsu played a major role in promoting Asustek’s first Eee PC in 2007, which helped the company significantly expand its global market share.

He was also the key player pushing the company’s Zenbook series of notebook computers over the past few years.

Despite S.Y. Hsu avoiding the spotlight since May 8, local media have reported that he resigned after failing to persuade the firm’s management to allocate more resources to his team — including research and development and marketing funding — from the smartphone business.

There has also been speculation about an internal power struggle in the company’s management.

However, Asustek has obviously made significant efforts to keep S.Y. Hsu on board, as he was named one of the key figures to lead the company’s latest restructuring program, which was announced on Friday.

In his new role overseeing both the notebook and desktop PC businesses, S.Y. Hsu is to have more resources and operational power, Asustek said, but added that there is no truth to rumors that an internal power struggle, an imbalance in resource allocations to different business units, or both, had anything to do with his resignation.

Over the past three years, Asustek has ambitiously branched out into various fields, including tablets, smartphones, virtual reality, augmented reality, robotics and artificial intelligence. The company over the past two years allocated more resources to the smartphone segment in a bid to grow handset revenue to above that of notebook’s by next year.

However, none of the new businesses, including smartphones, have eked out stable profits thus far. Moreover, by adding to its motherboard, desktop and notebook segments, the company has stretched its resources thin — in terms of limited capacity for engineers and research and development, while marketing and purchasing managers have been required to juggle several fields at the same time.

Asustek’s strategy of developing its non-PC businesses is correct, as the PC industry has been in decline for years, but it is questionable whether it was wise to extend its reach to so many fields simultaneously while its resources remain limited.

Asustek spokesman Nick Wu (吳長榮) said the company has high hopes that the latest corporate restructuring will optimize its resources and revitalize its momentum.

However, he might be overly optimistic, as a number of key figures remain in the dark about their future roles and the challenges for their tasks.

For instance, Chang Rangoon (張仰光), who previously headed the tablet team and has been named to lead a new gaming business unit as part of the restructuring, on Monday said that he did not know the details of his new operational scope or how many employees his new business unit would have.

“A lot of things have not been finalized. Jerry [Shen] and I have to discuss it,” Chang said on the sidelines of a pre-Computex news conference.

It remains to be seen if Asustek’s corporate restructuring will work in the long term, but concerns linger about the company’s decisionmaking and strategic planning, which could overshadow its performance in the remainder of the year.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

Nvidia Corp’s GB300 platform is expected to account for 70 to 80 percent of global artificial intelligence (AI) server rack shipments this year, while adoption of its next-generation Vera Rubin 200 platform is to gradually gain momentum after the third quarter of the year, TrendForce Corp (集邦科技) said. Servers based on Nvidia’s GB300 chips entered mass production last quarter and they are expected to become the mainstay models for Taiwanese server manufacturers this year, Trendforce analyst Frank Kung (龔明德) said in an interview. This year is expected to be a breakout year for AI servers based on a variety of chips, as

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)