The global banking elite left Davos yesterday battered and bruised by the latest round of the blame game over the world financial crisis.

Scolded by presidents, prime ministers, central bank chiefs and even billionaire investors over regulation and their salaries, the heads of the institutions that dominate the financial markets have had to admit that some kind of reform is necessary.

US President Barack Obama’s plans to limit the size and activities of banks prompted an urgent call at the World Economic Forum for new regulations coordinated on an international level.

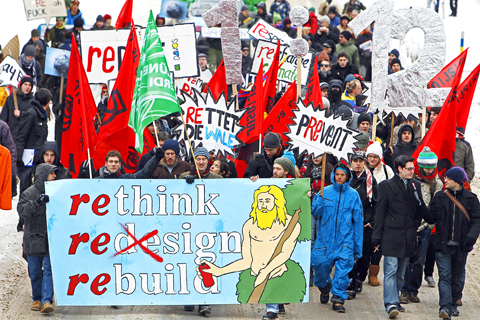

PHOTO: EPA

Bankers at first acted with shock. But they were jolted by criticism of their attitude.

“Don’t feel sorry for yourselves,” British Chancellor of the Exchequer Alistair Darling said.

And now ministers and bankers agree that if there are rules they have to be for every country.

“We must have global rules to treat global issues. This is absolutely essential. If not, it’s a recipe for catastrophe,” said Jean-Claude Trichet, head of the European Central Bank, at the Davos forum in Switzerland.

IMF managing director Dominique Strauss-Kahn said “my fear is that we may forget key lessons of crisis that is coordination.”

He was “a bit afraid that we’re not exactly going in that direction.”

During the London G20 summit on the crisis last April, world leaders asked the Financial Stability Board and the Basel Committee to draft new banking regulations.

The issue was left to the two institutions while governments turned their focus to lifting economic crisis management.

In September, the issue was brought up at the Pittsburgh summit. Britain and France made a call in December for a global banking regulation pact, and have since both followed that up by announcing a tax on traders’ bonuses.

Obama announced plans to limit banks’ size and activities, forcing them to choose between proprietary activities such as trading in stocks and sometimes risky financial instruments for their own benefit — and traditional activities, like making loans and collecting deposits.

The initiative annoyed some politicians in Europe who said that it went against the international coordination principles agreed on by the G20.

“Giving in to unilateralism, to ‘every man for himself,’ would also be an economic, political and moral error,” French President Nicolas Sarkozy said in his keynote address to the forum, even though he agreed with the essence of Obama’s plans.

In an interview, German Economy Minister Rainer Bruederle said: “Due to competition between financial centers, we should not implement [reforms] in an isolated way on a national or European basis.”

The private sector has also asked for international coordination. Tidjane Thiam, who heads British insurance group Prudential, said “consistency” was needed.

Josef Ackermann, chairman of Deutsche Bank, said an international harmonization of regulations was required.

Standard Chartered bank’s group chief executive Peter Sands asked for Asia’s voice to be taken into account on reforms.

“What we don’t want is a situation where we shape the future regulatory reform too dominated by Western voices with the effect of Asia having to take medicine for an illness” that it didn’t have, he said, pointing out that the region’s banks suffered little from the crisis.

In a sign of the urgency of the issue, ministers, bankers and central bankers held an informal meeting at Davos on Saturday.

Representative Barney Frank, chairman of the US House of Representatives’ Financial Services Committee, who took part in the meeting, said bankers now saw there would have to be “tough” regulation.

“There’s going to be regulation, they understand that. We are willing to talk to people about the specifics of how to achieve the goals, but ... there is general agreement that there has to be international coordination,” Frank said. “They aren’t in charge of this. The political leadership certainly in the US is going to go ahead with tough, sensible regulation.”

Micron Memory Taiwan Co (台灣美光), a subsidiary of US memorychip maker Micron Technology Inc, has been granted a NT$4.7 billion (US$149.5 million) subsidy under the Ministry of Economic Affairs A+ Corporate Innovation and R&D Enhancement program, the ministry said yesterday. The US memorychip maker’s program aims to back the development of high-performance and high-bandwidth memory chips with a total budget of NT$11.75 billion, the ministry said. Aside from the government funding, Micron is to inject the remaining investment of NT$7.06 billion as the company applied to participate the government’s Global Innovation Partnership Program to deepen technology cooperation, a ministry official told the

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s leading advanced chipmaker, officially began volume production of its 2-nanometer chips in the fourth quarter of this year, according to a recent update on the company’s Web site. The low-key announcement confirms that TSMC, the go-to chipmaker for artificial intelligence (AI) hardware providers Nvidia Corp and iPhone maker Apple Inc, met its original roadmap for the next-generation technology. Production is currently centered at Fab 22 in Kaohsiung, utilizing the company’s first-generation nanosheet transistor technology. The new architecture achieves “full-node strides in performance and power consumption,” TSMC said. The company described the 2nm process as

Shares in Taiwan closed at a new high yesterday, the first trading day of the new year, as contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) continued to break records amid an artificial intelligence (AI) boom, dealers said. The TAIEX closed up 386.21 points, or 1.33 percent, at 29,349.81, with turnover totaling NT$648.844 billion (US$20.65 billion). “Judging from a stronger Taiwan dollar against the US dollar, I think foreign institutional investors returned from the holidays and brought funds into the local market,” Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺) said. “Foreign investors just rebuilt their positions with TSMC as their top target,

H200 CHIPS: A source said that Nvidia has asked the Taiwanese company to begin production of additional chips and work is expected to start in the second quarter Nvidia Corp is scrambling to meet demand for its H200 artificial intelligence (AI) chips from Chinese technology companies and has approached contract manufacturer Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to ramp up production, sources said. Chinese technology companies have placed orders for more than 2 million H200 chips for this year, while Nvidia holds just 700,000 units in stock, two of the people said. The exact additional volume Nvidia intends to order from TSMC remains unclear, they said. A third source said that Nvidia has asked TSMC to begin production of the additional chips and work is expected to start in the second