Delta Air Lines Inc is set to emerge from 19 months of bankruptcy protection in another sign that one of the bleakest chapters for the US airline industry may be coming to an end.

The third-largest US carrier could exit Chapter 11 bankruptcy as early as today after a judge approved the final details of reorganization, leaving Delta with some US$2.5 billion in financing.

Delta and Northwest Airlines filed for creditor protection on the same day in September 2005, which at the time left four of the top six carriers in bankruptcy.

Since that time, the remaining carriers with the exception of Northwest Airlines Corp have emerged from court supervision and the financial picture of the industry has markedly improved.

"This is an exciting day for everyone at Delta," Delta chief executive Gerald Grinstein said after winning court approval of the exit plan.

"Achieving a turnaround of this magnitude in little more than 19 months would not have been possible without the hard work and dedication of Delta people worldwide and the leadership, the vision and the flawless execution of our plan by our outstanding management team," he said.

Delta lost US$6.2 billion last year amid a hefty US$5.4 billion charge for reorganization.

The carrier posted a much narrower US$130 million loss in the first quarter of this year, but sees its financial picture improving after major cost-cutting efforts.

"Delta has fundamentally transformed into a thriving industry leader," Grinstein said.

"We are stronger -- financially, operationally, and in spirit -- and Delta is ready to return to its traditional leadership position in this highly competitive industry," he said.

The US airline industry has been struggling with its worst-ever crisis since the Sept. 11, 2001 attacks triggered a slump in air travel and carriers were hit with record-high fuel prices.

The Air Transport Association of America (ATA), a trade organization of the leading US airlines, is projecting an overall net profit of approximately US$4 billion for passenger and cargo airlines this year after earnings of between US$2 billion and US$3 billion last year.

A profitable last year and this year would be the first back-to-back period of profitability since 1999 to 2000. US airlines lost a total of US$10 billion in 2005.

"In addition to a healthy revenue environment, US airlines are seeing the results of painstaking, ongoing cost reduction efforts and balance-sheet repair," said ATA chief economist John Heimlich, who nonetheless said caution is warranted.

"Although the industry is optimistic and well positioned to move forward, the reality is that events beyond airlines' control could easily push them off course," he said.

The traditional full service airlines such as Delta have been hurt by competition from low-cost startups like Southwest and JetBlue, which do not have "legacy" pension and health care costs and often have lower wages as well.

To streamline, Delta has trimmed some US$5 billion from operating costs compared to 2002 levels. This has included pay cuts amounting to US$1 billion, including concessions from pilots and a reduction in the workforce from 66,500 in 2005 to 47,000.

Delta rejected a takeover bid last year from US Airways Group Inc -- which itself emerged from bankruptcy in a deal that merged with low-cost carrier America West -- preferring to continue as a stand-alone company.

Standard & Poor's rating service said Delta's prospects are improving but that the airline will still have a low "B" credit rating.

"Delta's relatively rapid and successful reorganization should leave the airline with lower operating costs, improving revenue generation and a reduced debt load," S&P analyst Philip Baggaley said.

"Still, the airline's credit profile and its anticipated `B' corporate credit rating continue to reflect also risks associated with participation in the price-competitive, cyclical and capital-intensive airline industry; on below-average, albeit improving, revenue generation; and on significant intermediate-term debt and capital spending commitments," he said.

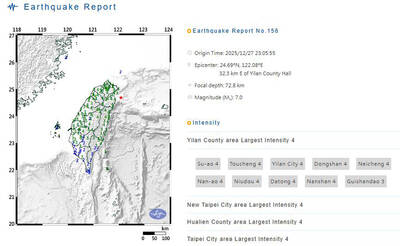

A magnitude 7.0 earthquake struck off Yilan at 11:05pm yesterday, the Central Weather Administration (CWA) said. The epicenter was located at sea, about 32.3km east of Yilan County Hall, at a depth of 72.8km, CWA data showed There were no immediate reports of damage. The intensity of the quake, which gauges the actual effect of a seismic event, measured 4 in Yilan County area on Taiwan’s seven-tier intensity scale, the data showed. It measured 4 in other parts of eastern, northern and central Taiwan as well as Tainan, and 3 in Kaohsiung and Pingtung County, and 2 in Lienchiang and Penghu counties and 1

A car bomb killed a senior Russian general in southern Moscow yesterday morning, the latest high-profile army figure to be blown up in a blast that came just hours after Russian and Ukrainian delegates held separate talks in Miami on a plan to end the war. Kyiv has not commented on the incident, but Russian investigators said they were probing whether the blast was “linked” to “Ukrainian special forces.” The attack was similar to other assassinations of generals and pro-war figures that have either been claimed, or are widely believed to have been orchestrated, by Ukraine. Russian Lieutenant General Fanil Sarvarov, 56, head

FOREIGN INTERFERENCE: Beijing would likely intensify public opinion warfare in next year’s local elections to prevent Lai from getting re-elected, the ‘Yomiuri Shimbun’ said Internal documents from a Chinese artificial intelligence (AI) company indicated that China has been using the technology to intervene in foreign elections, including propaganda targeting Taiwan’s local elections next year and presidential elections in 2028, a Japanese newspaper reported yesterday. The Institute of National Security of Vanderbilt University obtained nearly 400 pages of documents from GoLaxy, a company with ties to the Chinese government, and found evidence that it had apparently deployed sophisticated, AI-driven propaganda campaigns in Hong Kong and Taiwan to shape public opinion, the Yomiuri Shimbun reported. GoLaxy provides insights, situation analysis and public opinion-shaping technology by conducting network surveillance

‘POLITICAL GAME’: DPP lawmakers said the motion would not meet the legislative threshold needed, and accused the KMT and the TPP of trivializing the Constitution The Legislative Yuan yesterday approved a motion to initiate impeachment proceedings against President William Lai (賴清德), saying he had undermined Taiwan’s constitutional order and democracy. The motion was approved 61-50 by lawmakers from the main opposition Chinese Nationalist Party (KMT) and the smaller Taiwan People’s Party (TPP), who together hold a legislative majority. Under the motion, a roll call vote for impeachment would be held on May 19 next year, after various hearings are held and Lai is given the chance to defend himself. The move came after Lai on Monday last week did not promulgate an amendment passed by the legislature that