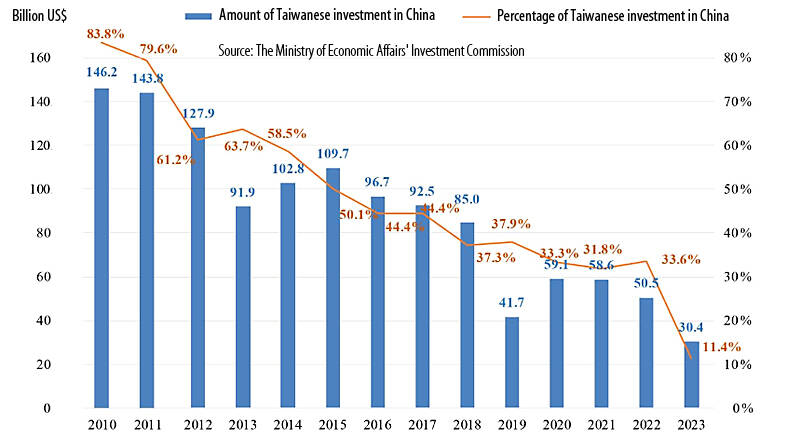

Taiwanese businesspeople’s investments in China last year hit a record low of 11.4 percent of total foreign investment, the Mainland Affairs Council said yesterday.

The number was a huge decline from 83.8 percent in 2010, mainly because Taiwanese businesspeople have been diversifying their investments globally over the past few years, with great success, the council said.

From 1991 to last year, 45,523 Taiwanese investments in China totaling US$206.37 billion had been approved, accounting for 50.7 percent of overall foreign investment, data from the Ministry of Economic Affairs’ Investment Commission showed.

Photo: Screen grab from Mainland Affairs Council’s Facebook page

The amount and proportion of Taiwanese investments in China has been declining, with 328 investments last year totaling US$3.04 billion, a decrease of 39.8 percent from the same period a year earlier, the data showed.

Amid geopolitical upheavals and escalating trade and technology disputes between the US and China, Taiwanese businesspeople have adjusted their global layout strategy according to the restructuring of international supply chains, the council said.

They have reduced investment in China and increased investment in the US, Europe, Japan and countries covered by the government’s New Southbound Policy to diversify production risks, it said.

International institutions, including the World Bank, IMF, S&P Global Ratings and Goldman Sachs Group Inc, have predicted that China’s annual economic growth would not exceed 4 percent this year, it said.

Japan’s Nomura Securities Co said that China’s economy would face four major challenges: stagnant consumption, a sluggish housing market, slow foreign trade and overcapacity in emerging industries such as new-energy vehicles, the council added.

Separately, many Taiwanese businesspeople have lost hope in China’s economy under the governance of Chinese President Xi Jinping (習近平) and have formulated five-year plans to withdraw from the nation, an official familiar with cross-strait affairs said yesterday.

China’s business environment is continuing to deteriorate, while labor costs and taxes are increasing as a result of Xi’s “common prosperity” policy and the US-China trade dispute, they said.

Most legal advisers are telling Taiwanese in China to divest from the nation, the official said.

Taiwanese would not have considered pulling out of China if the economy was good, the person said, adding that they would keep a low profile regarding their plans to pull out of China for fear of retaliation from Beijing.

The Chinese economy is facing structural challenges, with a large number of unfinished buildings in several provinces and cities, and foreign businesspeople trying to leave China, the official said.

Serious deflation, insufficient consumer demand, a high unemployment rate and a high savings rate mean China’s economic recovery is weak, they said.

Hon Hai Precision Industry Co (鴻海精密) would find it difficult to withdraw from China, as its huge scale means any move it makes would have wide-scale remifications, the official said, adding that small and medium-sized enterprises have begun to slowly “transfer” to other countries or return to Taiwan.

Directorate-General of Budget, Accounting and Statistics data showed that Taiwan’s economic growth last year was 1.4 percent, which was not particularly impressive, analysts said.

However, Taiwan’s stock market remains bullish, mainly because Taiwanese businesspeople took their capital from China to invest it in the local stock market, they said.

CHAOS: Iranians took to the streets playing celebratory music after reports of Khamenei’s death on Saturday, while mourners also gathered in Tehran yesterday Iranian Supreme Leader Ayatollah Ali Khamenei was killed in a major attack on Iran launched by Israel and the US, throwing the future of the Islamic republic into doubt and raising the risk of regional instability. Iranian state television and the state-run IRNA news agency announced the 86-year-old’s death early yesterday. US President Donald Trump said it gave Iranians their “greatest chance” to “take back” their country. The announcements came after a joint US and Israeli aerial bombardment that targeted Iranian military and governmental sites. Trump said the “heavy and pinpoint bombing” would continue through the week or as long

TRUST: The KMT said it respected the US’ timing and considerations, and hoped it would continue to honor its commitments to helping Taiwan bolster its defenses and deterrence US President Donald Trump is delaying a multibillion-dollar arms sale to Taiwan to ensure his visit to Beijing is successful, a New York Times report said. The weapons sales package has stalled in the US Department of State, the report said, citing US officials it did not identify. The White House has told agencies not to push forward ahead of Trump’s meeting with Chinese President Xi Jinping (習近平), it said. The two last month held a phone call to discuss trade and geopolitical flashpoints ahead of the summit. Xi raised the Taiwan issue and urged the US to handle arms sales to

BIG SPENDERS: Foreign investors bought the most Taiwan equities since 2005, signaling confidence that an AI boom would continue to benefit chipmakers Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) market capitalization swelled to US$2 trillion for the first time following a 4.25 percent rally in its American depositary receipts (ADR) overnight, putting the world’s biggest contract chipmaker sixth on the list of the world’s biggest companies by market capitalization, just behind Amazon.com Inc. The site CompaniesMarketcap.com ranked TSMC ahead of Saudi Aramco and Meta Platforms Inc. The Taiwanese company’s ADRs on Tuesday surged to US$385.75 on the New York Stock Exchange, as strong demand for artificial intelligence (AI) applications led to chip supply constraints and boost revenue growth to record-breaking levels. Each TSMC ADR represents

State-run CPC Corp, Taiwan (CPC, 台灣中油) yesterday said that it had confirmed on Saturday night with its liquefied natural gas (LNG) and crude oil suppliers that shipments are proceeding as scheduled and that domestic supplies remain unaffected. The CPC yesterday announced the gasoline and diesel prices will rise by NT$0.2 and NT$0.4 per liter, respectively, starting Monday, citing Middle East tensions and blizzards in the eastern United States. CPC also iterated it has been reducing the proportion of crude oil imports from the Middle East and diversifying its supply sources in the past few years in response to geopolitical risks, expanding