Shares of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) closed sharply higher yesterday on reports that Berkshire Hathaway Inc had taken a stake in the world’s largest contract chipmaker.

In a filing with the US Securities and Exchange Commission on Monday, billionaire investor Warren Buffett’s company said it had bought US$4.1 billion of TSMC’s American depositary receipts (ADRs) by the end of September.

The Omaha-based conglomerate acquired about 60 million ADRs in TSMC last quarter, a sign the legendary investor thinks the world’s leading chipmaker has bottomed out after a sell-off of more than US$250 billion.

Photo: Ann Wang, Reuters

That sent TSMC shares shooting up 7.87 percent to close at a two-month high of NT$480.

TSMC produces semiconductors for clients like Nvidia Corp and Qualcomm Inc, and is the exclusive supplier of Apple Inc’s custom silicon chips. Apple remains the most valuable single holding in Berkshire’s portfolio.

The 92-year-old Buffett long shied away from the tech industry, making the case that he did not want to invest in businesses that he did not fully understand. However, that stance changed in recent years, and he has dedicated an increasing proportion of his firm’s investments to the tech sector.

Chipmaking is one segment that promises sustained growth over the coming years as it is essential to the expansion of nascent industries such as self-driving and electric vehicles, artificial intelligence and connected home applications. Expansion of cloud services providers like Amazon.com Inc’s AWS also promises to bring in more orders for chips that go into vast data centers.

TSMC’s gains contributed almost 300 points alone to the TAIEX’s rise, which closed up 371.41 points, or 2.62 percent, at 14,546.31, Taiwan Stock Exchange data showed.

“Many investors here simply followed Buffett in picking up TSMC shares on Tuesday because they are impressed by the American investment guru’s vision and strategies,” Mega International Investment Services Corp (兆豐國際投顧) analyst Alex Huang (黃國偉) said.

“Investors see Buffett as someone who holds stocks for the long term, and the large buy of TSMC shares showed his faith in the chipmaker’s long-term outlook by ignoring short-term market uncertainty,” Huang added.

Berkshire also took a position in Jefferies Financial Group Inc even as it trimmed its stake in financial stocks, including US Bancorp and Bank of New York Mellon Corp, its quarterly filing showed.

New York-based Jefferies was one of three new bets unveiled by Berkshire, in addition to TSMC and construction materials manufacturer Louisiana-Pacific Corp.

Berkshire was a net buyer of equities in the quarter, with US$3.7 billion of purchases after sales. The company trimmed its exposure to financial stocks by about US$4.7 billion in the period.

Additional reporting by Bloomberg

CHAOS: Iranians took to the streets playing celebratory music after reports of Khamenei’s death on Saturday, while mourners also gathered in Tehran yesterday Iranian Supreme Leader Ayatollah Ali Khamenei was killed in a major attack on Iran launched by Israel and the US, throwing the future of the Islamic republic into doubt and raising the risk of regional instability. Iranian state television and the state-run IRNA news agency announced the 86-year-old’s death early yesterday. US President Donald Trump said it gave Iranians their “greatest chance” to “take back” their country. The announcements came after a joint US and Israeli aerial bombardment that targeted Iranian military and governmental sites. Trump said the “heavy and pinpoint bombing” would continue through the week or as long

TRUST: The KMT said it respected the US’ timing and considerations, and hoped it would continue to honor its commitments to helping Taiwan bolster its defenses and deterrence US President Donald Trump is delaying a multibillion-dollar arms sale to Taiwan to ensure his visit to Beijing is successful, a New York Times report said. The weapons sales package has stalled in the US Department of State, the report said, citing US officials it did not identify. The White House has told agencies not to push forward ahead of Trump’s meeting with Chinese President Xi Jinping (習近平), it said. The two last month held a phone call to discuss trade and geopolitical flashpoints ahead of the summit. Xi raised the Taiwan issue and urged the US to handle arms sales to

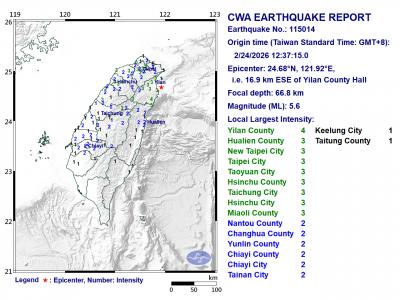

A magnitude 5.6 earthquake struck off the coast of Yilan County at 12:37pm today, with clear shaking felt across much of northern Taiwan. There were no immediate reports of damage. The epicenter of the quake was 16.9km east-southeast of Yilan County Hall offshore at a depth of 66.8km, Central Weather Administration (CWA) data showed. The maximum intensity registered at a 4 in Yilan County’s Nanao Township (南澳) on Taiwan’s seven-tier scale. Other parts of Yilan, as well as certain areas of Hualien County, Taipei, New Taipei City, Taoyuan, Hsinchu County, Taichung and Miaoli County, recorded intensities of 3. Residents of Yilan County and Taipei received

Taiwan has secured another breakthrough in fruit exports, with jujubes, dragon fruit and lychees approved for shipment to the EU, the Ministry of Agriculture said yesterday. The Animal and Plant Health Inspection Agency on Thursday received formal notification of the approval from the EU, the ministry said, adding that the decision was expected to expand Taiwanese fruit producers’ access to high-end European markets. Taiwan exported 126 tonnes of lychees last year, valued at US$1.48 million, with Japan accounting for 102 tonnes. Other export destinations included New Zealand, Hong Kong, the US and Australia, ministry data showed. Jujube exports totaled 103 tonnes, valued at