When the pandemic forced Nvidia Corp to hold a major product launch virtually, CEO Jensen Huang (黃仁勳) beamed video to promote the event from his kitchen, where he pulled the company’s latest chip out of his oven.

“I’ve got something I’ve gotta show you,” Huang says while reaching for a pot holder. “This has been cooking for a while,” he says before grunting to lift a circuit board the size of a baking sheet from the oven to show “the world’s largest graphics card.”

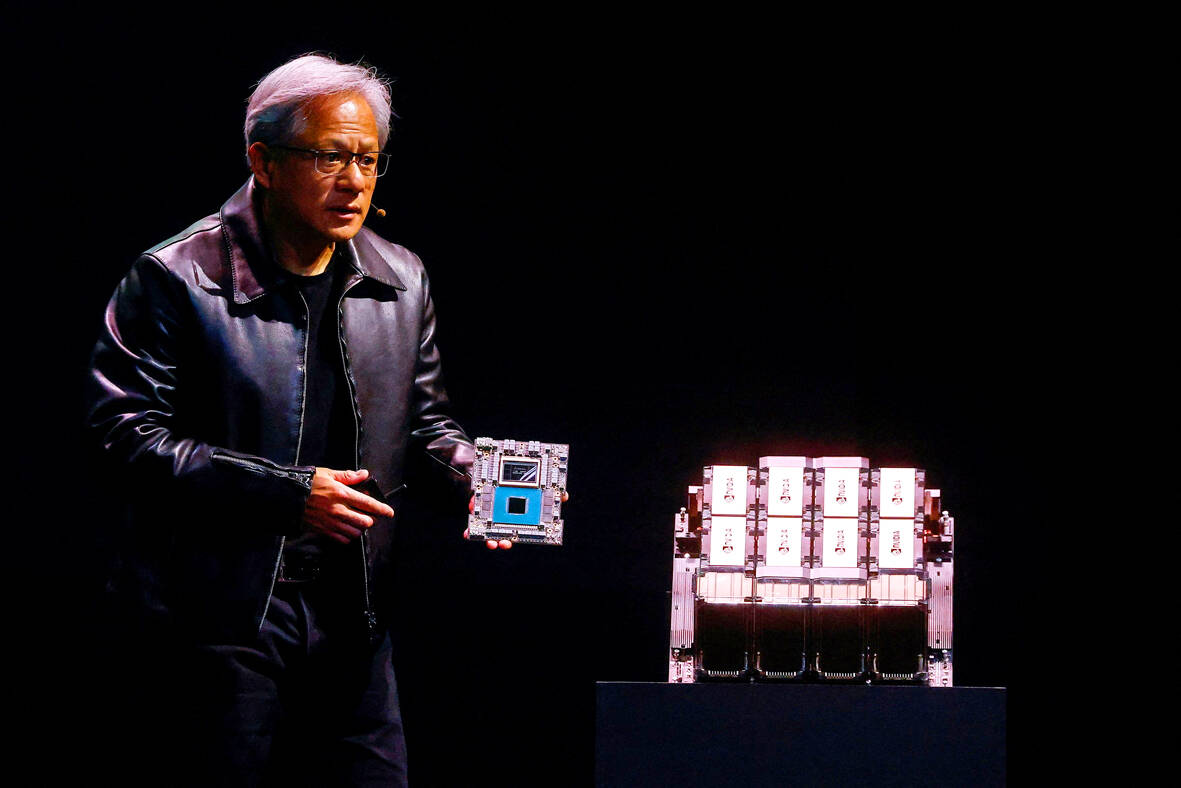

That’s the type of showmanship that has turned the Taiwanese-American immigrant, who typically wears a black leather motorcycle jacket for product launches, into one of the best known names in the computing business.

Photo: Reuters

On Tuesday, he joined an elite list of tech executives to head a company worth US$1 trillion.

Huang, 60, is only the second US CEO after Amazon.com Inc’s Jeff Bezos, who helmed the retailer until 2021, to hit such a milestone for a company they co-founded.

FACE OF A COMPANY

There are few CEOs this side of late Apple Inc chief Steve Jobs who are so synonymous with their companies. Huang even has a tattoo inspired by Nvidia’s logo on one arm.

Nvidia chips have been at the heart of major tech tends from video games to self-driving cars, to cloud computing, and now artificial intelligence.

The company’s shares have been on a tear, rising on stellar sales projections from a boom in AI. Since the launch of OpenAI’s ChatGPT in November last year, Nvidia’s value has ballooned from roughly US$420 billion to its current level.

Huang’s success stems in part from a desire to solve thorny computer science problems with a mix of software and hardware — a vision that has taken him three decades to perfect.

Born in Taiwan, Huang moved to the US as a child, earning engineering degrees at Oregon State University and Stanford University.

ROCK STAR WELCOME

Huang is popular in semiconductor powerhouse Taiwan and received a rock star welcome during a visit to Taipei this week for a trade fair, giving a key note address on Monday attended by thousands of people, some of whom surrounded him for selfies after his two-hour speech.

In 1993, when he was 30, he founded Nvidia along with Curtis Priem and Chris Malachowsky, securing backing from Silicon Valley’s Sequoia Capital and others. Its first big hits were specialized chips to power high-intensity motion graphics for computer games called graphics processing units (GPUs). Even then, Huang did not think of Nvidia as just a chip company.

“Computer graphics is one of the most complex parts of computer science,” Huang told an audience in Silicon Valley in 2021 while receiving a lifetime achievement award. “You have to understand everything.”

By the mid-2000s, Huang and his team realized Nvidia’s chips could be used on more general computing problems and released a software platform called CUDA to allow software developers of all stripes to program Nvidia chips.

AN EARLY BET

That kicked off of a wave of new uses, including for cryptocurrency. But Huang recognized that university labs were using his chips for work in AI, a niche in computer science that held promise of powering everything from virtual assistants to self-driving cars. He released a parade of chips for AI, and the bet paid off.

Nvidia also differentiated itself by outsourcing its silicon manufacturing to partners including Taiwan Semiconductor Manufacturing, bucking the model set by Intel, which is now worth a fraction of Nvidia’s value — which was just under US$1 trillion as of Tuesday’s close.

“He has helped enable a revolution that allows phones to answer questions out loud, farms to spray weeds but not crops, doctors to predict the properties of new drugs — with more wonders to come,” AI entrepreneur Andrew Ng wrote of Huang in Time magazine when the latter was named one of the 100 most influential people by Time in 2021.

William Liu (劉家君) moved to Kaohsiung from Nantou to live with his boyfriend Reg Hong (洪嘉佑). “In Nantou, people do not support gay rights at all and never even talk about it. Living here made me optimistic and made me realize how much I can express myself,” Liu tells the Taipei Times. Hong and his friend Cony Hsieh (謝昀希) are both active in several LGBT groups and organizations in Kaohsiung. They were among the people behind the city’s 16th Pride event in November last year, which gathered over 35,000 people. Along with others, they clearly see Kaohsiung as the nexus of LGBT rights.

Dissident artist Ai Weiwei’s (艾未未) famous return to the People’s Republic of China (PRC) has been overshadowed by the astonishing news of the latest arrests of senior military figures for “corruption,” but it is an interesting piece of news in its own right, though more for what Ai does not understand than for what he does. Ai simply lacks the reflective understanding that the loneliness and isolation he imagines are “European” are simply the joys of life as an expat. That goes both ways: “I love Taiwan!” say many still wet-behind-the-ears expats here, not realizing what they love is being an

In the American west, “it is said, water flows upwards towards money,” wrote Marc Reisner in one of the most compelling books on public policy ever written, Cadillac Desert. As Americans failed to overcome the West’s water scarcity with hard work and private capital, the Federal government came to the rescue. As Reisner describes: “the American West quietly became the first and most durable example of the modern welfare state.” In Taiwan, the money toward which water flows upwards is the high tech industry, particularly the chip powerhouse Taiwan Semiconductor Manufacturing Co (TSMC, 台積電). Typically articles on TSMC’s water demand

Every now and then, even hardcore hikers like to sleep in, leave the heavy gear at home and just enjoy a relaxed half-day stroll in the mountains: no cold, no steep uphills, no pressure to walk a certain distance in a day. In the winter, the mild climate and lower elevations of the forests in Taiwan’s far south offer a number of easy escapes like this. A prime example is the river above Mudan Reservoir (牡丹水庫): with shallow water, gentle current, abundant wildlife and a complete lack of tourists, this walk is accessible to nearly everyone but still feels quite remote.