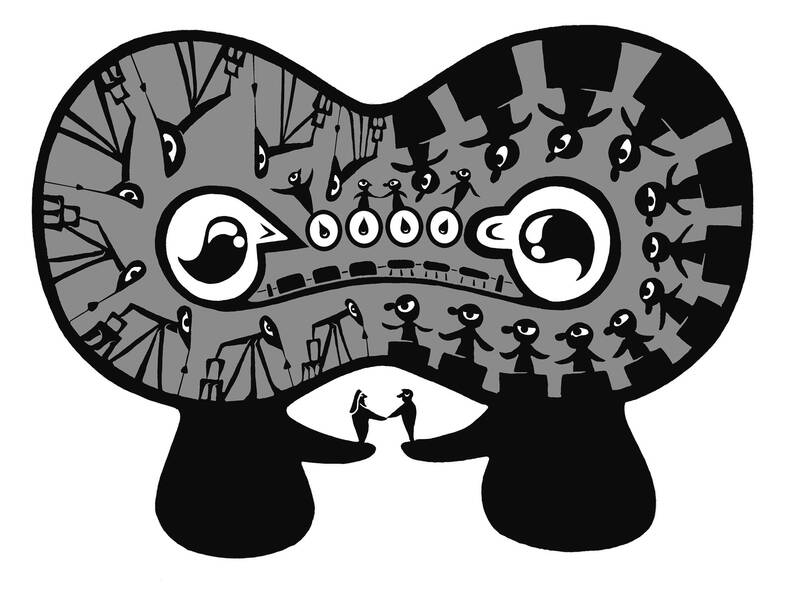

China’s independent oil companies are ramping up operations in Iraq, investing billions of dollars in OPEC’s No. 2 producer, even as some global majors have scaled back from a market dominated by Beijing’s big state-run firms.

Drawn by more lucrative contract arrangements, smaller Chinese producers are on track to double their output in Iraq to 500,000 barrels per day by about 2030, according to estimates by executives at four of the firms, a figure not previously reported.

For Baghdad, which is also seeking to lure global giants, the growing presence of the mostly privately run Chinese players marks a shift, as Iraq comes under growing pressure to accelerate projects, multiple Iraqi energy officials said. Over the past few years, the Iraqi Ministry of Oil had pushed back on rising Chinese control over its oilfields.

For the smaller Chinese firms, managed by veterans of China’s state heavyweights, Iraq is an opportunity to leverage lower costs and faster development of projects that might be too small for Western or Chinese majors.

With meager prospects in China’s state-dominated oil and gas industry, the overseas push mirrors a pattern by Chinese firms in other heavy industries to find new markets for productive capacity and expertise.

Little-known players including Geo-Jade Petroleum Corp, United Energy Group, Zhongman Petroleum and Natural Gas Group, and Anton Oilfield Services Group made a splash last year when they won half of Iraq’s exploration licensing rounds.

Executives at smaller Chinese producers said Iraq’s investment climate has improved, as the country becomes more politically stable, and Baghdad is keen to attract Chinese and Western companies.

Iraq wants to boost output by more than half to more than 6 million barrels per day (bpd) by 2029. China National Petroleum Corp (CNPC) alone accounts for more than half of Iraq’s production at massive fields, including Haifaya, Rumaila and West Qurna 1.

Iraq’s shift a year ago to contracts based on profit-sharing from fixed-fee agreements — an attempt to accelerate projects after ExxonMobil and Shell scaled back — helped lure Chinese independents.

These smaller firms are nimbler than the big Chinese companies and more risk-tolerant than many companies that might consider investing in the Gulf economy.

Chinese companies offer competitive financing, cut costs with cheaper Chinese labor and equipment, and are willing to accept lower margins to win long-term contracts, said Ali Abdulameer at state-run Basra Oil Co, which finalizes contracts with foreign firms.

“They are known for rapid project execution, strict adherence to timelines and a high tolerance for operating in areas with security challenges,” he said. “Doing business with the Chinese is much easier and less complicated, compared to Western companies.”

Smaller Chinese firms could develop an oilfield in Iraq in two to three years, faster than the five to 10 years for Western firms, Chinese executives said.

“Chinese independents have much lower management costs compared to Western firms and are also more competitive versus Chinese state-run players,” said Dai Xiaoping (戴小平), CEO of Geo-Jade Petroleum, which has five blocks in Iraq.

The independents have driven down the industry cost to drill a development well in a major Iraqi oilfield by about half from a decade ago to between US$4 million and US$5 million, Dai said.

A Geo-Jade-led consortium agreed in May to invest in the South Basra project, which includes ramping up the Tuba field in southern Iraq to 100,000 bpd and building a 200,000-bpd refinery.

Geo-Jade, committing US$848 million, plans to revive output at the largely mothballed field to 40,000 bpd by about mid-2027, he said.

The project also calls for a petrochemical complex and two power stations, requiring a multibillion dollar investment, said Dai, a reserve engineer who previously worked overseas with CNPC and Sinopec.

Zhenhua Oil, a small state-run firm that partnered with CNPC in a US$3 billion deal to develop the Ahdab oilfield in 2008, the first major foreign-invested project after Saddam Hussein was toppled in 2003, aims to double its production to 250,000 bpd by 2030, a company official said.

Zhongman Petroleum announced in June a plan to spend US$481 million on the Middle Euphrates and East Baghdad North blocks won last year.

Chinese firms’ cheaper projects could come at the expense of Iraq’s goal to introduce more advanced technologies.

Former Basra Oil crude operations manager Muwafaq Abbas expressed concern about transparency and technical standards among Chinese firms, which he said have faced criticism for relying heavily on Chinese staff and relegating Iraqis to lower-paid roles.

To be sure, some Western firms are returning to Iraq: TotalEnergies announced a US$27 billion project in 2023, and BP is expected to spend up to US$25 billion to redevelop four Kirkuk fields, Reuters reported.

China has not been a top-tier issue for much of the second Trump administration. Instead, Trump has focused considerable energy on Ukraine, Israel, Iran, and defending America’s borders. At home, Trump has been busy passing an overhaul to America’s tax system, deporting unlawful immigrants, and targeting his political enemies. More recently, he has been consumed by the fallout of a political scandal involving his past relationship with a disgraced sex offender. When the administration has focused on China, there has not been a consistent throughline in its approach or its public statements. This lack of overarching narrative likely reflects a combination

Father’s Day, as celebrated around the world, has its roots in the early 20th century US. In 1910, the state of Washington marked the world’s first official Father’s Day. Later, in 1972, then-US president Richard Nixon signed a proclamation establishing the third Sunday of June as a national holiday honoring fathers. Many countries have since followed suit, adopting the same date. In Taiwan, the celebration takes a different form — both in timing and meaning. Taiwan’s Father’s Day falls on Aug. 8, a date chosen not for historical events, but for the beauty of language. In Mandarin, “eight eight” is pronounced

US President Donald Trump’s alleged request that Taiwanese President William Lai (賴清德) not stop in New York while traveling to three of Taiwan’s diplomatic allies, after his administration also rescheduled a visit to Washington by the minister of national defense, sets an unwise precedent and risks locking the US into a trajectory of either direct conflict with the People’s Republic of China (PRC) or capitulation to it over Taiwan. Taiwanese authorities have said that no plans to request a stopover in the US had been submitted to Washington, but Trump shared a direct call with Chinese President Xi Jinping (習近平)

It is difficult to think of an issue that has monopolized political commentary as intensely as the recall movement and the autopsy of the July 26 failures. These commentaries have come from diverse sources within Taiwan and abroad, from local Taiwanese members of the public and academics, foreign academics resident in Taiwan, and overseas Taiwanese working in US universities. There is a lack of consensus that Taiwan’s democracy is either dying in ashes or has become a phoenix rising from the ashes, nurtured into existence by civic groups and rational voters. There are narratives of extreme polarization and an alarming