For any government, overhauling a nationwide residential real-estate market would be risky under the best of circumstances. Chinese President Xi Jinping (習近平) is attempting it at a time when the economy is slowing, the Omicron variant of SARS-CoV-2 is threatening his “zero COVID-19” policy and relations with the outside world are increasingly fraught.

As that perilous combination takes a growing toll on Chinese financial markets, one question keeps popping up: What is Xi’s endgame?

Given the Chinese Communist Party’s (CCP) opacity and its history of backtracking on property reforms, the answer is impossible to know for sure.

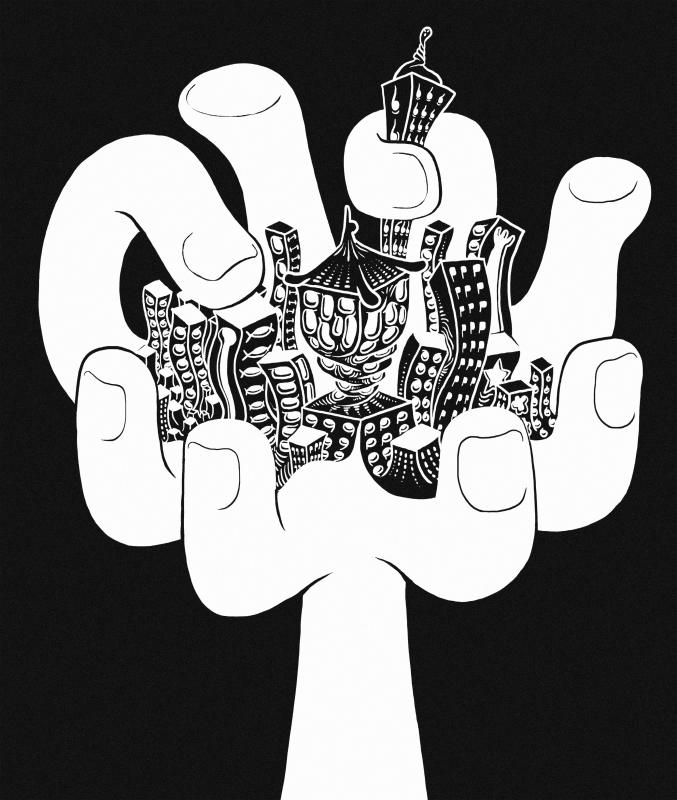

Illustration: Mountain People

However, China watchers have begun sketching out a likely future for the real-estate market that looks far different from its more than two-decade run of supercharging economic growth, household wealth and government revenue.

In short, the days of blistering home-price gains and debt-fueled building sprees by billionaire property tycoons are set to fade. They would be replaced by a much more staid market where authorities are quick to clamp down on speculative frenzies and development is dominated by state-run companies earning utility-like returns.

“If we call the past decade a golden age for the real-estate industry, it is now trapped in the age of rust,” said Li Kai, Beijing-based founding partner of bond fund Shengao Investment, which specializes in distressed debt.

That transition promises to be especially painful for privately owned developers like China Evergrande Group that have already saddled international stock and credit investors with billions of dollars in losses.

At the same time, it could go a long way toward achieving two of Xi’s most prized goals: a more stable Chinese financial system and a narrower gap between the country’s rich and poor.

Xi’s challenge is to pull off the transformation without sparking a crisis on the eve of a leadership confab widely expected to cement his rule for life.

While few analysts are predicting an imminent financial meltdown, risks from the real-estate market are growing. Weaker property companies are under immense stress, hit by a double whammy of punishingly high borrowing costs and slumping sales. Lower-rated developers, including Evergrande, are already defaulting on dollar debt at record rates and contagion is spreading to stronger companies. Shares and bonds of Country Garden Holdings Co, China’s largest developer by sales, on Thursday sank following a report that it struggled to find demand for a new convertible bond.

There are plenty of reasons why China needs to remold its property market. The sector is riddled with speculative buying and is over-levered, posing a risk to the financial system in a downturn. The price of housing is a burden on China’s already shrinking families. The average cost of buying an apartment in Shenzhen was about 44 times the average annual salary for local residents in 2020. It worsens inequality as wealthy landlords hoard properties. Millions of homes sit empty and some construction projects damage the environment.

The industry has an oversized impact on the economy. When related sectors like construction and property services are included, real estate accounts for more than one-quarter of Chinese economic output, by some estimates. More than 70 percent of urban China’s wealth is stored in housing.

“The property market is a symptom of the underlying problems in China’s economy,” Pantheon Macroeconomics chief China economist Craig Botham said. “For decades it’s been the go-to, easy solution to generate local government revenue, boost economic growth, and provide households with a place to put their money and see it grow.”

The solution, as is increasingly the case in Xi’s China, is tighter control by the state.

In Guangdong — home to Evergrande — local officials are facilitating meetings between struggling developers and state-owned enterprises, according to a Cailian report.

Borrowing by major property firms used to fund mergers and acquisitions would not be counted toward metrics that limit debt, people familiar with the matter told Bloomberg last week.

“The government wants to encourage consolidation in the housing sector — larger and often state-owned developers will likely take over the weaker players,” said Gabriel Wildau, a senior vice president at global business advisory firm Teneo. “They want to break the economy’s addiction to property.”

Chinese authorities have targeted excess in the property market before, but the importance of the sector to the economy meant such drives petered out when growth targets were threatened. Beijing is seeking to reduce the reliance on property by boosting investment in high-tech and clean energy industries — part of Xi’s plans to make growth more sustainable and higher quality. Yet such a process would take time and patience.

“The transition will be long and painful, and we are not entirely sure whether the top has strong enough resolve to see through the arduous process,” Bocom International Holdings Co chief strategist Hao Hong (洪灝) said.

Officials’ determination is being tested. China’s property downturn is accelerating, even prompting a warning from the US Federal Reserve. In cities nationwide, the decline in new-home prices has deepened every month since September last year, when prices fell for the first time in six years. Home sales continue to sink. Data show property investment grew just 5.2 percent last year, economists predict, the slowest since 2015.

Chinese developers are resorting to bond swaps, payment delays, equity sales and other desperate measures to repay debt.

At least eight of the firms defaulted on pay dollar bonds since October. That includes Evergrande, whose crisis has ensnared lender China Minsheng Banking Corp, the world’s worst-performing bank stock. An index of property shares fell 34 percent last year, its worst since the global financial crisis in 2008.

Authorities are prepared to accept the risks to economic growth and financial stability from the campaign, said Eswar Prasad, who once led the IMF’s China team and is now at Cornell University.

“Beijing seems to have determined that these are likely to be transitory costs that cannot be avoided any longer for the sake of limiting future financial market gyrations and even more imbalances in property markets,” Prasad said.

Such costs are increasing. Shares of property firms fell 4.3 percent on Thursday, the most in four months, and are valued at just 30 percent their reported assets. That is the cheapest in data stretching back to 2005.

“Only a few survivors” will do well going forward, Citigroup Inc stock analysts wrote in a recent note.

The rout in China’s high-yield dollar bond market is accelerating, triggered by firms previously considered financially more sound than Evergrande — like Shimao Group Holdings Ltd and Sunac China Holdings Ltd. More worryingly, it is spreading to higher-grade issuers such as Country Garden. Shares of the developer plunged almost 8 percent on Thursday.

Whatever form Beijing’s campaign to deleverage the property market takes, it is clear that the era which enriched real-estate moguls and homeowners alike has ended. A duller, more stable future awaits, if the CCP can stay the course and dodge a financial crisis.

“The golden age of booming property prices and soaring revenue for developers is probably gone,” Natixis SA senior economist Gary Ng (吳卓殷) said. “Home prices will only grow at a tightly managed zone in the future, meaning housing will look increasingly like utilities.”

In the US’ National Security Strategy (NSS) report released last month, US President Donald Trump offered his interpretation of the Monroe Doctrine. The “Trump Corollary,” presented on page 15, is a distinctly aggressive rebranding of the more than 200-year-old foreign policy position. Beyond reasserting the sovereignty of the western hemisphere against foreign intervention, the document centers on energy and strategic assets, and attempts to redraw the map of the geopolitical landscape more broadly. It is clear that Trump no longer sees the western hemisphere as a peaceful backyard, but rather as the frontier of a new Cold War. In particular,

As the Chinese People’s Liberation Army (PLA) races toward its 2027 modernization goals, most analysts fixate on ship counts, missile ranges and artificial intelligence. Those metrics matter — but they obscure a deeper vulnerability. The true future of the PLA, and by extension Taiwan’s security, might hinge less on hardware than on whether the Chinese Communist Party (CCP) can preserve ideological loyalty inside its own armed forces. Iran’s 1979 revolution demonstrated how even a technologically advanced military can collapse when the social environment surrounding it shifts. That lesson has renewed relevance as fresh unrest shakes Iran today — and it should

The last foreign delegation Nicolas Maduro met before he went to bed Friday night (January 2) was led by China’s top Latin America diplomat. “I had a pleasant meeting with Qiu Xiaoqi (邱小琪), Special Envoy of President Xi Jinping (習近平),” Venezuela’s soon-to-be ex-president tweeted on Telegram, “and we reaffirmed our commitment to the strategic relationship that is progressing and strengthening in various areas for building a multipolar world of development and peace.” Judging by how minutely the Central Intelligence Agency was monitoring Maduro’s every move on Friday, President Trump himself was certainly aware of Maduro’s felicitations to his Chinese guest. Just

When it became clear that the world was entering a new era with a radical change in the US’ global stance in US President Donald Trump’s second term, many in Taiwan were concerned about what this meant for the nation’s defense against China. Instability and disruption are dangerous. Chaos introduces unknowns. There was a sense that the Chinese Nationalist Party (KMT) might have a point with its tendency not to trust the US. The world order is certainly changing, but concerns about the implications for Taiwan of this disruption left many blind to how the same forces might also weaken